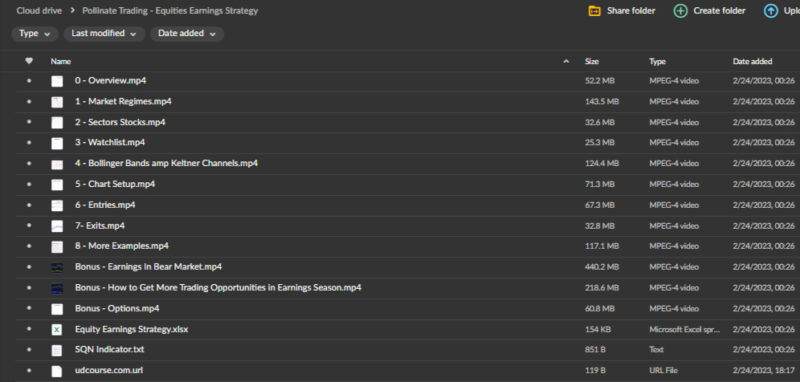

Pollinate Trading – Equities Earnings Strategy

Master the Markets with Pollinate Trading’s Equities Earnings Strategy Course

Unlock the full potential of your trading abilities with Pollinate Trading’s Equities Earnings Strategy course. This comprehensive program is meticulously designed to help traders and investors capitalize on the unique opportunities that emerge during corporate earnings seasons. This course aims to enhance your decision-making skills and optimize your returns in the dynamic equities market by leveraging a strategic blend of fundamental analysis, technical indicators, and advanced options strategies.

Whether you’re an experienced trader looking to refine your approach or a beginner eager to learn the intricacies of earnings-based trading, this course offers a robust framework for confidently and precisely navigating market volatility.

Why Choose Pollinate Trading’s Equities Earnings Strategy?

What makes Pollinate Trading’s Equities Earnings Strategy stand out in the crowded world of trading education? The unique integration of fundamental and technical analysis, tailored specifically for the earnings season, sets this course apart. Learn how to harness these tools to maximize your profit potential.

How Does Fundamental Analysis Drive This Strategy?

In-Depth Examination of Company Fundamentals

The Equities Earnings Strategy course focuses on fundamental analysis. Understanding a company’s financial health, such as revenue growth, earnings per share (EPS), and key performance indicators, is crucial to predicting its market behavior. Pollinate Trading guides you through evaluating these factors to identify stocks poised for growth or those likely to exceed market expectations. You can capture substantial gains from earnings surprises by mastering these analytical techniques.

Leveraging Financial Health Indicators

The course teaches you how to interpret essential financial indicators that reveal a company’s potential for growth or decline. You will learn to assess balance sheets, cash flow, and income statements to gain insights into a company’s financial stability and growth prospects. This focus on economic fundamentals helps identify stocks with the highest potential for positive earnings surprises, allowing you to make informed decisions and increasing your chances of success.

How Can You Use the Earnings Calendar to Your Advantage?

Strategic Planning Around Earnings Reports

One key aspect of the Equities Earnings Strategy is the tactical use of the earnings calendar. The course emphasizes the importance of staying informed about upcoming earnings reports and strategically planning trades around these events. By focusing on earnings announcements, you can exploit the volatility that often follows, capturing profits from rapid price movements.

Timing Trades for Maximum Impact

Pollinate Trading teaches you how to align your trades with crucial earnings events. You’ll learn to anticipate the market’s reaction to different types of earnings results, whether positive, negative, or neutral. The course also covers how to utilize pre- and post-earnings announcement strategies to maximize your trading performance, ensuring that you are well-prepared to act quickly and effectively in response to market changes.

How Do Technical Indicators Enhance the Equities Earnings Strategy?

Refining Entry and Exit Points with Technical Tools

In addition to fundamental analysis, Pollinate Trading’s Equities Earnings Strategy course incorporates a range of technical indicators to refine your entry and exit points. You’ll learn to use tools such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to gauge price momentum and potential reversals. These indicators help you make well-timed decisions by aligning trades with fundamental insights and prevailing market sentiment during earnings seasons.

Mastering Technical Analysis for Strategic Trading

By understanding the role of technical analysis in identifying market trends, participants can improve their timing and increase their profitability. The course covers interpreting chart patterns, volume trends, and momentum signals to better anticipate stock movements. Armed with these skills, you can enhance your trading strategies, ensuring they are in sync with broader market trends and specific earnings-driven events.

What Role Do Options Play in Risk Management?

Using Options Strategies for Enhanced Risk Control

Earnings seasons often come with increased volatility, which can present both opportunities and risks. Pollinate Trading’s Equities Earnings Strategy integrates advanced options strategies to help you manage these risks effectively. Learn how to employ options to hedge against potential downside risks or to capitalize on bullish expectations. The course covers various options strategies, such as straddles, strangles, and protective puts, equipping you with the tools to navigate earnings-related price fluctuations confidently.

Mitigating Risk and Amplifying Returns

Options trading provides flexibility and strategic advantages during earnings announcements. The course teaches you how to utilize these financial instruments to protect your capital while maximizing returns. By mastering options strategies, you can manage risk more effectively, ensuring that your trading strategy remains robust even in the most volatile market conditions.

How Does Sector and Industry Analysis Improve Your Earnings Strategy?

Identifying Trends Beyond Individual Stocks

Pollinate Trading’s Equities Earnings Strategy goes beyond just analyzing individual stocks. The course teaches you to examine broader market trends by focusing on sector and industry analysis. Understanding macroeconomic factors that affect specific sectors allows you to identify patterns and correlations that can lead to profitable trading opportunities.

Gaining a Macro Perspective for Better Decision-Making

By examining industry dynamics and sector trends, you can make more informed decisions about which stocks are likely to perform well during earnings seasons. This holistic approach ensures that you focus on individual stock performance and understand the broader market context, providing a competitive edge in your trading decisions.

How Does Continuous Learning and Adaptation Enhance Your Trading?

Staying Ahead in a Dynamic Market

A unique feature of Pollinate Trading’s Equities Earnings Strategy course is its emphasis on continuous learning and adaptation. Markets are constantly evolving, and successful traders must remain adaptable to changing conditions. The course encourages you to stay informed about the latest market developments, refine your strategies based on feedback, and adapt to new information.

Building a Growth-Oriented Mindset

This approach fosters a mindset of continuous improvement, ensuring that you remain agile and responsive to market shifts. By embracing a learning-oriented attitude, you can refine your strategies over time, allowing you to stay ahead of the curve and capitalize on emerging opportunities.

Why Should You Enroll in Pollinate Trading’s Equities Earnings Strategy Course?

A Comprehensive, Integrated Approach to Trading

Pollinate Trading’s Equities Earnings Strategy course offers a complete, integrated approach to navigating earnings seasons. By combining fundamental analysis, technical indicators, options strategies, and sector analysis, the course provides a well-rounded framework for making informed trading decisions. Whether you are a novice trader or an experienced investor, this course equips you with the knowledge and tools needed to thrive in the dynamic world of earnings-driven market movements.

Expert Guidance and Real-world Applications

With Pollinate Trading, you’re not just learning theory but applying it. The course offers practical insights and actionable strategies to immediately implement to enhance your trading performance. Expert guidance, real-world examples, and a supportive learning environment that encourages continuous growth and improvement will benefit you.

Conclusion: Elevate Your Trading Game with Pollinate Trading’s Equities Earnings Strategy

The Equities Earnings Strategy course by Pollinate Trading is your gateway to mastering the complexities of trading during earnings seasons. With a focus on fundamental and technical analysis, options strategies, and continuous learning, this course offers everything you need to navigate the equities market successfully.

Take control of your financial future by enrolling in Pollinate Trading’s Equities Earnings Strategy course today and start capitalizing on the opportunities that earnings seasons present. Unlock the tools, knowledge, and confidence to elevate your trading strategy and achieve your financial goals.