VMO Profile and Order Flow Daytrading By Johannes Forthmann

Master Market Dynamics with the VMO Profile and Order Flow Daytrading Course by Johannes Forthmann

Are you a day trader looking to gain a deeper understanding of market dynamics and elevate your trading strategies? The VMO Profile and Order Flow Daytrading By Johannes Forthmann course is the ultimate guide to mastering the complexities of intraday trading through a combination of Volume Market Profile (VMO) and Order Flow techniques. Johannes Forthmann, a renowned expert in technical analysis and market structure, offers a comprehensive program that goes beyond traditional approaches, providing you with the skills to analyze market behavior, identify high-probability trades, and optimize your trading decisions in real time.

Why Is This Course Worth Buying?

The VMO Profile and Order Flow Daytrading By Johannes Forthmann course stands out for its unique approach to day trading. Unlike standard courses that rely solely on technical indicators, this program integrates the VMO Profile and Order Flow strategies to offer a more nuanced perspective on market movements. Through this dual approach, Johannes Forthmann teaches traders how to dissect both historical and real-time data, giving them the edge needed to make informed trading decisions. Whether you’re a beginner or an experienced trader, this course will equip you with the tools and insights to understand market sentiment, manage risk effectively, and achieve consistent profitability.

What Are the Core Components of the VMO Profile and Order Flow Daytrading Course?

How Does VMO Profile Provide a Deeper Understanding of Market Volume?

What Is VMO Profile and How Does It Enhance Trading Strategies?

Volume Market Profile (VMO) is a powerful analytical tool that goes beyond traditional volume analysis by focusing on the distribution of trading activity across different price levels. In the VMO Profile and Order Flow Daytrading By Johannes Forthmann course, you’ll learn how to use VMO Profile to gain a deeper understanding of where market participants are most active and how these areas of interest can signal potential price movements. Key concepts include:

- Decoding Volume Clusters: Learn how to identify volume clusters—areas where trading activity is concentrated—and use these clusters to pinpoint potential support and resistance levels.

- Spotting High-Liquidity Zones: Understand how high-liquidity zones can indicate strong market interest and influence future price action, providing valuable insights into trend reversals and breakout opportunities.

- Analyzing Price Rejections: Discover how to interpret price rejections using VMO Profile, helping you identify areas where the market is likely to reverse or stall.

By mastering VMO Profile, you’ll be able to analyze the market’s underlying structure and make more informed decisions based on where the “smart money” is placing their trades.

How Can You Utilize Order Flow to Navigate Real-Time Market Dynamics?

What Is Order Flow Day Trading and Why Is It Crucial for Real-Time Analysis?

Order Flow Daytrading focuses on tracking the live buying and selling activities within the market, offering a real-time glimpse into market sentiment and momentum. In the VMO Profile and Order Flow Daytrading By Johannes Forthmann course, you’ll learn how to interpret order flow data to gauge the strength of price movements and make quick, accurate decisions. The course covers:

- Reading Market Intentions: Learn how to analyze the flow of buy and sell orders to determine whether market participants are more inclined to buy or sell, helping you anticipate price movements before they happen.

- Identifying Key Levels: Use order flow data to identify critical levels of support and resistance, allowing you to enter and exit trades with precision.

- Spotting Absorption and Aggression: Understand how to detect absorption (where large players are absorbing the opposite side’s orders) and aggression (where buyers or sellers are pushing the market in their favor), giving you insight into potential breakouts or reversals.

Order flow analysis is essential for traders who want to navigate fast-paced markets and adapt their strategies in real-time, making it a valuable addition to your trading toolkit.

What Are the Advantages of Combining VMO Profile and Order Flow Strategies?

How Does a Holistic Approach Improve Trading Accuracy?

The true power of the VMO Profile and Order Flow Daytrading By Johannes Forthmann course lies in its integration of both VMO Profile and Order Flow techniques. By combining these two methodologies, you gain a comprehensive understanding of market behavior, allowing you to analyze both historical trends and current market conditions. Key benefits include:

- Enhanced Market Clarity: By using VMO Profile to identify volume-based support and resistance levels and Order Flow to validate these levels in real time, you can filter out false signals and focus on high-probability trades.

- Adaptability Across Market Conditions: Whether you’re trading trending or range-bound markets, this dual approach equips you to adapt your strategies and capitalize on various market scenarios.

- Improved Risk Management: Understanding the volume distribution and live order flow helps you assess the risk-reward ratio more accurately, enabling you to confidently manage your trades.

With this holistic framework, you can fine-tune your entries and exits, increasing the precision and profitability of your trades.

What Risk Management Strategies Are Included in the Course?

How Does Johannes Forthmann Address Risk in Day Trading?

Risk management is a critical aspect of successful trading, and the VMO Profile and Order Flow Daytrading By Johannes Forthmann course strongly emphasises minimizing risk while maximizing potential gains. Johannes Forthmann covers:

- Calculating Risk-Reward Ratios: Learn how to evaluate the risk-reward ratio for every trade, ensuring that you only take positions with favourable outcomes.

- Setting Stop-Loss Levels: Understand how to place stop-loss orders using VMO Profile and Order Flow data, protecting yourself from sudden market reversals.

- Position Sizing Techniques: Discover how to size your positions based on market conditions and your risk tolerance, preventing overexposure and maintaining a balanced portfolio.

By mastering these risk management strategies, you can safeguard your capital and trade with greater confidence, even in volatile market conditions.

How Does Johannes Forthmann’s Approach Elevate Day Trading Skills?

Why Should You Learn from Johannes Forthmann?

Johannes Forthmann is a seasoned trader and educator with a deep understanding of market structure and intraday trading dynamics. His unique methodology combines theoretical knowledge with practical application, making complex concepts accessible and actionable. In the VMO Profile and Order Flow Daytrading By Johannes Forthmann course, you’ll benefit from:

- Real-World Examples and Case Studies: Each concept is illustrated with real-world trading examples, showing you how to apply VMO Profile and Order Flow strategies in live market conditions.

- Hands-On Exercises and Assignments: Reinforce your learning through interactive exercises and assignments that challenge you to implement the techniques covered in the course.

- Continuous Support and Community Access: Join a community of like-minded traders to share insights, ask questions, and receive ongoing support from Johannes Forthmann and other experts.

By learning directly from Johannes, you’ll gain the knowledge and confidence to tackle even the most challenging market conditions.

What Can You Expect from the VMO Profile and Order Flow Daytrading Course?

How Is the Course Structured?

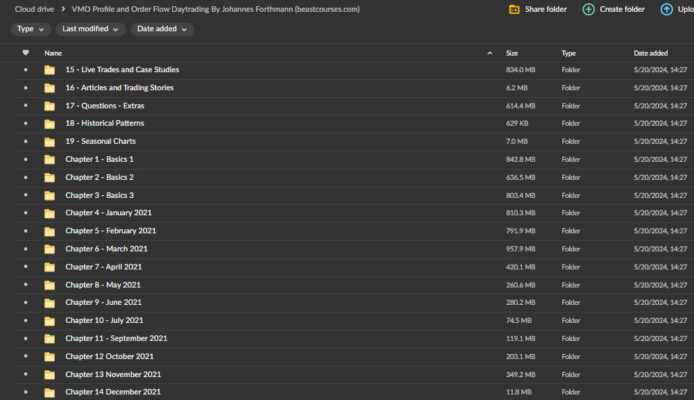

The VMO Profile and Order Flow Daytrading By Johannes Forthmann course is structured into multiple modules, each focusing on a specific aspect of day trading. Key modules include:

- Introduction to VMO Profile and Order Flow: This course provides an overview of the core concepts and sets the stage for more advanced strategies.

- VMO Profile Analysis: Dive deep into volume dynamics, volume clusters, and high-liquidity zones.

- Order Flow Techniques: Learn how to read and interpret live order flow data, including market depth, bid-ask spreads, and tape reading.

- Combining VMO and Order Flow: Discover how to integrate both methodologies for maximum trading accuracy.

- Risk Management and Trade Execution: Develop a robust risk management plan and execute trades precisely.

This comprehensive structure ensures you gain a well-rounded understanding of VMO Profile and Order Flow strategies, equipping you to tackle a wide range of trading scenarios.

Take Your Day Trading to the Next Level with the VMO Profile and Order Flow Daytrading Course!

Why Should You Enroll in This Course Today?

The VMO Profile and Order Flow Daytrading By Johannes Forthmann course is the perfect training program for traders looking to elevate their skills and achieve consistent profitability. With its focus on understanding both volume dynamics and real-time order flow, this course provides a complete framework for mastering the intricacies of intraday trading.

Don’t miss this opportunity to learn from an expert in the field—enroll today and start transforming your day trading strategies with the VMO Profile and Order Flow Daytrading By Johannes Forthmann course. Gain the knowledge, confidence, and edge you need to succeed in the fast-paced world of day trading!