What is the Patrick Nill Trading Strategy?

The Patrick Nill Trading Strategy is a professional trading methodology that eliminates guesswork by teaching traders how to read markets using objective price action analysis, order flow interpretation, and market structure identification. Unlike conventional trading systems that rely on lagging indicators like MACD and Bollinger Bands, this approach uses the same techniques employed by Wall Street market makers and institutional traders.

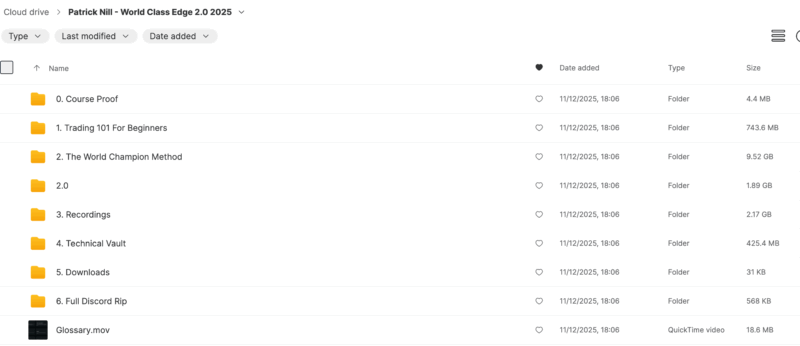

Developed by Patrick Nill, a market strategist and trading educator, the World Class Edge 2.0 2025 course provides a complete education in reading markets directly rather than interpreting delayed signals. This methodology works across all markets including stocks (NYSE, NASDAQ), futures (ES, NQ), forex pairs (EUR/USD), and cryptocurrencies like Bitcoin and Ethereum. Traders looking to master forex trading fundamentals will find these universal principles equally applicable.

What You’ll Learn in World Class Edge 2.0

The Patrick Nill Trading Strategy course delivers systematic training across multiple disciplines essential for professional trading success:

- Price Action Analysis (PAA): Learn to identify trends, support/resistance zones, and market reversals without indicators. Students who want to explore comprehensive price action strategies can accelerate their learning with these techniques.

- Order Flow Interpretation (OFI): Understand bid/ask dynamics, footprint data, and volume profile analysis used by CME traders

- Market Structure Identification (MSI): Find swing highs/lows and zones of institutional interest

- Risk Management: Master win rate optimization, risk/reward ratios, and proper position sizing

- High Probability Trade Setups: Execute trades on 1-minute timeframes for day trading or 4-hour and daily charts for swing trading

- Order Types Mastery: Use Market, Limit, and Stop orders effectively on TradingView, NinjaTrader, and ThinkOrSwim

Who Should Enroll in This Trading Course

The World Class Edge 2.0 program is designed for traders at every experience level who want to trade like professionals:

- Beginner traders seeking to learn professional trading principles from the ground up through Trading 101 foundation modules

- Active traders treating trading as a business who want to improve their technical analysis using the Patrick Nill Trading Strategy. Many successful traders learn to command their trading with these institutional methods.

- Day traders taking high probability trades on stocks and futures using 1-minute timeframe setups

- Swing traders looking to identify quality trade setups on 4-hour and daily timeframes

- Anyone ready to stop using lagging indicators and learn how institutions read markets

Technical Vault: Professional Trading Tools Included

Students gain unlimited access to the Technical Vault, a professional-grade resource library containing the same charting setups used by institutional traders and private trading firms.

Market and Volume Profile

Master Time Price Opportunity (TPO) analysis to identify value areas, Point of Control (POC), and volume distribution patterns. These tools work seamlessly with TradingView, Sierra Chart, and NinjaTrader for institutional-level market structure analysis.

1-Minute Footprint and Order Flow

The primary structure in the Patrick Nill Trading Strategy for day trading. Get precise entries by catching exact breakouts and reversals on ES and NQ futures using real-time order flow data. Traders seeking to dive deeper into order flow techniques will find these methods transformative.

5-Minute Profile Order Flow

Confirm your directional bias before entering trades. This is the same construct used by prop trading firms at Lightspeed Trading and Centerpoint Securities for trading ES and NQ futures.

Trading 101: Foundation Modules

The course begins with comprehensive foundation training covering everything new traders need to know:

- Module 101: What is trading?

- Module 102: Assets and Contracts

- Module 103: Brokers (Charles Schwab, Interactive Brokers, TD Ameritrade)

- Module 104: Leverage and margin requirements

- Module 105: Order types and execution

- Module 106: CFD trading mechanics

- Module 107: Futures contracts explained

- Module 108: Forex and currency swaps

- Module 109: How to read a chart professionally

- Module 110: Risk management essentials

- Module 111: Market structure fundamentals

Frequently Asked Questions

What is the Patrick Nill Trading Strategy?

The Patrick Nill Trading Strategy is a professional trading methodology that uses objective price action analysis, order flow interpretation, and market structure identification to read markets directly without relying on lagging indicators.

How does the Patrick Nill Trading Strategy work?

This strategy teaches traders to analyze price action and market structure directly rather than using delayed technical indicators. By reading order flow and understanding institutional price levels, traders can identify high-probability setups across any market. Those who want to master advanced order flow edge techniques will appreciate this systematic approach.

Who is World Class Edge 2.0 for?

This course is designed for traders at all levels—from beginners who need foundation training to experienced traders looking to eliminate emotional trading and adopt institutional methods.

What makes this strategy different from indicator-based trading?

Traditional indicators like MACD and moving averages are lagging by nature. The Patrick Nill Trading Strategy focuses on reading price action and order flow in real-time, providing direct market signals without delay.

What markets can I trade with this strategy?

The methodology works on stocks (NYSE, NASDAQ), futures (CME), forex markets, and cryptocurrencies including Bitcoin and Ethereum. The principles apply across all liquid markets.

Do I need trading experience to start?

No prior experience required. The course includes complete Trading 101 foundation modules covering everything from basic concepts to advanced order flow analysis.

Is this for day trading or swing trading?

Both. The Patrick Nill Trading Strategy includes 1-minute setups for day trading and 4-hour/daily methods for swing trading positions.

What platforms are compatible with these tools?

The Technical Vault charting setups work with TradingView, NinjaTrader, Sierra Chart, and ThinkOrSwim platforms.

Start Trading Like a Professional Today

The Patrick Nill Trading Strategy taught in World Class Edge 2.0 2025 gives you the same market reading techniques used by institutional traders and Wall Street professionals. Stop guessing with lagging indicators and start trading with objective, systematic methods that work across any market and any timeframe. After completing this course, students often advance to price action manipulation training to further refine their edge.