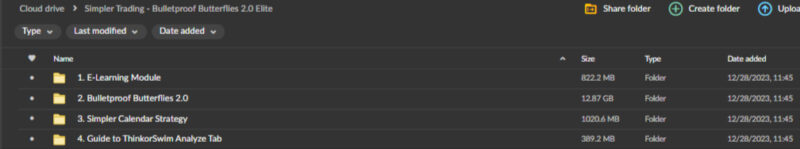

Simpler Trading Bulletproof Butterflies 2.0 Elite

Master the Markets with Simpler Trading Bulletproof Butterflies 2.0 Elite Course

Elevate your trading skills with the Simpler Trading Bulletproof Butterflies 2.0 Elite course. This cutting-edge strategy, designed by the experts at Simpler Trading, combines the versatility of butterfly spreads with advanced risk management techniques to give traders a robust approach to navigating today’s dynamic markets. Building upon the success of its predecessor, Bulletproof Butterflies 2.0 Elite refines the method, offering adaptable strategies that suit a wide range of market conditions and asset classes.

Whether you’re a novice trader looking for an accessible yet powerful trading strategy or an experienced investor seeking to add more precision to your trading portfolio, the Simpler Trading Bulletproof Butterflies 2.0 Elite course provides all the tools, insights, and resources you need to succeed. From mastering butterfly spreads to protecting against tail risks, this course teaches you how to manage risk effectively while maximizing opportunities in the financial markets.

Why Is the Simpler Trading Bulletproof Butterflies 2.0 Elite Course a Must-Have?

Why should traders invest in the Bulletproof Butterflies 2.0 Elite course? In an ever-changing financial landscape, the key to sustained success lies in having a flexible strategy that can adapt to different market conditions. The Simpler Trading Bulletproof Butterflies 2.0 Elite offers precisely that—an elite system that combines simplicity with effectiveness, helping traders of all levels navigate the complexities of the market. This course focuses on practical strategies that enable you to make informed decisions, minimize risk, and generate consistent returns.

Designed by seasoned traders, this elite version builds on proven trading techniques while introducing dynamic adjustments and tail risk protection to enhance your performance across asset classes. Whether you’re trading stocks, options, or futures, this course offers a robust framework for maximizing your potential in any market environment. Its user-friendly interface and comprehensive educational resources make it accessible to both beginner and seasoned traders alike.

What Are the Key Features of the Simpler Trading Bulletproof Butterflies 2.0 Elite Course?

How Does Bulletproof Butterflies 2.0 Elite Adapt to Market Conditions?

What makes this strategy so adaptable to different market environments? One of the standout features of the Simpler Trading Bulletproof Butterflies 2.0 Elite is its adaptability. Markets can be unpredictable, and traders need a strategy to respond effectively to volatility, trends, and range-bound environments. This course teaches participants how to fine-tune their trading approach based on the specific conditions of the asset class they’re dealing with, whether it’s stocks, options, or futures.

This strategy’s flexibility lies in its ability to adjust to various volatility levels. When markets are quiet, Bulletproof Butterflies 2.0 Elite provides a framework for capitalizing on small price movements. At the same time, during more volatile times, the strategy allows for protective adjustments to minimize risk exposure. This adaptability gives traders the confidence to trade consistently, regardless of market conditions.

By the end of this module, traders will know to tailor their trades according to current market behavior, ensuring they can remain profitable across different market scenarios.

How Does Bulletproof Butterflies 2.0 Elite Enhance Risk Management?

Why is risk management a central focus of this strategy? The Simpler Trading Bulletproof Butterflies 2.0 Elite course strongly emphasizes risk management, making it one of the most comprehensive trading strategies available today. In trading, protecting your capital is just as important as generating profits, and this elite strategy is designed to do both.

By incorporating advanced risk mitigation techniques, this course teaches traders how to implement butterfly spreads while managing the downside effectively. Traders will learn how to set up trades with defined risk, meaning there’s no need to worry about unlimited losses. The strategy also includes the use of stop-loss orders, position sizing, and dynamic adjustments to help traders manage risk on every trade.

Tail risk protection is another critical feature of this strategy. In periods of extreme market turbulence or unexpected events, Bulletproof Butterflies 2.0 Elite aims to shield traders from severe losses by building mechanisms that protect against outlier events. This focus on risk management ensures traders can trade with confidence and peace of mind.

What Makes Bulletproof Butterflies 2.0 Elite Versatile Across Asset Classes?

How does this strategy apply to different financial instruments? Another key feature of the Simpler Trading Bulletproof Butterflies 2.0 Elite is its versatility across multiple asset classes. Whether you prefer trading stocks, options, or futures, this strategy can be adapted to suit your needs. This multi-asset flexibility allows traders to diversify their portfolios while sticking to a reliable trading framework.

For options traders, butterfly spreads offer a defined-risk strategy that can capitalize on market movements within a specific range. The course covers setting up butterfly spreads and adjusting them to various market conditions, making it easier for traders to profit from small price fluctuations or sideways market trends. Additionally, for futures and stock traders, the adaptability of the strategy means you can apply the principles learned in this course to your preferred trading style.

By learning how to apply the Bulletproof Butterflies 2.0 Elite strategy to different asset classes, traders can expand their market opportunities and enhance their profitability across the board.

What Are the Strategic Components of the Bulletproof Butterflies 2.0 Elite Course?

What Role Do Butterfly Spreads Play in This Strategy?

How do butterfly spreads work, and why are they central to this course? At the core of the Simpler Trading Bulletproof Butterflies 2.0 Elite strategy are butterfly spreads, a popular options trading strategy that involves using three strike prices to create a defined-risk position. Butterfly spreads allow traders to profit from price movements within a specific range, making them an ideal strategy for capturing gains in stable or low-volatility markets.

This course breaks down how to set up butterfly spreads step by step, from selecting the right strike prices to adjusting positions as the market evolves. Traders will learn the nuances of different butterfly spread variations—such as long butterfly spreads and iron butterflies—and how to choose the right structure based on their market outlook and risk tolerance.

By the end of this module, participants will understand how to use butterfly spreads to capitalize on small price movements while managing their risk effectively.

How Does the Elite Version Protect Against Tail Risk?

Why is tail risk protection important in trading? Tail risk refers to the potential for extreme market events that lie outside the range of normal expectations—events that can lead to significant financial losses. The Simpler Trading Bulletproof Butterflies 2.0 Elite course places a strong emphasis on protecting against tail risks, ensuring that traders are prepared for sudden market volatility or unforeseen events.

In this module, traders will learn how to build tail risk protection into their trades using specific hedging strategies and adjustments. This could involve adding positions that counterbalance potential losses in extreme conditions or using options strategies like buying out-of-the-money puts as insurance. The aim is to prevent traders from experiencing catastrophic losses during market downturns or black swan events.

With tail risk protection integrated into their strategy, traders can maintain confidence even during unpredictable market movements, knowing that their capital is protected from significant losses.

How Do Dynamic Adjustments Maximize Opportunities?

Why are dynamic adjustments critical for maintaining a profitable strategy? One of the major advantages of the Simpler Trading Bulletproof Butterflies 2.0 Elite strategy is its ability to adapt dynamically to changing market conditions. Markets are rarely static, and traders must be able to adjust their positions to stay ahead of fluctuations. This course teaches participants how to make real-time adjustments to their trades, ensuring their strategies remain effective in various market environments.

Dynamic adjustments could include modifying the strike prices of existing butterfly spreads, adjusting position sizes, or closing out portions of a trade to lock in profits or minimize losses. By being proactive with these adjustments, traders can maximize potential profits while minimizing risk, even as market conditions change.

By the end of this module, participants will have mastered the art of dynamic trading adjustments, allowing them to optimize their positions and stay agile in any market environment.

How Does Simpler Trading Support Traders with Educational Resources?

What Educational Resources Are Included in the Course?

How does Simpler Trading ensure traders fully understand and apply the strategy? To help traders implement the Bulletproof Butterflies 2.0 Elite strategy effectively, Simpler Trading offers a comprehensive suite of educational resources. These materials are designed to deepen participants’ understanding of the strategy and its application in live markets.

The course includes in-depth video tutorials, detailed written guides, and access to live webinars where traders can learn directly from experts. These resources cover every aspect of the strategy, from setting up trades to making dynamic adjustments and managing risk. Simpler Trading also offers ongoing support through its community forums, allowing traders to connect with peers, ask questions, and get feedback on their trades.

By providing these educational tools, Simpler Trading ensures that traders not only learn the strategy but also build the confidence to apply it successfully in their own trading journey.

Conclusion: Why Simpler Trading Bulletproof Butterflies 2.0 Elite is the Ultimate Trading Strategy

The Simpler Trading Bulletproof Butterflies 2.0 Elite course is a comprehensive, versatile, and adaptable strategy that empowers traders to navigate today’s complex financial markets with confidence. With its focus on butterfly spreads, tail risk protection, and dynamic adjustments, this course offers a proven framework for managing risk while maximizing profit potential. Whether you’re a beginner or an experienced trader, the elite version of Bulletproof Butterflies provides everything you need to succeed, backed by a user-friendly interface and extensive educational support.

Enroll in the Simpler Trading Bulletproof Butterflies 2.0 Elite course today and take control of your trading future with this innovative and powerful strategy!