AXIA Futures Central Bank Trading Strategies

$499.00 Original price was: $499.00.$17.00Current price is: $17.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

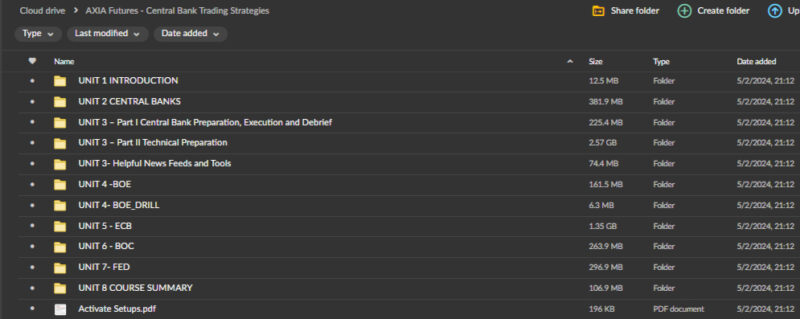

AXIA Futures Central Bank Trading Strategies

AXIA Futures Central Bank Trading Strategies Course: Master the Art of Trading with Central Bank Insights

Elevate your trading skills to a new level with the AXIA Futures Central Bank Trading Strategies Course. This advanced program offers a deep dive into the intricacies of trading influenced by central bank decisions. With a focus on providing a comprehensive understanding of how central banks impact financial markets, this course equips traders with the strategic insights needed to navigate and profit from central bank-driven dynamics.

Why Invest in the AXIA Futures Central Bank Trading Strategies Course?

The AXIA Futures Central Bank Trading Strategies Course is designed for traders who seek to enhance their market acumen by mastering the influence of central banks. Central banks are powerful entities that shape global financial markets through their policy decisions, making it crucial for traders to understand their actions. This course offers a structured approach to integrating central bank insights into trading strategies, providing a significant competitive advantage.

What Makes the AXIA Futures Central Bank Trading Strategies Course Unique?

AXIA Futures has established itself as a leader in trading education by offering specialized programs that cater to traders’ evolving needs. The Central Bank Trading Strategies Course stands out due to its focus on central bank policies and their direct impact on market movements. By offering a detailed examination of how central banks influence financial markets, this course provides traders with the tools and knowledge required to make informed decisions based on central bank actions.

Cutting-Edge Insights and Real-Time Applications

The course goes beyond traditional trading education by incorporating real-time applications and cutting-edge insights. Participants gain access to advanced strategies and tools that are essential for understanding and capitalizing on central bank decisions. This hands-on approach ensures that traders learn theoretical concepts and are equipped to apply these strategies in real-world trading scenarios.

Comprehensive Coverage of Central Bank Dynamics

The AXIA Futures Central Bank Trading Strategies Course covers a wide range of topics related to central bank actions, including interest rate decisions, monetary policy shifts, and central bank communications. This comprehensive coverage thoroughly explains how central banks operate and how their decisions impact various asset classes. By mastering these concepts, traders can gain a competitive edge and improve their trading performance.

What Will You Learn in the AXIA Futures Central Bank Trading Strategies Course?

How Does the Course Illuminate Strategies Rooted in Central Bank Decisions?

At the core of the AXIA Futures Central Bank Trading Strategies Course is a focus on strategies that align with and capitalize on central bank decisions. Understanding central banks’ pivotal role in shaping global economies is essential for any trader looking to gain an edge in the markets. This course provides in-depth insights into crafting trading strategies based on central bank actions, including interest rate decisions, monetary policy changes, and the nuanced language used in central bank communications.

Interest Rate Decisions

Central banks frequently adjust interest rates to manage economic growth and control inflation. The course teaches participants how to interpret and incorporate these decisions into their trading strategies. By understanding the impact of interest rate changes on various asset classes, traders can make more informed decisions and anticipate market movements with greater accuracy.

Monetary Policy Shifts

Monetary policy shifts, such as changes in quantitative easing or tightening measures, have significant implications for financial markets. The course provides detailed guidance on analysing these shifts and adjusting trading strategies accordingly. By mastering this aspect of central bank trading, participants can better navigate market fluctuations and capitalize on emerging opportunities.

Nuanced Language of Central Banks

Central banks often use complex language in their communications, which can be challenging to interpret. The course offers insights into understanding this language and extracting actionable information. By learning to decode central bank statements and reports, traders can gain valuable insights into future policy actions and adjust their strategies in real-time.

How Does Macro-Fundamental Analysis Play a Role in Central Bank Trading Strategies?

Macro-Fundamental Analysis is a key component of the AXIA Futures Central Bank Trading Strategies Course. This analytical approach involves examining economic indicators, inflation rates, and employment data – factors that central banks closely monitor. Understanding these macroeconomic elements is crucial for anticipating central bank actions and their impact on various asset classes.

Economic Indicators

Economic indicators, such as GDP growth and consumer confidence, provide valuable insights into an economy’s health. The course teaches participants how to analyze these indicators and understand their implications for central bank policy decisions. By integrating this analysis into their trading strategies, traders can make more informed decisions and better anticipate market movements.

Inflation Rates

Inflation is a key concern for central banks, as it affects purchasing power and economic stability. The course provides a thorough examination of how inflation rates influence central bank decisions and how traders can incorporate this information into their strategies. By understanding the relationship between inflation and monetary policy, participants can enhance their ability to navigate central bank-driven market movements.

Employment Data

Employment data, such as unemployment rates and job creation figures, play a significant role in central bank policy decisions. The course covers how to interpret employment data and its impact on central bank actions. By integrating this analysis into their trading strategies, traders can better understand market dynamics and improve their trading performance.

What Are the Benefits of Real-Time Application and Case Studies in the Course?

The AXIA Futures Central Bank Trading Strategies Course goes beyond theoretical frameworks by incorporating real-time application and case studies. This hands-on approach allows participants to witness the practical implementation of central bank trading strategies and understand how they perform in dynamic market conditions.

Live Demonstrations

Participants have the opportunity to observe live demonstrations of central bank trading strategies in action. These demonstrations provide practical insights into how to apply the strategies taught in the course and how to adapt them to real-time market conditions. By observing live trading scenarios, traders can gain valuable experience and enhance their ability to implement advanced strategies effectively.

Historical Scenario Analysis

The course also includes analyses of historical scenarios, allowing participants to examine past central bank actions and their impact on financial markets. This analysis helps traders understand how similar strategies might perform in future market conditions and provides a valuable reference for developing their trading approach.

Hands-On Practice

The course’s interactive nature ensures that participants engage in hands-on practice with central bank trading strategies. This practical experience is essential for reinforcing theoretical concepts and building confidence in applying advanced strategies. By practicing in a controlled environment, traders can refine their skills and prepare for real-world trading scenarios.

How Does the Course Address Risk Management in Central Bank-Driven Markets?

Risk Management is a critical aspect of the AXIA Futures Central Bank Trading Strategies Course. Given the heightened volatility often associated with central bank-driven events, the course places a strong emphasis on risk management strategies tailored to navigate uncertainties and protect trading positions.

Managing Volatility

Central bank decisions can lead to sudden and significant market movements, making effective risk management crucial. The course teaches participants how to manage volatility by implementing strategies safeguarding positions and optimising risk-reward ratios. By understanding how to handle market turbulence, traders can protect their investments and minimize potential losses.

Optimizing Risk-Reward Ratios

The course emphasizes the importance of optimizing risk-reward ratios when trading in central bank-influenced markets. Participants learn to assess potential profits against potential losses and make informed decisions based on this analysis. By applying these principles, traders can improve their overall trading performance and achieve more consistent results.

Safeguarding Positions

Effective risk management involves implementing techniques to safeguard trading positions during periods of high volatility. The course provides practical guidance on setting stop-loss orders, managing position sizes, and using other risk management tools. By mastering these techniques, traders can enhance their ability to navigate central bank-driven events and protect their trading capital.

How Does Quantitative Tools and Technology Integration Enhance the Course?

Quantitative Tools and Technology Integration are key features of the AXIA Futures Central Bank Trading Strategies Course. The course incorporates modern approaches to trading by leveraging algorithms, data analytics, and technological advancements to enhance the precision and efficiency of central bank trading strategies.

Leveraging Algorithms

Participants gain insights into leveraging algorithms to improve trading accuracy and efficiency. The course covers how to use algorithmic trading techniques to automate strategies and execute trades with greater precision. By incorporating algorithms into their trading approach, traders can enhance their ability to capitalize on central bank-driven market movements.

Data Analytics

The course also emphasizes the use of data analytics to inform trading decisions. Participants learn how to analyze large volumes of market data to identify patterns and trends related to central bank actions. By integrating data analytics into their trading strategies, traders can make more informed decisions and improve their overall trading performance.

Technological Advancements

The integration of technological advancements into the course ensures that participants stay ahead of the curve in the evolving landscape of trading. The course covers how to use modern tools and technologies to enhance trading strategies and adapt to changes in central bank policies. By embracing these advancements, traders can gain a competitive edge and improve their trading outcomes.

What is the Interactive Learning Environment of the Course Like?

Interactive Learning Environment is a hallmark of the AXIA Futures Central Bank Trading Strategies Course. The course fosters a collaborative and engaging learning experience by offering opportunities for live Q&A sessions, discussions, and feedback.

Live Q&A Sessions

Participants have the opportunity to engage in live Q&A sessions with instructors, allowing them to clarify doubts and gain deeper insights into central bank trading strategies. These sessions provide valuable opportunities for personalized learning and ensure that participants can address specific questions or concerns.

Collaborative Discussions

The course encourages collaborative discussions among participants, fostering a supportive community of learners. By sharing insights and experiences, traders can learn from each other and build a network of like-minded individuals focused on mastering central bank trading strategies.

Feedback and Support

Instructors provide feedback and support throughout the course, helping participants refine their strategies and enhance their trading skills. This personalized support ensures that traders receive the guidance they need to succeed and make the most of the course content.

Conclusion: Download the AXIA Futures Central Bank Trading Strategies Course Today

The AXIA Futures Central Bank Trading Strategies Course stands as a valuable resource for traders aspiring to master the complexities of financial markets influenced by central bank decisions. By providing strategic insights, emphasizing macro-fundamental analysis, integrating risk management principles, and incorporating cutting-edge technology, AXIA Futures empowers traders to approach central bank-driven events with confidence and proficiency.

For those seeking a competitive edge in their trading journey, this course offers a comprehensive and strategic approach to navigating the intricate dynamics of central bank policies. Download the course today and elevate your trading skills to new heights with AXIA Futures.

Related Products

Product For Sale

Product For Sale