TL;DR: Base Camp Trading Explosive Growth teaches aggressive options trading strategies for capital growth. Students report account gains of 40-80% within months using momentum setups and strategic position sizing to compound returns in stocks and options markets.

Base Camp Trading Explosive Growth

The Base Camp Trading Explosive Growth course delivers what growth-focused traders need—systematic options strategies designed for capital multiplication rather than slow income generation. This program targets traders ready for directional plays with significant upside potential who want structured methodology instead of gambling on random trades.

The methodology identifies momentum opportunities in trending stocks and teaches strategic options positioning to maximize leverage while controlling downside risk. Students learn when aggressive positions make sense and how to manage trades while pursuing larger returns. One trader reported turning a $15,000 account into $24,000 within four months using the breakout strategies taught in this comprehensive course.

Explosive Growth Options Strategy Review: Core Methodology

Most options education focuses on income strategies—selling premium, collecting theta, managing defined-risk positions for steady monthly returns. The Explosive Growth approach complements these conservative methods with directional strategies targeting larger moves that can significantly accelerate account growth.

Students learn to identify momentum setups where options leverage amplifies stock moves by 3x to 10x. The curriculum covers breakout identification using volume and price action, optimal entry timing based on technical catalysts, options selection for favorable leverage without excessive premium decay, position management through the complete trade lifecycle, and disciplined profit-taking rules. Traders seeking similar systematic momentum approaches often benefit from programs like Trading FanaticWay which emphasizes repeatable trading processes.

Growth Trading Course Review: Student Results and Testimonials

Students implementing the Base Camp Trading methodology report measurable improvements in their directional trading performance. One member documented a 67% account increase over six months, attributing success to the momentum screening criteria and position sizing rules that prevented him from over-leveraging on any single trade. Another trader noted that the trade management framework helped him hold winners significantly longer while cutting losers faster—a mental shift that transformed his profit factor.

A third student shared that after struggling with options for two years, the structured approach finally gave him the confidence to take meaningful positions instead of timid trades that barely moved the needle. The course emphasizes realistic expectations—not every trade wins, but the system creates positive expectancy over dozens of trades. Students learn to filter opportunities using defined criteria, size positions appropriately for their account size, accept losses as part of the growth strategy, and compound winners into meaningful portfolio growth. For traders interested in trend identification tools, Top Trade Tools Hedge Fund Trender provides complementary momentum indicators.

Options Trading Review: Who This Course Serves Best

This options trading course serves traders who have basic options knowledge and want systematic growth strategies, seek larger returns than income strategies typically provide, can handle directional risk with proper position sizing discipline, want a structured approach to aggressive trading instead of random speculation, and are building accounts toward significant capital that enables full-time trading.

The ideal student understands basic options mechanics but wants to move beyond conservative iron condors and credit spreads into directional plays that can double or triple positions. Traders stuck in slow-growth mode particularly benefit from the momentum identification framework. For foundational price action concepts, the Price Action Traders Institute Command Your Trading program builds essential chart reading skills.

Base Camp Trading Review: Is It Worth $997?

At $997, the course provides systematic methodology for aggressive options positioning that many traders spend years developing through expensive trial and error. Students gain clear frameworks for identifying high-probability opportunities, sizing positions appropriately for risk tolerance, and managing trades through completion without emotional interference. One trader mentioned recouping the course cost within his first month using the breakout setups on momentum stocks—though results vary based on market conditions and individual execution.

For traders ready to move beyond conservative income strategies that grow accounts slowly, this program delivers actionable growth methodology backed by real trading principles. The investment represents a fraction of potential gains from properly executed directional trades and far less than most traders lose figuring out growth strategies on their own.

Explosive Growth Course Review: What Is Included?

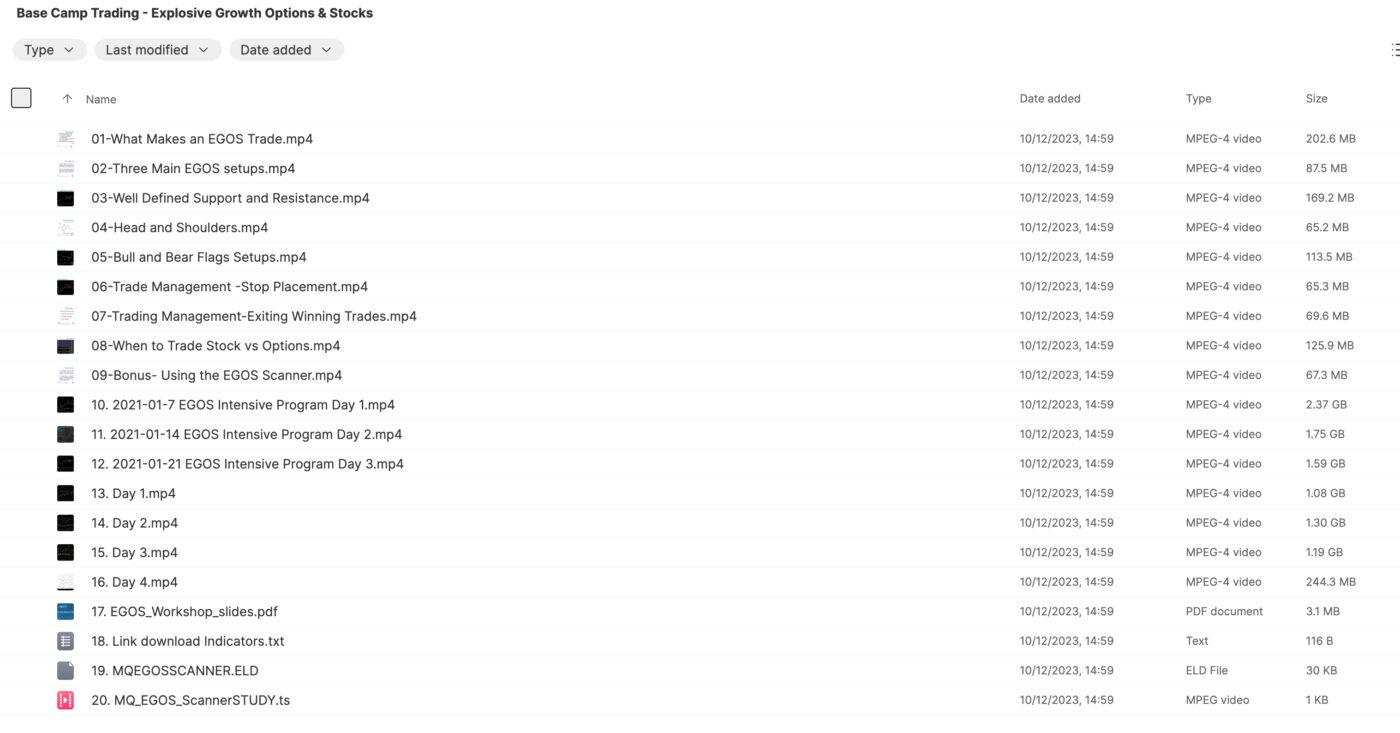

Base Camp Trading Explosive Growth includes complete training on directional options strategies for momentum stocks, technical analysis techniques for identifying breakout setups, position sizing frameworks that balance aggression with capital preservation, and trade management methodology for maximizing winners while limiting losers. The curriculum covers both the chart analysis for finding setups and the options mechanics for structuring positions with favorable risk-reward profiles that give traders edge over time.

Base Camp Trading Legitimacy Review: Is It Legit?

Yes, Base Camp Trading is a legitimate trading education company offering structured courses on stocks and options strategies. The Explosive Growth course provides systematic methodology for directional trading rather than unrealistic promises of guaranteed profits. Students receive practical frameworks they can implement immediately in live markets, with strong emphasis on risk management alongside growth objectives. The approach acknowledges that losses are part of trading while teaching students to maintain positive expectancy.

Options Course Review: Experience Requirements

Basic options knowledge is recommended before taking this course. Students should understand calls, puts, strike selection, expiration dynamics, and basic options mechanics before learning advanced directional strategies. The methodology focuses on stock options trading in liquid names, teaching students to identify momentum in equities and position options for maximum leverage across major markets. Complete beginners should first build foundational knowledge before studying aggressive growth techniques.

Growth vs Income Strategy Review: Key Differences Explained

The Explosive Growth approach focuses on directional trades targeting larger moves using calls and puts on momentum stocks, while income courses emphasize premium selling through strategies like iron condors, credit spreads, and covered calls that profit from theta decay. Traders interested in volatility-based approaches may also explore Fractal Flow Volatility Trading for advanced market analysis. Both approaches have merit in different market conditions—growth strategies excel for building small accounts quickly, while income strategies provide consistent monthly cash flow for larger accounts. Many successful traders use both methods depending on market conditions and their current goals. The CAN SLIM methodology provides additional frameworks for identifying explosive growth opportunities.