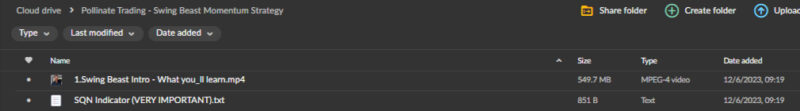

Pollinate Trading – Swing Beast Momentum Strategy

Master Market Trends with the Swing Beast Momentum Strategy Course

Elevate your trading game and master navigating financial markets with the Swing Beast Momentum Strategy course by Pollinate Trading. This unique course blends swing trading precision with momentum investing dynamics, providing a robust framework for capturing short to medium-term opportunities. Designed to help traders harness market trends with accuracy and confidence, this course is your key to consistent profitability. Whether you’re a novice trader or a seasoned investor, the Swing Beast Momentum Strategy course equips you with the tools and knowledge to make informed trading decisions and achieve financial success.

What Makes Pollinate Trading’s Swing Beast Momentum Strategy Unique?

Why Should You Consider the Swing Beast Momentum Strategy?

Are you looking for a trading strategy that combines precision with the ability to capitalize on sustained market movements? Pollinate Trading’s Swing Beast Momentum Strategy offers just that. This course is meticulously designed to help traders capture profitable price swings and ride the wave of momentum in financial markets. By focusing on both swing trading and momentum investing principles, the strategy provides a balanced approach that maximizes returns while managing risk effectively. But what makes this strategy genuinely unique?

Comprehensive Approach to Trading

The Swing Beast Momentum Strategy course stands out because of its dual approach. It blends the principles of swing trading — which focuses on capturing short-term price movements — with momentum investing strategies that aim to profit from strong, sustained trends. This combination allows traders to exploit market opportunities across different time frames, enhancing their potential for consistent gains.

Developed by Experienced Professionals

Pollinate Trading brings years of experience and expertise to the table. The course is crafted by seasoned traders who understand the intricacies of financial markets. Their goal is to provide a clear, actionable strategy that empowers you to make better trading decisions. With this strategy, you gain access to techniques that have been tested and refined over time, ensuring that you’re learning from real-world success.

How Does the Swing Beast Momentum Strategy Work?

What is the Core of the Swing Beast Momentum Strategy?

The Swing Beast Momentum Strategy is centred around the precise timing of market entries and exits. It focuses on capturing “swings” in asset prices, using a combination of technical indicators, chart patterns, and market sentiment analysis. The goal is to enter trades when there is a high probability of a favourable move and to exit before the trend reverses.

- Swing Trading Precision: The strategy hinges on the accurate timing of trades. By using a systematic approach to identify price swings, traders can profit from short to medium-term movements. This is achieved through careful analysis of technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), which help pinpoint optimal entry and exit points.

- Momentum Investing Dynamics: The strategy incorporates momentum investing principles to capitalize on strong price movements. By identifying assets with sustained momentum, traders can align their positions with prevailing market trends, increasing their chances of capturing extended gains.

What Technical Analysis Tools are Used in the Strategy?

How Does Technical Analysis Drive the Swing Beast Momentum Strategy?

The Swing Beast Momentum Strategy relies heavily on technical analysis to make informed trading decisions. By utilizing a range of technical indicators and oscillators, traders can identify potential trade setups and manage risk effectively.

- Indicators and Oscillators: The strategy employs a robust set of tools, including moving averages, RSI, and MACD. These indicators assess the strength of price movements and identify potential entry and exit points. Moving averages help smooth out price data to identify trends, while RSI measures the speed and change of price movements, and MACD provides insights into the momentum and direction of a trend.

- Candlestick Patterns: Candlestick patterns play a critical role in enhancing the accuracy of the strategy. Patterns such as engulfing patterns and doji candles provide insights into market psychology and potential reversals. By closely observing these patterns, traders can anticipate trend changes and make timely decisions to enter or exit trades.

How Does the Swing Beast Momentum Strategy Manage Risk?

What Risk Management Techniques are Employed in the Strategy?

Effective risk management is a cornerstone of the Swing Beast Momentum Strategy. To achieve consistent profitability, traders must protect their capital and limit potential losses. The course emphasizes several risk management techniques to help traders navigate the uncertainties of financial markets.

- Position Sizing: A key aspect of the strategy is proper position sizing. Traders allocate their capital based on the perceived risk of each trade, ensuring that no single position can significantly impact the overall portfolio. This disciplined approach helps safeguard against substantial losses while promoting sustainable growth.

- Stop-Loss Orders: The strategy incorporates strategically placed stop-loss orders to minimize downside risk. These orders are set at predefined levels, aligned with the trader’s risk tolerance and market analysis. With stop-losses, traders can limit potential losses during adverse market conditions and protect their capital.

How is the Swing Beast Momentum Strategy Executed and Monitored?

What Steps are Involved in Executing the Strategy?

The Swing Beast Momentum Strategy is built around disciplined execution and continuous monitoring. This systematic approach ensures that traders maintain consistency and avoid impulsive decisions driven by emotions.

- Trade Execution: The strategy emphasizes disciplined trade execution based on predetermined criteria. Traders enter positions only when specific technical conditions are met, ensuring a systematic and rule-based approach. This helps maintain objectivity and consistency, which are crucial for long-term success.

- Continuous Monitoring: Successful implementation requires constant vigilance. Traders must monitor individual trades and overall market conditions for any signs of changing dynamics or emerging patterns. Regular reviews and adjustments are made to adapt to evolving market trends, ensuring the strategy remains effective in different market environments.

What are the Benefits of the Swing Beast Momentum Strategy?

How Can This Strategy Improve Your Trading Results?

The Swing Beast Momentum Strategy course offers numerous benefits, making it a valuable investment for traders looking to enhance their skills and achieve consistent profitability.

- Clear Framework for Success: The course provides a well-defined trading framework that combines the precision of swing trading with the dynamics of momentum investing. This comprehensive approach allows traders to capitalize on a wide range of market opportunities, from short-term price swings to extended trends.

- Enhanced Decision-Making: By leveraging technical analysis tools and risk management techniques, traders can make more informed decisions. This reduces emotional trading and increases the likelihood of achieving favorable outcomes.

- Adaptability to Market Conditions: The strategy adapts to various market environments. Whether markets are trending or range-bound, the Swing Beast Momentum Strategy provides the flexibility to adjust and thrive.

Who Should Enroll in the Swing Beast Momentum Strategy Course?

Is This Course Right for You?

The Swing Beast Momentum Strategy course is suitable for traders of all levels, from beginners to seasoned professionals.

- Aspiring Traders: If you are new to trading and looking for a strategy that combines simplicity with effectiveness, this course provides a solid foundation to build your skills.

- Experienced Traders: If you are an experienced trader seeking to refine your approach and enhance your profitability, this course offers advanced strategies and techniques to help you achieve your goals.

- Risk-Conscious Investors: For those who prioritize risk management and seek to protect their capital while maximizing returns, this course provides a balanced approach that aligns with your investment philosophy.

How to Get Started with Pollinate Trading’s Swing Beast Momentum Strategy?

What Are the Next Steps to Begin Your Journey?

Enrolling in the Swing Beast Momentum Strategy course is easy. Here’s how you can get started:

- Sign Up Today: Join the course and gain immediate access to all learning materials and resources. Start implementing the strategies right away and begin your journey toward trading mastery.

- Access Continuous Learning: Benefit from ongoing updates and new lessons that keep you updated with the latest market trends and techniques. Stay ahead of the curve by continuously enhancing your skills.

- Join a Community of Traders: Connect with a community of like-minded traders who share your passion for success. Exchange ideas, ask questions, and learn from the experiences of others to further your growth.

Conclusion: Unlock Your Trading Potential with the Swing Beast Momentum Strategy

The Swing Beast Momentum Strategy course by Pollinate Trading offers a unique and powerful approach to trading. By combining the precision of swing trading with the momentum of investing, this strategy provides a comprehensive framework for capturing market opportunities and achieving consistent profitability. Focusing on technical analysis, disciplined execution, and effective risk management, this course empowers traders to make informed decisions and navigate the complexities of financial markets confidently.

Don’t miss this opportunity to elevate your trading skills and unlock your potential.

Enroll in the Swing Beast Momentum Strategy course today and take the first step toward a more profitable trading journey!