What is WondaFX Signature Strategy? The WondaFX Signature Strategy is a forex trading course teaching a specific price action methodology for trading currency pairs. This WondaFX Signature Strategy course focuses on identifying high-probability setups using market structure, support/resistance zones, and candlestick patterns. Designed for forex traders who want a clear, repeatable system rather than complex indicator combinations.

Verified Deliverables:

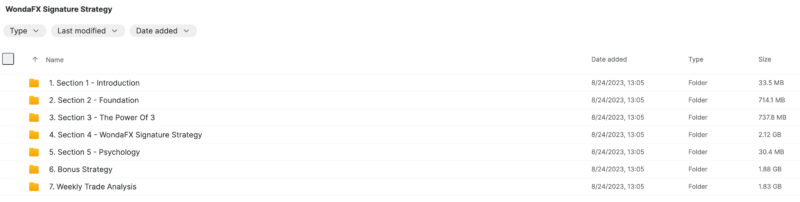

- Complete WondaFX Signature Strategy curriculum

- Video training modules (~4.2GB total)

- PDF strategy guides with chart examples

- Trade setup templates and checklists

- Delivery: Mega & Google Drive

- Access: PC, Tablet, Mobile

- Lifetime access included

WondaFX Chart Configuration: The ‘Naked’ Setup

Unlike retail traders who clutter charts with EMAs, Bollinger Bands, and RSI, the WondaFX Signature Strategy uses a specific “clean-chart” hierarchy designed to eliminate analysis paralysis:

- Primary View: H4 Timeframe for ‘Major Structure’ identification (swing highs/lows, key zones)

- Execution View: M15 Timeframe for candlestick confirmation and precise entries

- Key Markups: Identification of ‘Dynamic’ vs ‘Static’ support/resistance levels

- Session Focus: London Open and New York Session for maximum volatility

By isolating these three variables, the strategy reduces the “Analysis Paralysis” that causes traders to miss fast-moving session setups. No indicators means no conflicting signals.

The Signature Entry Logic: 3-Bar Confirmation Method

The core of the WondaFX Signature Strategy is the Confirmation Candle system. An entry is only valid when all three conditions align:

Entry Checklist:

- Zone Tap: Price reaches a pre-marked H4 Supply/Demand zone

- Rejection Candle: A pin bar OR engulfing pattern forms on M15

- Follow-Through: The next candle breaks the high/low of the rejection candle

Only when all 3 conditions are met does the trader execute. This filters out 70%+ of false signals.

Stop Loss and Take Profit Rules

The WondaFX Signature Strategy uses structure-based risk management rather than arbitrary pip values:

| Element | Rule | Example |

|---|---|---|

| Stop Loss (Long) | Below swing low + 5 pip buffer | Swing low at 1.0850 → SL at 1.0845 |

| Stop Loss (Short) | Above swing high + 5 pip buffer | Swing high at 1.0920 → SL at 1.0925 |

| Take Profit 1 | Next H4 structure level | 1:1.5 Risk/Reward minimum |

| Take Profit 2 | Measured move (equal leg) | 1:3 Risk/Reward target |

Why Price Action Over Indicators for Forex

Indicators lag price—they’re calculated from historical data, so they always show what already happened. Price action traders read the source directly. In forex markets where news moves currencies within milliseconds, reacting to lagging indicators often means entering after the move is over.

Price action setups based on market structure and candlestick patterns can signal entries as moves begin rather than after confirmation arrives too late. This approach keeps charts clean and focuses attention on what matters: where is price, where has it been, and where is it likely to go.

Market Structure Analysis Framework

Understanding whether a market is trending or ranging determines which setups to trade. The WondaFX Signature Strategy teaches identifying these states using swing highs and lows:

- Uptrend: Higher highs (HH) + Higher lows (HL)

- Downtrend: Lower highs (LH) + Lower lows (LL)

- Range: Equal highs and lows bouncing between zones

- Transition: Break of structure (BOS) signals trend change

Recognizing these transitions early creates trading opportunities while reducing the chance of trading against momentum.

Indicator-Based vs WondaFX Price Action Trading

| Aspect | Indicator-Based | WondaFX Method |

|---|---|---|

| Chart appearance | Cluttered with 5+ indicators | Clean, price-only |

| Signal timing | Lagging by 3-5 candles | Real-time confirmation |

| Entry precision | Wait for indicator cross | Enter on candle close |

| Adaptability | Fixed formula settings | Context-based decisions |

| Learning curve | Learn each indicator | Learn price behavior |

Session-Based Trade Management

Currency pairs move 24 hours per day, but not all hours are equal. The WondaFX Signature Strategy teaches session-specific management:

- Asian Session (Tokyo): Range-bound, avoid breakout trades, tighter stops

- London Open: High volatility, ideal for breakouts, wider initial stops

- New York Session: Trend continuation, momentum trades, scale out positions

- London Close: Profit-taking zone, avoid new entries

Related Forex Trading Methods

While the WondaFX Signature Strategy focuses purely on price action, traders often combine it with complementary approaches:

- For indicator confirmation: Macro Ops Price Action Masterclass adds confluence signals

- For institutional flow: Forex Scalper Indices Orderflow Masterclass shows smart money positioning

- For market structure depth: Braveheart Market Structure Masterclass expands zone identification

- For prop firm traders: Zlankator FX Course covers risk parameters for funded accounts

Trade Journaling and Performance Review

The WondaFX Signature Strategy includes guidance on documenting trades and analyzing patterns in your results. Identifying which setups work best for your personality allows refining the approach over time. Some traders excel at trend trades while others perform better at range fades.

About WondaFX

WondaFX provides forex education focused on price action methodology. The WondaFX Signature Strategy represents their core trading approach refined through years of live market application. The course has been updated for 2025 market conditions.

Who This Course Is For

- Forex traders wanting clean chart trading without indicator overload

- Traders frustrated by lagging indicator signals and late entries

- Anyone wanting specific, rule-based entry and exit criteria

- Beginners who want to learn reading price from the start

- Prop firm traders needing consistent, documented methodology

- Experienced traders looking to simplify their approach

For more forex education, explore Forex Trading courses on GeniTrader.

Why get it here: Original price $550 — instant download at a fraction of the cost. If the link breaks, we replace it within 24 hours. 30-day money-back guarantee if files are corrupt.

WondaFX Signature Strategy FAQ

What is the WondaFX Signature Strategy?

A forex trading course teaching price action methodology using market structure, H4/M15 multi-timeframe analysis, support/resistance zones, and the 3-bar confirmation entry system.

What timeframes does WondaFX use?

H4 for structure identification and M15 for entry confirmation. Some setups use H1 as an intermediate view.

Is this the complete course?

Yes. Full WondaFX Signature Strategy curriculum with all video modules (~4.2GB) and PDF materials.

What currency pairs does it work on?

The methodology applies to major pairs (EUR/USD, GBP/USD), minor pairs, and crosses. Price action works on any liquid forex instrument.

Does it work for prop firm challenges?

Yes. The defined rules and risk management align with prop firm requirements for consistent, documented trading.

How do I access it after purchase?

Instant download link provided immediately after payment via Mega and Google Drive.

What if the download link doesn’t work?

Contact us and we’ll replace it within 24 hours.

Is there a refund policy?

Yes. 30-day money-back guarantee if files are corrupt or incomplete.