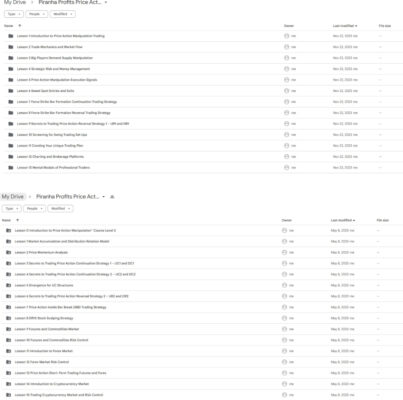

Master Market Dynamics with the Piranha Profits Price Action Manipulation Course Level 1 + Level 2

The Piranha Profits Price Action Manipulation Course Level 1 + Level 2 course is a comprehensive program designed to equip traders with the knowledge and skills needed to excel in the complex world of financial markets. Divided into two progressive levels, this course provides an in-depth understanding of price action dynamics, from foundational principles to advanced manipulation techniques used by institutional players. Whether you are a beginner looking to build a solid foundation or an experienced trader aiming to refine your skills, this course offers the tools and insights necessary to make informed trading decisions.

By mastering these techniques, participants are better positioned to navigate the market’s volatility and enhance their overall trading success.

What Will You Learn in the Piranha Profits Price Action Manipulation Course Level 1?

How does understanding price action dynamics improve your trading? The Price Action Manipulation Course Level 1 serves as the cornerstone of your journey into mastering price action analysis. This foundational level delves deep into the essential concepts that every trader needs to understand in order to make strategic decisions based on market behavior.

- Candlestick Patterns Mastery: One of the key components of Level 1 is learning to interpret candlestick patterns, which are crucial indicators of market sentiment. Participants gain an in-depth understanding of various patterns, such as engulfing, dojis, hammers, and shooting stars, and learn how these patterns signal potential market reversals or continuations. By mastering these patterns, traders can better predict price movements and improve their timing when entering or exiting trades.

- Trend Analysis for Strategic Trading: Understanding trends is critical to successful trading, and Level 1 places a strong emphasis on trend analysis. Traders learn to identify and follow market trends, using technical tools such as moving averages and trendlines to confirm trend directions. This module teaches participants how to spot trend reversals early, giving them a strategic advantage in positioning their trades effectively.

- Support and Resistance Fundamentals: Support and resistance levels are key areas on a price chart where buying or selling pressure can influence market direction. In this module, traders learn how to identify these critical levels and use them as strategic points for entering and exiting trades. By understanding how to leverage support and resistance, traders can better manage risk and optimize their profit potential.

How Does Level 1 Help You Develop Effective Entry and Exit Strategies?

What sets successful traders apart is their ability to formulate and execute precise entry and exit strategies. The Price Action Manipulation Course Level 1 equips participants with practical techniques to recognize ideal trade setups and make timely decisions that maximize profitability.

- Identifying Key Market Signals: Level 1 focuses on helping traders identify key market signals that indicate potential entry and exit points. By analyzing price action in conjunction with candlestick patterns, trend lines, and support and resistance levels, traders can pinpoint optimal moments to enter the market. This approach reduces guesswork and enhances the accuracy of trade execution.

- Practical Application of Price Action Theories: The course emphasizes the practical application of price action theories, allowing traders to put their knowledge into practice through real-world examples and case studies. This hands-on approach ensures that participants gain a deep understanding of how to apply these concepts in live trading scenarios, giving them the confidence to execute strategies with precision.

- Building a Strategic Trading Plan: Developing a strategic trading plan is essential for consistent success. Level 1 guides participants through the process of creating a plan that includes clear entry and exit rules, risk management protocols, and performance evaluation criteria. This structured approach helps traders maintain discipline and make data-driven decisions, reducing emotional trading and enhancing overall performance.

What Advanced Techniques Are Covered in the Price Action Manipulation Course Level 2?

Ready to take your trading skills to the next level? The Price Action Manipulation Course Level 2 builds on the foundational principles learned in Level 1, introducing advanced techniques that delve into the psychology of price movements and the manipulation tactics employed by institutional players.

- Understanding Market Depth and Order Flow: One of the standout features of Level 2 is its focus on market depth analysis and order flow. Participants learn how to interpret the real-time dynamics of buying and selling pressure, gaining insights into the true intentions of market participants. By understanding how order flow influences price action, traders can anticipate potential market movements and align their strategies accordingly.

- Volume Analysis for Enhanced Decision-Making: Volume is a powerful tool that confirms price trends and helps identify potential reversals. In Level 2, traders learn to analyze volume spikes, divergences, and patterns that indicate shifts in market sentiment. This knowledge enables traders to validate price movements and make more informed trading decisions, reducing the likelihood of being caught on the wrong side of the market.

- Institutional Order Flow Manipulation: Large market participants, such as hedge funds and banks, often use their significant buying power to manipulate price action. Level 2 provides an in-depth exploration of how these players influence market behavior and how retail traders can recognize and capitalize on these movements. By understanding institutional manipulation tactics, traders can avoid common pitfalls and align their strategies with the market’s true direction.

How Do the Advanced Trading Strategies in Level 2 Enhance Your Market Performance?

How can advanced trading strategies improve your success in complex market conditions? The Price Action Manipulation Course Level 2 equips traders with sophisticated strategies that incorporate the principles of market depth, order flow, and volume analysis, providing a systematic approach to navigating intricate market scenarios.

- Developing a Systematic Approach: Advanced trading strategies taught in Level 2 focus on creating a systematic approach to market analysis and trade execution. By integrating market depth and volume data, traders can develop strategies that are not only reactive but also predictive, allowing them to anticipate market movements before they occur. This proactive approach enhances the effectiveness of trading decisions and improves overall performance.

- Sophisticated Entry and Exit Techniques: Level 2 introduces advanced entry and exit techniques that go beyond basic support and resistance levels. Traders learn how to use volume-weighted average price (VWAP), time-weighted averages, and other sophisticated tools to refine their trade entries and exits. These techniques provide a competitive edge, enabling traders to execute trades with greater precision and accuracy.

- Navigating Market Manipulation: One of the most valuable skills taught in Level 2 is how to navigate and leverage market manipulation to your advantage. By recognizing patterns of institutional activity, such as false breakouts and stop runs, traders can position themselves strategically to profit from these deceptive moves. This knowledge is crucial for maintaining an edge in the highly competitive trading environment.

What Are the Key Benefits of the Piranha Profits Price Action Manipulation Course?

Why should you consider enrolling in the Price Action Manipulation Course Level 1 + Level 2? Piranha Profits has designed these courses to provide a comprehensive and progressive learning experience that equips traders with the skills needed to thrive in today’s financial markets.

- A Complete Learning Journey: The course structure, spanning two levels, ensures a complete learning journey from foundational knowledge to advanced techniques. Participants progress at their own pace, building on each concept as they advance, which helps solidify their understanding and boost their confidence in applying what they’ve learned.

- Real-World Applications and Case Studies: Unlike many trading courses that focus solely on theory, Piranha Profits emphasizes real-world applications through interactive case studies and practical exercises. This hands-on approach ensures that traders are prepared to face real market challenges and apply their skills effectively.

- Enhanced Market Awareness and Decision-Making: By learning to analyze market depth, understand institutional manipulation, and interpret volume data, traders gain a heightened awareness of market conditions. This improved market intuition enhances their ability to make strategic decisions, reducing the impact of emotional trading and increasing their potential for consistent profits.

How Does the Course Prepare You for Real-World Trading Challenges?

What sets Piranha Profits’ Price Action Manipulation Course apart from other trading programs is its focus on preparing traders for the real-world challenges they will face in the markets. The course goes beyond technical analysis, addressing the psychological and strategic aspects of trading that are often overlooked.

- Developing Mental Resilience: Trading is as much about mental resilience as it is about technical skills. The course addresses the psychological aspects of trading, teaching participants how to manage emotions, maintain discipline, and develop the mindset of a successful trader. This focus on trading psychology is crucial for maintaining consistency and staying focused under pressure.

- Building a Comprehensive Trading Plan: A key takeaway from the course is the importance of having a comprehensive trading plan. Participants learn to develop a plan that encompasses their trading goals, risk management protocols, and strategies for continuous improvement. This structured approach helps traders stay organized, focused, and aligned with their long-term objectives.

- Continuous Learning and Adaptation: The dynamic nature of financial markets means that traders must constantly adapt to new conditions and challenges. Piranha Profits emphasizes the importance of continuous learning and provides resources for ongoing education, ensuring that traders remain up-to-date with market trends and can refine their strategies over time.

Conclusion: Elevate Your Trading Skills with Piranha Profits Price Action Manipulation Course Level 1 + Level 2

The Piranha Profits Price Action Manipulation Course Level 1 + Level 2 is a must-have program for traders seeking to master price action analysis and manipulation techniques. By combining foundational principles with advanced market insights, this course equips participants with the knowledge and skills needed to excel in the financial markets. Whether you’re just starting your trading journey or looking to refine your existing strategies, this course offers a comprehensive education that will elevate your trading performance.

Enroll today and take the first step towards mastering the art of price action manipulation with Piranha Profits.