Master Proprietary Trading with Our Comprehensive Prop Trading Formula Course

The Trading Busters Prop Trading Formula Course represents a revolutionary approach to mastering proprietary trading through scientifically-backed strategies and systematic methodologies. Designed for both aspiring and experienced traders, this comprehensive program transforms complex market dynamics into actionable, profitable trading formulas that deliver consistent results in today’s volatile financial markets. You might also want to explore more trading strategies.

Our expertly crafted curriculum combines cutting-edge algorithmic trading principles with time-tested forex strategies, creating a unique learning experience that bridges the gap between theoretical knowledge and practical application. Unlike traditional trading courses that rely on outdated methods, our program focuses on statistical probability and data-driven decision making to ensure sustainable long-term profitability. You might also want to discover professional trading techniques.

Complete Course Overview and Learning Journey

This intensive trading education program spans multiple modules, each meticulously designed to build upon previous concepts while introducing advanced proprietary trading techniques. Students progress through a structured learning path that begins with fundamental market analysis and evolves into sophisticated algorithmic trading strategies used by professional prop trading firms worldwide. You might also want to learn advanced market analysis.

The course architecture emphasizes practical implementation over theoretical discussion, ensuring every lesson translates directly into actionable trading skills. Our proprietary methodology has been refined through years of market testing and real-world application, providing students with proven strategies that have generated consistent profits across various market conditions. For more advanced techniques, check out our futures trading blueprint course.

Foundation Module: Market Dynamics and Risk Management

Students begin their journey by mastering essential market fundamentals, including price action analysis, volume interpretation, and comprehensive risk management protocols. This foundation ensures traders develop the disciplined mindset required for long-term success in proprietary trading environments. For more advanced techniques, check out our professional trading masterclass course.

Advanced Strategy Development

The program’s core focuses on developing and implementing sophisticated trading algorithms that identify high-probability opportunities across multiple timeframes. Students learn to construct robust trading systems that adapt to changing market conditions while maintaining consistent performance metrics.

What You’ll Learn in This Comprehensive Program

Our curriculum covers every aspect of modern proprietary trading, from basic market mechanics to advanced algorithmic strategy development. Each module delivers practical skills that students can immediately apply to their trading activities.

- Statistical Arbitrage Techniques: Master proven mathematical models that identify market inefficiencies and exploit price discrepancies across correlated instruments

- Algorithmic Strategy Construction: Learn to build, test, and optimize automated trading systems using professional-grade tools and methodologies

- Risk Management Protocols: Implement sophisticated position sizing algorithms and portfolio management techniques used by top-tier prop trading firms

- Market Microstructure Analysis: Understand order flow dynamics, liquidity patterns, and institutional trading behavior to gain competitive advantages

- Performance Optimization: Develop systematic approaches to strategy refinement and continuous improvement of trading performance

- Psychological Trading Mastery: Build mental resilience and emotional discipline required for consistent execution under pressure

- Technology Integration: Utilize cutting-edge trading platforms and analytical tools to maximize efficiency and accuracy

Key Course Features and Learning Benefits

Our program distinguishes itself through innovative teaching methodologies and comprehensive support systems designed to accelerate student success. Every feature has been carefully developed to address common challenges faced by proprietary traders.

Real-Time Trading Signals and Analysis

Students receive access to our proprietary signal generation system, providing real-time trade opportunities with detailed analysis and execution guidance. This feature allows learners to observe professional-grade decision-making processes while building their own analytical capabilities.

Interactive Learning Platform

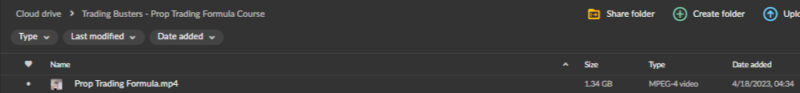

Our state-of-the-art learning management system delivers content through multiple formats, including video lectures, interactive simulations, and hands-on trading exercises. This multi-modal approach ensures optimal knowledge retention and practical skill development.

Ongoing Mentorship and Support

Students benefit from direct access to experienced proprietary traders who provide personalized guidance, strategy feedback, and career development advice. This mentorship component significantly accelerates the learning curve and helps avoid common pitfalls.

Performance Tracking and Analytics

Advanced analytics tools monitor student progress and trading performance, identifying areas for improvement and celebrating achievements. This data-driven approach ensures continuous development and measurable results.

Who Is This Course For?

The Trading Busters Prop Trading Formula Course caters to a diverse range of individuals seeking to excel in proprietary trading environments. Our flexible curriculum accommodates different experience levels while maintaining rigorous professional standards.

Aspiring Professional Traders looking to launch careers with proprietary trading firms will find comprehensive preparation for industry challenges and opportunities. The course provides essential skills and knowledge required to pass prop firm evaluations and succeed in funded trading programs.

Independent Traders seeking to improve consistency and profitability will benefit from systematic approaches to strategy development and risk management. Our methodologies help eliminate emotional decision-making and establish disciplined trading practices.

Financial Professionals including portfolio managers, analysts, and advisors can enhance their skill sets with advanced quantitative trading techniques and algorithmic strategies that complement traditional investment approaches.

Technology Enthusiasts interested in combining programming skills with financial markets will discover opportunities to develop sophisticated trading systems and automated strategies using cutting-edge technologies.

Why Choose This Course Over Competitors

The Trading Busters program stands apart from conventional trading education through its emphasis on statistical validity and systematic implementation. While other courses focus primarily on discretionary trading methods, our approach leverages quantitative analysis and algorithmic precision to deliver superior results.

Our instructors bring decades of combined experience from top-tier proprietary trading firms, hedge funds, and financial institutions. This real-world expertise ensures students learn industry-standard practices and cutting-edge techniques currently employed by successful professional traders.

The course curriculum undergoes continuous updates to reflect evolving market conditions and technological advances. Students always receive the most current strategies and tools available in the proprietary trading industry.

Our commitment to student success extends beyond course completion through ongoing support, strategy updates, and career placement assistance. This comprehensive approach ensures long-term success rather than short-term knowledge transfer.

Frequently Asked Questions

How long does it take to complete the course?

The complete program typically requires 8-12 weeks for thorough completion, depending on individual learning pace and time commitment. Students can access materials for lifetime learning and reference, allowing for continuous skill development and strategy refinement.

Do I need prior trading experience to succeed?

While trading experience is beneficial, our curriculum is designed to accommodate beginners through advanced practitioners. The progressive structure ensures foundational concepts are thoroughly covered before advancing to complex strategies. Dedicated students without prior experience often achieve excellent results through consistent application and practice.

What trading capital is required to implement these strategies?

Our strategies are scalable across various account sizes, from small personal accounts to institutional-level capital. The course emphasizes proper position sizing and risk management techniques that adapt to individual capital constraints while maintaining strategy effectiveness.

Is ongoing support available after course completion?

Yes, graduates receive continued access to strategy updates, market analysis, and community forums where they can interact with instructors and fellow traders. This ongoing support system ensures students remain current with market developments and continue improving their trading performance over time.