Wonda FX Signature Strategy

Wonda FX Signature Strategy Course: A Comprehensive Path to Forex Trading Mastery

The Wonda FX Signature Strategy course is designed to revolutionize how traders approach the forex market. Combining expert technical analysis, a unique set of proprietary indicators, and robust risk management practices, this course provides a complete toolkit for anyone serious about mastering forex trading. Whether you’re a seasoned trader or just beginning your journey, the Wonda FX Signature Strategy offers a proven method to navigate the complexities of the forex market with confidence and precision.

A reliable, well-tested strategy is crucial for consistent success in an unpredictable and volatile market like forex. The Wonda FX Signature Strategy equips traders with the knowledge, skills, and tools needed to make informed decisions and maximize profitability. With its adaptable framework and supportive community, the course ensures that traders are never alone on their journey to financial success.

H2: What Sets the Wonda FX Signature Strategy Apart?

The Wonda FX Signature Strategy is distinct in its approach, blending technical precision with a proprietary set of indicators. It goes beyond just teaching trading techniques – it introduces traders to an innovative framework that adapts to various market conditions and personal trading styles.

Unique Indicator Set

One of the standout features of the Wonda FX Signature Strategy is the use of proprietary indicators, designed specifically to give traders an edge in understanding market sentiment and volatility. These indicators provide insights that traditional tools might overlook, helping traders spot potential reversals, anticipate market shifts, and make well-timed entries and exits.

Unlike many trading systems that rely heavily on general indicators available to everyone, the Wonda FX Signature Strategy gives participants access to exclusive indicators, offering a clearer view of the market’s direction. This proprietary edge allows traders to respond with agility and precision, making the strategy uniquely powerful for those looking to stand out in the crowded forex landscape.

Technical Precision

At the heart of the Wonda FX Signature Strategy is a strong emphasis on technical precision. Traders are walked through the detailed analysis of chart patterns, trend lines, and other critical technical factors that impact market movements. This component ensures that traders can confidently identify optimal entry and exit points, leading to more accurate trades and higher profitability.

In the Wonda FX Signature Strategy course, participants are taught how to interpret various technical data. This includes understanding the significance of support and resistance levels, recognizing trend patterns, and using these insights to inform trading decisions. By mastering technical precision, traders gain the ability to make data-driven decisions rather than emotional ones.

H2: How Does Risk Management Play a Role in Wonda FX?

A core principle of the Wonda FX Signature Strategy is the rigorous approach to risk management. Managing risk effectively can mean the difference between long-term success and short-term failure in the fast-moving world of forex. The course dedicates extensive time to teaching traders how to safeguard their capital while taking advantage of market opportunities.

Protecting Your Capital

One of the key risk management techniques taught in the Wonda FX Signature Strategy is using stop-loss orders. By strategically placing stop-losses at predetermined levels, traders ensure that they limit their potential losses, protecting their portfolio from significant downturns. In addition to this, the course teaches the importance of setting appropriate risk-reward ratios for each trade, ensuring that the potential upside justifies the risk being taken.

Position Sizing

Another critical aspect of risk management emphasized in the course is position sizing. Traders learn how to scale their positions based on their account size and market volatility, ensuring they are never overleveraged. Proper position sizing reduces the chance of wiping out a trading account during unexpected market moves, fostering a more disciplined and sustainable approach to trading.

H2: How Does the Wonda FX Strategy Adapt to Different Time Frames?

One of the major advantages of the Wonda FX Signature Strategy is its adaptability across different time frames. Traders have diverse preferences – some prefer short-term trading, such as scalping, while others are more comfortable with longer-term swing trading. The Wonda FX Signature Strategy is designed to work seamlessly across all these time frames, offering a versatile approach suitable for a wide range of trading styles.

Scalping with Wonda FX

For traders who favor short-term trades, the Wonda FX Signature Strategy provides a framework for making quick, calculated decisions based on minute-by-minute chart movements. Scalpers will find that the proprietary indicators offer the precision they need to identify small windows of opportunity, maximizing profitability within tight time constraints.

Swing Trading for Larger Moves

On the other hand, those who prefer to hold positions over longer periods will find the strategy equally effective. The technical analysis tools and risk management principles taught in the course allow swing traders to ride larger market movements, with clear guidance on where to place entries, exits, and stop-losses to optimize results.

H2: What Comprehensive Training Does Wonda FX Offer?

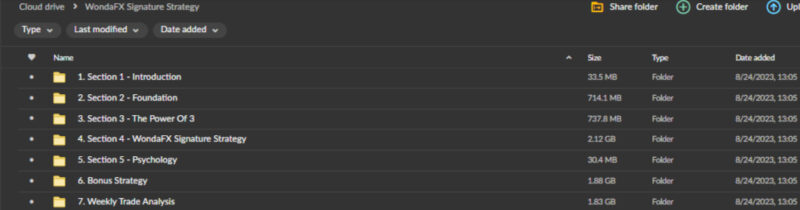

The Wonda FX Signature Strategy course isn’t just about providing the strategy itself – it offers a complete training program to ensure participants fully understand and can apply the strategy effectively. Through a combination of video lessons, live webinars, and written materials, traders receive a well-rounded education.

Video Tutorials and Live Webinars

Participants have access to detailed video tutorials that walk through each component of the strategy. These videos offer visual step-by-step instructions on how to set up trades, read indicators, and manage risk. Additionally, live webinars allow participants to ask questions in real-time, engaging directly with expert traders who can provide personalized advice.

Written Guides and Resources

For those who prefer to learn at their own pace, the course also includes comprehensive written guides and downloadable resources. These materials cover everything from basic forex terminology to advanced trading techniques, making sure participants have all the information they need to succeed.

H2: How Does Wonda FX Encourage Continuous Optimization?

The Wonda FX Signature Strategy is not a static method – it’s a constantly evolving system that adapts to changing market conditions. Traders are encouraged to continuously refine their approach, based on both their own trading experiences and the feedback provided through regular course updates.

Refining the Strategy Over Time

As markets evolve, so do the tools and strategies used to navigate them. Wonda FX encourages participants to experiment with different market conditions, adjust their use of indicators, and continuously track their performance. This commitment to ongoing refinement ensures that traders are always using the most effective version of the strategy.

H2: What Are the Benefits of Community Engagement in Wonda FX?

Trading can often be a solitary endeavor, but the Wonda FX Signature Strategy course fosters a strong sense of community among its participants. Through discussion forums, social media groups, and live webinars, traders are able to engage with one another, share insights, and collaborate on refining their strategies.

Learning from Fellow Traders

By connecting with a network of like-minded traders, participants gain access to a wealth of knowledge and experience. These interactions can lead to valuable insights, whether it’s learning a new way to interpret a chart or gaining confidence from seeing how others are applying the strategy in real-world markets.

H2: How Does Performance Tracking Enhance the Strategy?

A key component of the Wonda FX Signature Strategy is the ability to track and analyze performance. Traders are taught how to evaluate their trades using a set of key performance indicators (KPIs), allowing them to assess the effectiveness of the strategy and make data-driven decisions.

Analyzing Performance for Better Results

By regularly reviewing trade outcomes and comparing them to set goals, traders can identify areas of improvement. Whether it’s refining entry points or adjusting risk levels, the process of tracking performance ensures that traders are always learning from both their successes and mistakes.

Conclusion

The Wonda FX Signature Strategy course is a comprehensive program that offers traders a strategic edge in the forex market. With its emphasis on technical precision, unique proprietary indicators, rigorous risk management, time frame adaptability, continuous training, community engagement, and performance tracking, the course equips traders with everything they need to succeed.

By enrolling in this course, traders are not just learning a strategy – they are joining a community of committed individuals, all working toward mastery in the forex market.

Related Trading Courses

Continue your trading education with these recommended courses: