Rekt Capital – Technical Analysis (English)

Rekt Capital – Technical Analysis (English): Elevate Your Crypto Trading Mastery

In the ever-evolving world of cryptocurrency, a solid understanding of technical analysis (TA) can significantly enhance trading decisions, minimize risks, and optimize returns. For investors looking to master the art of analyzing crypto markets, the Rekt Capital—Technical Analysis (English) course stands as an essential guide. This course, developed by Rekt Capital, a trusted name in the cryptocurrency trading community, focuses on the tools, strategies, and techniques needed to confidently navigate digital asset volatility.

Why Choose the Technical Analysis (English) Course?

The Technical Analysis (English) course by Rekt Capital is designed for beginner and advanced traders seeking to understand market dynamics and make informed investment decisions. Whether you’re just starting or are a seasoned trader, this course provides comprehensive insights into analysing cryptocurrency price movements, recognising market patterns, and acting decisively in the fast-paced crypto environment.

This course is built around practical application and a deep understanding of technical indicators, candlestick patterns, and support and resistance levels. By the end of the program, you’ll have the knowledge and skills necessary to make educated decisions that align with your financial goals in cryptocurrency markets.

What Is Technical Analysis and Why Does It Matter?

What is Technical Analysis?

Technical analysis involves studying historical price movements and trading volumes to predict future market behavior. Unlike fundamental analysis, which examines the intrinsic value of an asset, technical analysis focuses purely on price action and patterns to identify potential trading opportunities. The Rekt Capital – Technical Analysis (English) course breaks down these concepts clearly and understandably, offering real-world examples and hands-on learning for students.

Why Does It Matter?

With cryptocurrencies, market prices can fluctuate dramatically within hours or even minutes. By mastering technical analysis, traders can quickly assess whether an asset is likely to rise or fall, enabling them to enter or exit trades at the most opportune moments. This course will teach you how to interpret price charts, identify trends, and make data-driven trading decisions that can improve your overall performance in the crypto market.

What You Will Learn in the Rekt Capital – Technical Analysis (English) Course?

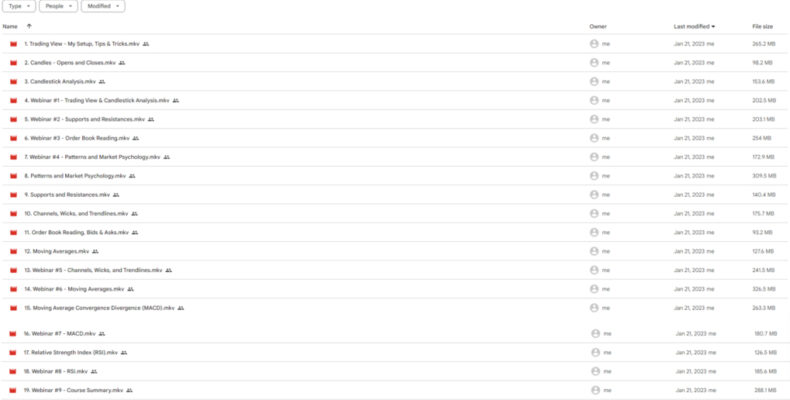

The Technical Analysis (English) course covers a wide array of critical topics in cryptocurrency technical analysis. The course is broken down into several key modules designed to teach participants the most effective ways to interpret market movements and apply technical indicators to their trading strategies.

Introduction to Technical Analysis: Why It’s Crucial for Crypto Traders

What is Technical Analysis, and why is it essential for trading?

The first module introduces the core principles of technical analysis, including how and why it works in the cryptocurrency space. Unlike traditional markets, the crypto market is highly volatile, and being able to read market trends and price actions becomes indispensable for traders. In this module, you’ll learn about the basic tools of technical analysis, from chart patterns to understanding market psychology.

Advanced Charting Tools: Harnessing Data for Precise Decision-Making

How do advanced charting tools help traders succeed?

One of the cornerstones of technical analysis is the ability to read and analyze charts accurately. This course offers hands-on training in using advanced charting tools that provide real-time insights into cryptocurrency price movements. You’ll learn how to use various types of charts, such as candlestick charts, bar charts, and line charts, to get a complete picture of market trends.

In this module, you will learn:

- Candlestick Patterns: Understanding the most important candlestick patterns, such as engulfing, doji, and hammer patterns, and how these can signal trend reversals or continuations.

- Moving Averages: Learn about simple moving averages (SMA), exponential moving averages (EMA), and how they can help identify buying or selling opportunities.

- Volume Indicators: Discover how to use volume as a confirming indicator to validate price movements and avoid false signals.

By mastering charting techniques, you’ll be better positioned to make informed decisions that align with your risk tolerance and investment strategy.

Trend Identification: Mastering the Art of Riding the Market Waves

How can you effectively identify and confirm market trends?

In the crypto markets, trends are crucial for determining the overall direction of prices. However, differentiating between short-term price fluctuations and long-term trends is vital for profitable trading. The Rekt Capital – Technical Analysis (English) course teaches you how to identify trends early on and ride them to maximize your profits.

Key topics covered in this module include:

- Trendlines: How to draw trendlines and use them to identify bullish and bearish markets.

- Support and Resistance Levels: Learn to recognize key levels where price is likely to stall or reverse, and how these levels act as psychological barriers for traders.

- Breakouts and Breakdowns: How to identify when a market is breaking out of a range and how to capitalize on these movements for high-probability trades.

By mastering trend identification and confirmation, you will be able to avoid false breakouts and enter trades with greater confidence.

Support and Resistance: The Key to Optimal Entry and Exit Points

How do support and resistance levels guide your trading strategy?

Support and resistance levels are fundamental to any trader’s toolbox. These levels indicate where buyers or sellers are likely to step in, creating turning points in the market. The Technical Analysis (English) course explains how to identify and use these levels effectively to optimize entry and exit points in your trades.

In this section, you will learn:

- Support Levels: How to identify price levels where demand is strong enough to prevent the price from falling further.

- Resistance Levels: Learn how to spot resistance areas where supply is high, preventing price from rising.

- Setting Stop-Losses and Take-Profits: Setting appropriate stop-losses below support levels and take-profits just before resistance levels, ensuring that your trades maximize profits while minimizing risk.

This module gives you the tools to make smarter decisions about when to enter or exit a trade, helping you avoid costly mistakes.

Candlestick Patterns: Interpreting Market Sentiment

Why are candlestick patterns important for understanding market sentiment?

Candlestick patterns are visual representations of price movements within a specific timeframe. By recognising and interpreting these patterns, traders can anticipate potential price movements and act accordingly. The Rekt Capital – Technical Analysis (English) course offers a deep dive into candlestick pattern recognition, teaching traders how to confidently predict trend reversals and continuations.

Some key candlestick patterns covered include:

- Doji Patterns: These signal market indecision and can be a precursor to a reversal.

- Engulfing Patterns: How bullish or bearish engulfing patterns can signal a significant shift in market sentiment.

- Hammer and Hanging Man Patterns: How these patterns can be used to spot market tops and bottoms, offering prime entry points for trades.

Understanding these patterns allows traders to grasp market psychology and capitalize on opportunities as they emerge.

Real-Time Market Updates: Staying Ahead in the Crypto Markets

Why is staying informed about real-time market conditions essential for traders?

In the volatile world of cryptocurrency, market conditions can change instantly. The Rekt Capital – Technical Analysis (English) course offers real-time market updates, giving traders the latest information and insights. This allows traders to make quick, informed decisions based on the most up-to-date data available.

With this feature, you will learn:

- Reacting to Market News: How to interpret breaking news and adapt your strategy in real-time.

- Adjusting Your Strategy: Learn how to tweak your trading strategy based on emerging trends or shifts in market sentiment.

- Staying Competitive: Gain a competitive edge by having access to the latest market updates and reacting faster than the broader market.

Real-time updates are crucial for anyone looking to succeed in the fast-paced crypto markets. They ensure that you never miss a trading opportunity.

Conclusion: Why the Rekt Capital – Technical Analysis (English) Course is Worth the Investment

The Rekt Capital – Technical Analysis (English) course is an essential resource for anyone looking to master the world of cryptocurrency trading. By combining advanced charting techniques, trend analysis, support and resistance, candlestick patterns, and real-time market updates, this course offers a holistic approach to technical analysis that will significantly enhance your trading capabilities.

Whether you’re an aspiring trader or someone with experience looking to fine-tune your skills, the knowledge and strategies you will gain from this course are invaluable for navigating the volatile and complex crypto markets. Rekt Capital has designed this program with one goal in mind: to empower traders to make informed, data-driven decisions that maximize profitability while minimizing risk.

Enroll in the Technical Analysis (English) course today and take control of your financial future by mastering the art of cryptocurrency trading.