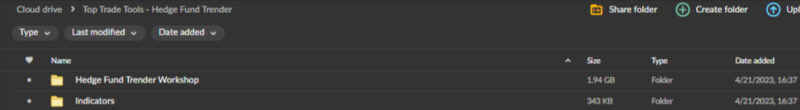

Top Trade Tools – Hedge Fund Trender

Hedge Fund Trender Course by Top Trade Tools: Empower Your Trading Strategy

Top Trade Tools presents the Hedge Fund Trender, an advanced trading tool designed to empower investors and traders with sophisticated insights and trend analysis. This software aims to provide users, from seasoned professionals to aspiring traders, with a competitive edge in navigating financial markets. In this comprehensive tool, Top Trade Tools incorporates various features and analytics to facilitate informed decision-making.

Algorithmic Trend Analysis: Core Functionality of Hedge Fund Trender

What Makes Algorithmic Trend Analysis Essential?

Its advanced algorithmic trend analysis is at the Hedge Fund Trender is core. This feature allows users to identify trends in financial markets with precision. The tool employs sophisticated algorithms to analyze historical price data, recognizing patterns and potential trend reversals. Traders can leverage this functionality to make informed market entry and exit points decisions.

The algorithmic trend analysis is precious because it removes much of the guesswork involved in trading. By systematically evaluating market data, the Hedge Fund Trender provides users with actionable insights, increasing the likelihood of successful trades. This tool enhances traders’ ability to predict market movements, ultimately leading to more profitable trading strategies.

How Does Algorithmic Trend Analysis Work?

The Hedge Fund Trender analyzes vast historical price data to identify recurring patterns and trends. It utilizes advanced mathematical models and machine learning techniques to predict future market behavior. This approach allows traders to anticipate price movements and make strategic decisions based on robust data analysis.

By incorporating algorithmic trend analysis, the Hedge Fund Trender ensures that users have access to the latest and most accurate market information. This feature is essential for traders who want to stay ahead of the competition and capitalize on emerging market opportunities.

Real-Time Market Scanning: Timely Identification of Opportunities

Why Real-Time Market Scanning Matters

A standout feature of the Hedge Fund Trender is its real-time market scanning capabilities. Traders can receive live updates on market conditions and potential trading opportunities. The tool scans various financial instruments, providing timely alerts based on the identified trends. This real-time information empowers users to stay ahead of market movements and make timely investment decisions.

Real-time market scanning is crucial for traders who need to respond quickly to market changes. By continuously monitoring the market, the Hedge Fund Trender ensures that users are always informed about the latest trends and can act swiftly to capitalize on new opportunities.

How to Leverage Real-Time Market Scanning

The Hedge Fund Trender’s real-time market scanning feature continuously analyzes market data and identifies potential trading opportunities. Users can customize the tool to focus on specific financial instruments or market conditions, ensuring that the alerts they receive are relevant to their trading strategies.

By leveraging real-time market scanning, traders can stay ahead of the curve and make informed decisions based on the latest market data. This feature is handy for day traders and other active market participants who need to respond quickly to changing conditions.

Customizable Alerts and Notifications: Tailored to User Preferences

The Importance of Customization in Trading

Recognizing the importance of personalized trading strategies, the Hedge Fund Trender offers customizable alerts and notifications. Users can set specific criteria for trend alerts, ensuring that the tool aligns with their trading preferences and objectives. Whether focusing on particular markets or timeframes, traders can tailor the alerts to suit their individual strategies.

Customization is essential in trading because it allows users to focus on the information that matters most to them. By tailoring the alerts and notifications to their specific needs, traders can ensure that they are only receiving relevant information, reducing the likelihood of being overwhelmed by unnecessary data.

How to Customize Your Alerts and Notifications

The Hedge Fund Trender allows users to customize their alerts and notifications in a variety of ways. Users can set specific criteria for trend alerts, such as price thresholds, volume changes, or technical indicators. This level of customization ensures that traders are only alerted to the most relevant market developments.

By customizing their alerts and notifications, traders can focus on the information that matters most to them and make more informed trading decisions. This feature is handy for traders who have specific strategies or market preferences and need a tool that can adapt to their unique needs.

Risk Management Insights: Enhancing Decision-Making

Why Risk Management is Crucial in Trading

The program incorporates risk management insights to enhance decision-making. The Hedge Fund Trender provides risk analysis metrics, helping traders assess the potential downside of a trade. This feature aids in setting stop-loss levels and managing risk effectively, a critical aspect of successful trading strategies.

Effective risk management is crucial for traders because it helps protect their capital and minimize losses. By providing insights into the potential risks of a trade, the Hedge Fund Trender allows users to make more informed decisions and manage their risk exposure effectively.

How to Utilize Risk Management Insights

The Hedge Fund Trender provides users with a variety of risk management tools and insights. These include risk analysis metrics, which help traders assess the potential downside of a trade, and tools for setting stop-loss levels and managing position sizes. By utilizing these tools, traders can develop effective risk management strategies and protect their capital.

By incorporating risk management insights into their trading strategies, users can minimize their losses and maximize their profits. This feature is precious for traders who want to ensure that their trading strategies are sustainable and profitable in the long term.

User-Friendly Interface: Accessibility and Ease of Use

Why a User-Friendly Interface Matters

Top Trade Tools prioritizes accessibility with a user-friendly interface. The Hedge Fund Trender is designed to be intuitive, allowing both seasoned professionals and newer traders to navigate the tool seamlessly. The clear and concise interface ensures that users can focus on analyzing trends and making decisions without unnecessary complexity.

A user-friendly interface is crucial because it ensures that traders can easily navigate the tool and access the information they need. By minimizing complexity, the Hedge Fund Trender allows users to focus on their trading strategies and make more informed decisions.

How to Navigate the User-Friendly Interface

The Hedge Fund Trender’s user-friendly interface is designed to be intuitive and easy to navigate. Users can quickly access the tool’s various features and functions, such as real-time market scanning, customizable alerts, and risk management insights. The clear and concise design ensures that users can easily find the information they need and make informed decisions.

By providing a user-friendly interface, the Hedge Fund Trender ensures that traders can focus on their trading strategies and make more informed decisions. This feature is precious for newer traders who may be unfamiliar with more complex trading tools.

Backtesting Capabilities: Historical Performance Analysis

The Importance of Backtesting in Trading

To provide users with confidence in their strategies, the Hedge Fund Trender incorporates backtesting capabilities. Traders can analyze the historical performance of specific trading strategies against past market conditions. This allows users to assess the effectiveness of their chosen strategies before implementing them in live markets.

Backtesting is crucial because it allows traders to evaluate the performance of their strategies before risking real capital. By analyzing historical data, traders can identify potential weaknesses and make adjustments to improve their strategies.

How to Use Backtesting Capabilities

The Hedge Fund Trender’s backtesting capabilities allow users to analyze the historical performance of their trading strategies. Users can input their chosen criteria and analyze how their strategy would have performed under past market conditions. This allows traders to assess the effectiveness of their strategies and make any necessary adjustments.

By utilizing backtesting capabilities, traders can gain confidence in their strategies and ensure that they are effective before implementing them in live markets. This feature is precious for traders who want to test their strategies and make data-driven decisions.

Community Collaboration: Sharing Insights and Strategies

The Value of Community Collaboration in Trading

Recognizing the value of community collaboration, Top Trade Tools facilitates a community platform for users of the Hedge Fund Trender. Traders can share insights, strategies, and experiences within the community. This collaborative environment enhances the overall learning experience, allowing users to benefit from diverse perspectives and trading approaches.

Community collaboration is valuable because it allows traders to learn from each other and share their experiences. By collaborating with other traders, users can gain new insights and develop more effective trading strategies.

How to Engage in Community Collaboration

The Hedge Fund Trender provides users with a platform for community collaboration. Users can join discussions, share their insights and strategies, and learn from other traders. This collaborative environment allows users to benefit from diverse perspectives and develop more effective trading strategies.

By engaging in community collaboration, traders can enhance their learning experience and develop more effective trading strategies. This feature is particularly valuable for newer traders who can learn from the experiences of more seasoned professionals.

Continuous Updates and Support: Evolving with Market Dynamics

The Importance of Continuous Updates and Support

The Hedge Fund Trender is backed by continuous updates and support from Top Trade Tools. This ensures that the tool evolves with changing market dynamics, incorporates new features, and addresses any issues promptly. Traders can rely on ongoing support to enhance their trading experience and adapt to the ever-evolving financial landscape.

Continuous updates and support are crucial because they ensure that the tool remains effective and relevant in changing market conditions. By providing ongoing support, Top Trade Tools ensures that users can rely on the Hedge Fund Trender for their trading needs.

How to Benefit from Continuous Updates and Support

The Hedge Fund Trender provides users with continuous updates and support. This includes regular updates to the tool’s features and functionality, as well as ongoing support from Top Trade Tools. Users can rely on this support to enhance their trading experience and adapt to changing market conditions.

By benefiting from continuous updates and support, traders can ensure that the Hedge Fund Trender remains effective and relevant in changing market conditions. This feature is particularly valuable for traders who want to stay ahead of the competition and ensure their trading strategies remain effective.