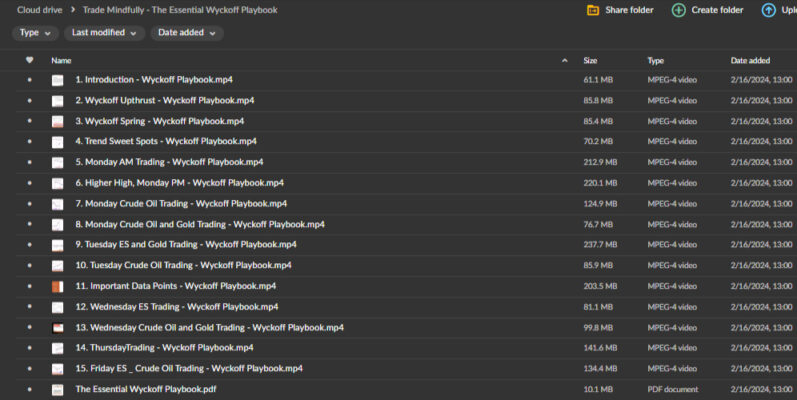

Trade Mindfully – The Essential Wyckoff Playbook

$499.00 Original price was: $499.00.$12.00Current price is: $12.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Trade Mindfully – The Essential Wyckoff Playbook

Master Market Dynamics with the Essential Wyckoff Playbook Course

Are you looking to simplify your trading strategy and maximize your profits with a time-tested methodology? The Essential Wyckoff Playbook course offers traders a comprehensive guide to understanding market dynamics using the powerful Wyckoff principles. Dr. Gary created this course for traders of all levels seeking to enhance their trading precision and profitability. By focusing on four essential trade setups and incorporating Wyckoff Market Principles, the course delivers a robust trading framework that allows you to identify high-probability trades across various markets.

Why Is This Course Worth Buying?

The Trade Mindfully – The Essential Wyckoff Playbook course goes beyond generic trading advice and delves into the core dynamics of the financial markets. It’s not just about learning technical indicators; it’s about understanding the market’s structure, momentum, and the psychology behind price movements. This program provides traders with a solid foundation in Wyckoff Market Principles, including the nuanced details of supply and demand, trend characteristics, and market sentiment. With these skills, traders can move past guesswork and focus on consistent, rule-based decision-making.

Whether you’re trading S&P e-minis, Crude Oil, Gold, or any other instrument, mastering the Wyckoff principles will help you make more intelligent, more strategic trades. The Essential Wyckoff Playbook course empowers you to trade confidently, knowing you have a robust methodology backing every move.

What Are Wyckoff Market Principles?

How Do Wyckoff Market Principles Define Market Behavior?

The Wyckoff Method, developed by Richard D. Wyckoff, is one of the most comprehensive frameworks for understanding market behaviour. It emphasizes the importance of studying price, volume, and market structure to determine the most opportune times to enter and exit trades. In the Essential Wyckoff Playbook, Dr. Gary breaks down the most crucial Wyckoff Market Principles, including:

- Supply & Demand Dynamics: Understand how the balance between supply and demand drives price movements and how to identify shifts in these dynamics.

- Effort vs. Result Analysis: Learn how to compare the effort (volume) and result (price movement) to gauge the strength of a trend.

- Accumulation and Distribution Patterns: Identity areas where institutional players accumulate or distribute prominent positions, signaling potential trend reversals.

By mastering these principles, you’ll gain a deeper understanding of the market’s underlying forces, allowing you to anticipate price movements with greater accuracy.

What Are the Key Concepts to Understand in Wyckoff Trading?

Why Are Market Phases Important?

Market phases play a pivotal role in the Wyckoff Method. Each phase—Accumulation, Markup, Distribution, and Markdown—offers unique opportunities and risks. The Essential Wyckoff Playbook explains how to recognize these phases and adapt your strategy accordingly. You’ll learn:

- Trend Characteristics: Understand how to differentiate between trending and non-trending markets and the appropriate strategies for each.

- Climatic Action and Stopping Volume: Discover how to spot market tops and bottoms using the concepts of Climatic Action (sharp price movements) and Stopping Volume (high volume signaling the end of a trend).

- Tests and Shortening of the Thrust: Recognize signs of trend exhaustion, such as reduced price movement, to determine when a trend is likely to reverse.

These concepts form the backbone of effective Wyckoff trading, helping you navigate both trending and range-bound markets with confidence.

What Are the Four Essential Wyckoff Trade Setups?

How Can You Simplify Trading with Four Core Setups?

The Essential Wyckoff Playbook course focuses on four simple yet powerful trade setups. Each setup is based on classic Wyckoff principles and is designed to be easy to identify, execute, and manage. These setups occur frequently across all markets, making them versatile tools for any trader. Dr. Gary covers:

- The Spring Setup: Learn how to identify when prices dip below a key support level only to spring back up, signaling a potential long entry.

- The Upthrust Setup: Understand how to trade when prices temporarily break above resistance, only to reverse and create a short opportunity.

- The Reversal Bar Setup: Spot quick trend changes using reversal bars, which signal a shift in market sentiment.

- The Test Setup: Discover how to use volume analysis to confirm a support or resistance level, providing a strong entry point for a new trend.

By mastering these four setups, you’ll have a streamlined playbook that simplifies decision-making and enhances your ability to spot profitable trades.

How Does the Playbook Simplify Trading?

Why Is Focusing on Essential Setups Effective?

One of the biggest challenges traders face is being overwhelmed by too much information—too many indicators, setups, and conflicting signals. The Essential Wyckoff Playbook aims to cut through this clutter by providing a clear, straightforward methodology. You’ll learn how to:

- Eliminate Unnecessary Indicators: Focus only on the setups that matter, using a combination of price action and volume analysis.

- Create a Consistent Trading Plan: Develop a trading plan that revolves around these four setups, allowing you to trade with discipline and consistency.

- Set Realistic Profit Targets: Know exactly where to enter and exit trades, minimizing guesswork and maximizing your profit potential.

With a simplified trading approach, you’ll be able to make faster decisions and avoid analysis paralysis, which can hinder trading performance.

What Critical Success Factors Does Dr. Gary Cover?

When and How Should You Enter a Trade?

Timing is everything in trading. The Trade Mindfully – The Essential Wyckoff Playbook course offers detailed guidance on when and how to enter trades based on Wyckoff principles. Dr. Gary teaches you to:

- Use Confirmatory Volume Analysis: Learn how to use volume as a confirming factor to validate your entry signals.

- Set Stop-Loss Levels Effectively: Understand how to place stop-loss orders using Wyckoff patterns, minimizing your risk without cutting off potential gains.

- Identify Optimal Entry Points: Spot the exact moment when price action confirms your trade setup, ensuring high-probability entries.

By mastering entry techniques, you’ll avoid premature entries and increase the likelihood of successful trades.

How Do You Manage Trades Effectively?

What Are the Best Practices for Exiting Trades?

Knowing when to exit a trade is just as crucial as knowing when to enter. The Essential Wyckoff Playbook provides comprehensive strategies for managing trades, including:

- Setting Profit Targets: Determine realistic profit targets based on market structure and volume patterns, ensuring that you lock in gains at the right time.

- Trailing Stop Techniques: Use trailing stops to protect your profits while allowing the trade to continue running if the trend extends.

- Recognizing Warning Signs: Learn how to read volume and price action to spot when a trade is losing momentum, signaling an impending exit.

With these management strategies, you’ll be able to maximize your profits while keeping your losses small, creating a balanced approach to risk and reward.

How Does the Course Apply Across Different Markets?

Can the Wyckoff Playbook Be Used in Multiple Markets?

The beauty of the Trade Mindfully – The Essential Wyckoff Playbook is its adaptability across different asset classes and timeframes. Whether you’re trading futures like S&P e-minis, commodities like Gold and Crude Oil, or even forex, the principles and setups remain effective. Dr. Gary illustrates:

- Practical Examples Across Markets: Walk through recent trading days in popular markets to see how the playbook setups work in real-world scenarios.

- Identifying Market-Specific Patterns: Learn how to adapt the setups to account for the unique characteristics of different instruments.

- Executing Trades in Various Conditions: Understand how to tweak your strategy based on volatility, liquidity, and market structure.

This flexibility makes the Essential Wyckoff Playbook an invaluable tool for any trader, regardless of their preferred market.

Simplify Your Trading Journey with the Essential Wyckoff Playbook!

Why Should You Enroll in This Course Today?

The Trade Mindfully – The Essential Wyckoff Playbook is more than just a trading course—it’s a complete guide to understanding and mastering market dynamics. With a focus on essential Wyckoff principles, clear trade setups, and effective risk management, this course offers a roadmap to consistent profitability.

Enroll today and start trading with the confidence and clarity that comes from understanding the market’s inner workings.

With the Essential Wyckoff Playbook course, you’ll have the tools you need to navigate the financial markets and achieve lasting success!

Product For Sale

Product For Sale

Product For Sale

Product For Sale Related Products

$997.00 Original price was: $997.00.$23.00Current price is: $23.00.

$2,799.00 Original price was: $2,799.00.$24.00Current price is: $24.00.

$997.00 Original price was: $997.00.$9.00Current price is: $9.00.

$500.00 Original price was: $500.00.$15.00Current price is: $15.00.