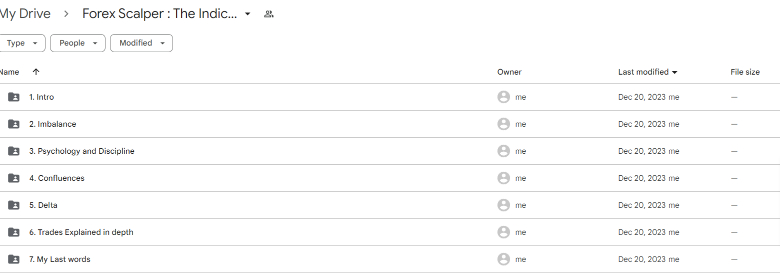

Forex Scalper The Indices Orderflow Masterclass

Master the Markets with the Forex Scalper The Indices Orderflow Masterclass

Unlock the secrets of market dynamics and achieve a competitive edge with the Forex Scalper The Indices Orderflow Masterclass course. Dive deep into the world of order flow trading, a method that gives you unparalleled insights into the true drivers of price movements. Designed for traders aiming to move beyond basic techniques and leverage institutional-level data, this masterclass equips you to stay ahead of the curve and maximize your trading potential.

Why Choose the Forex Scalper The Indices Orderflow Masterclass?

In today’s rapidly evolving financial landscape, conventional trading strategies often fail to provide the insight needed to stay competitive. Forex Scalper The Indices Orderflow Masterclass goes beyond the basics, helping you decipher complex market behaviors using sophisticated techniques such as order flow analysis, delta metrics, market profiles, and more. By leveraging real-time data from institutional sources, this course positions you to anticipate market moves with a level of confidence that leaves retail traders in the dust.

What Will You Learn in the Forex Scalper The Indices Orderflow Masterclass?

What Is Order Flow Trading, and Why Is It a Game-Changer?

Order flow trading is an advanced methodology that examines the volume and direction of buy and sell orders in the market. This approach differs from traditional methods that rely on historical price patterns by offering insights into market participants’ real-time sentiment and behavior.

In this masterclass, you’ll learn how to interpret order flow data to predict price trends accurately. This includes understanding the impact of large institutional trades, recognizing subtle shifts in market sentiment, and pinpointing key support and resistance areas. Mastering order flow trading will give you a profound understanding of market dynamics, enabling you to make more informed and profitable trading decisions.

How Can Delta, Footprints, and Market Profile Enhance Your Trading Strategy?

Understanding Delta: The Core Metric of Order Flow

Delta measures the difference between buying and selling pressure in the market, making it an essential metric for order flow analysis. Understanding delta is critical for identifying shifts in momentum and gauging the strength of price movements.

In the Forex Scalper The Indices Orderflow Masterclass, you’ll explore how delta can act as a leading indicator for market sentiment. You’ll learn to use delta as a cornerstone of your trading strategy, interpreting changes in delta to identify high-probability setups, manage risk effectively, and avoid false breakouts. By mastering delta, you can make smarter decisions, refine your entries and exits, and stay in sync with market direction.

Decoding Footprints for Precision Market Analysis

Footprints offer a detailed view of the flow of orders at specific price levels, providing crucial insights into where buyers and sellers are most active. This granular information allows traders to pinpoint precise entry and exit points by revealing areas of significant supply and demand imbalances.

This course teaches you how to use footprint charts to “read” the market’s footprints and spot potential reversals or continuations before they are evident to others. By integrating footprint analysis into your trading toolkit, you’ll develop a sharper edge in the markets, enhancing your ability to identify profitable trades.

Utilizing Market Profile to Decode Market Structure

Market Profile is a powerful analytical tool that helps traders visualize the distribution of trades over a given period. This tool provides a comprehensive view of the market structure, including the Point of Control (POC), which indicates the price level with the most traded volume.

You will discover how to use Market Profile to identify value areas, trading ranges, and potential breakout points. By combining Market Profile with delta and footprints, you’ll gain a more holistic understanding of market behavior, enabling you to effectively adapt your strategies to different market conditions.

How Can You Leverage Future Volume, Order Books, and VWAP?

Analyzing Future Volume for Market Foresight

Future volume analysis helps traders anticipate potential market directions by examining the flow of upcoming orders. This proactive approach enables you to position yourself advantageously in the market before trends fully develop.

In the Forex Scalper The Indices Orderflow Masterclass, you’ll learn how to analyze future volume data to spot where significant buying or selling interest will likely emerge. You’ll be trained to recognize volume patterns often preceding major market moves, providing you with the foresight needed to enter trades at optimal moments.

Mastering Order Books for Real-Time Market Sentiment

The order book shows the market’s current buy and sell orders, providing a transparent view of the supply and demand dynamics. Mastering order book reading can help you gauge the strength of support and resistance levels and make better trading decisions.

This course will teach you how to interpret order book data to understand where major players will likely place their trades. By recognizing these key levels, you can anticipate potential breakouts or breakdowns and adjust your trading strategies accordingly.

Utilizing VWAP for Accurate Price Assessment

The Volume Weighted Average Price (VWAP) is a critical indicator that represents the average trading price of an asset throughout the day, weighted by volume. VWAP is a benchmark for retail and institutional traders, helping them determine whether a price is overvalued or undervalued.

You’ll learn to use VWAP in your trading strategy to assess the fair value of an asset and determine entry and exit points that align with the broader market trend. Mastering VWAP will enable you to make more informed decisions and improve your trading performance.

What Tools and Software Will You Use in This Masterclass?

Cutting-Edge Market Reading Software

A key component of the Forex Scalper The Indices Orderflow Masterclass is understanding how to use advanced market reading software. These tools provide a wealth of data that, when properly interpreted, can offer deep insights into market sentiment and potential future moves.

You’ll gain hands-on experience with the latest market reading software, learning how to analyze real-time data to spot trading opportunities. These skills will allow you to react quickly to market changes, giving you a competitive edge over traders who rely solely on traditional methods.

Access to Data Exchanges for Comprehensive Analysis

Navigating data exchanges is critical for interpreting market movements and making informed trading decisions. This course provides a detailed overview of how to use data exchanges to your advantage, from understanding trade flow to identifying the actions of institutional players.

By mastering these tools, you’ll be able to dissect the market’s underlying mechanics and better predict future price movements, leading to more profitable trades.

How Do You Apply These Concepts to Real-World Trading Scenarios?

Practical Examples of Value Areas and Imbalance

Theory alone isn’t enough; you need to see how these concepts work in practice. This course provides numerous examples of how to apply order flow analysis to real-world trading scenarios. You’ll learn how to identify “value areas” where significant trading occurs and recognize imbalances that can lead to potential market reversals.

Understanding Imbalance and Absorption

The concepts of imbalance and absorption are fundamental to order flow trading. Imbalance occurs when there is a significant difference between buy and sell orders, while absorption refers to the market’s ability to absorb these orders without changing price levels drastically.

By understanding these concepts, you’ll be able to spot potential turning points in the market and position yourself for maximum profit.

How to Build a Comprehensive Trading System?

The Forex Scalper The Indices Orderflow Masterclass isn’t just about learning individual techniques; it’s about creating a complete trading system. You’ll learn how to integrate all the elements of order flow trading—such as delta, footprints, market profile, and VWAP—into a cohesive strategy.

By combining these insights with supply and demand principles, you’ll be able to develop a trading system that adapts to various market conditions, helping you stay ahead of the competition. This holistic approach will ensure you are prepared to tackle any trading scenario with confidence and precision.

Key Features of the Forex Scalper The Indices Orderflow Masterclass

- Expert Instruction: Learn directly from experienced traders who specialize in order flow and market profile analysis.

- Comprehensive Curriculum: Dive deep into advanced topics like delta, footprints, VWAP, and more, with clear explanations and practical applications.

- Interactive Learning: Engage with hands-on exercises, real-world examples, and data analysis to reinforce your understanding.

- Ongoing Support and Updates: Enjoy continuous access to course materials, updates, and a community of traders to help you on your journey.

Why Should You Enroll in This Course?

The Forex Scalper The Indices Orderflow Masterclass is not just another trading course; it’s a complete transformation in how you approach the markets. Whether you are an experienced trader looking to refine your strategies or someone looking to break into institutional-level trading, this course provides the insights, tools, and techniques you need to succeed.

Take Control of Your Trading Journey Today!

Enroll in the Forex Scalper The Indices Orderflow Masterclass and gain the knowledge, skills, and confidence to master the art of order flow trading. Equip yourself with the strategies that institutional traders use to dominate the markets and transform your trading outcomes. Join now and start your journey toward trading excellence!