Braveheart Trading Market Structure Masterclass

Original price was: $999.00.$13.00Current price is: $13.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Braveheart Trading Market Structure Masterclass

Master Market Dynamics with the Braveheart Trading Market Structure Masterclass Course

Unlock your trading potential with the Braveheart Trading Market Structure Masterclass course. This comprehensive program is designed to provide traders with deep insights into market dynamics from an interbank perspective, equipping them with the skills and knowledge necessary to make informed decisions and maximize their trading success. Whether you’re a novice trader eager to learn or an experienced trader seeking to refine your strategy, this course offers invaluable expertise to help you excel in today’s fast-paced financial markets.

Why Choose the Braveheart Trading Market Structure Masterclass Course?

The Braveheart Trading Market Structure Masterclass course offers a complete education in market structure, drawing on the principles of the Inner Circle Trader (ICT) methodology. Participants will explore everything from foundational concepts to advanced techniques, enabling them to navigate the financial markets confidently. With practical tools and actionable insights, this course sets traders up for long-term success.

What Will You Learn in the Braveheart Trading Market Structure Masterclass?

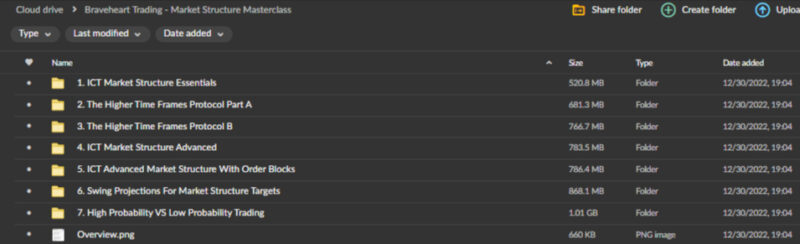

The Braveheart Trading Market Structure Masterclass course is built around several key modules that provide a step-by-step journey through the complexities of market dynamics. Here’s what you’ll learn:

How Do the ICT Market Structure Essentials Form the Foundation?

The ICT Market Structure Essentials module is the starting point of the Braveheart Trading Market Structure Masterclass, laying a strong foundation for understanding market behaviour.

Understanding the Fundamentals of Market Structure

In this module, you will learn to decode the intricacies of market movements by identifying key support and resistance zones, discerning market trends, and understanding the significance of liquidity pools. These core principles help traders recognize patterns that drive price action, providing the basis for strategic decision-making. By mastering these fundamentals, you’ll gain the confidence to interpret market behavior accurately and make well-informed trades.

The ICT Market Structure Essentials also introduces participants to the concept of market phases—accumulation, distribution, markup, and markdown—enabling them to identify where the market is in its cycle and anticipate future price movements. This understanding is crucial for setting the stage for more advanced trading techniques.

Why Is the Higher Time Frames Protocol Crucial for Traders?

The Braveheart Trading Market Structure Masterclass moves beyond the basics with the Higher Time Frames Protocol, a vital component for gaining a comprehensive market perspective.

Leveraging the Higher Time Frames for Strategic Insight

This module teaches participants how to analyze higher time frames—such as daily, weekly, and monthly charts—to gain a holistic view of market dynamics. Understanding the broader market context allows traders to align their strategies with long-term trends, enhancing their ability to identify high-probability trading opportunities. By focusing on the macro perspective, you can make more informed decisions and improve your overall trading performance.

The Higher Time Frames Protocol helps traders avoid the pitfalls of short-term noise and volatility by emphasizing the importance of trading in line with dominant market trends. This approach minimises risk and increases the likelihood of success by ensuring that trades are placed in harmony with the prevailing market direction.

What Advanced Concepts Are Covered in the ICT Market Structure Advanced Module?

Building on foundational knowledge, the Braveheart Trading Market Structure Masterclass course delves into advanced market structure analysis.

Mastering the Nuances of Market Dynamics

The ICT Market Structure Advanced module takes traders deeper into the study of price action and volume analysis, enabling them to identify market manipulation and the footprints of institutional players. By understanding how market structure evolves, participants can anticipate price movements and adjust their strategies accordingly. This advanced level of insight provides a competitive edge, allowing traders to adapt to changing market conditions with greater precision.

This module also covers advanced techniques such as identifying false breakouts, recognizing divergence patterns, and understanding the role of volume in confirming price movements. These skills are essential for traders who want to move beyond basic technical analysis and develop a more sophisticated understanding of market behavior.

How Do Order Blocks Enhance Your Trading Strategy?

The Braveheart Trading Market Structure Masterclass introduces the concept of Order Blocks, a key element in advanced market structure analysis.

Utilizing Order Blocks for Precision in Trading

Order Blocks are areas where institutional orders are placed, significantly influencing price movements. In this module, participants learn to identify, interpret, and leverage Order Blocks to refine their trade entries and exits. By understanding the flow of institutional money, traders can position themselves more effectively in the market, enhancing their ability to capitalize on major moves.

This segment also teaches you to differentiate between strong and weak Order Blocks, enabling you to focus on the most significant levels that are likely to impact price action. By incorporating Order Blocks into your trading strategy, you’ll better understand market dynamics and improve your ability to make accurate predictions.

What Are Swing Projections and How Do They Improve Trade Management?

Swing projections are a critical tool for setting profit targets and managing risk, both of which are covered in detail in the Braveheart Trading Market Structure Masterclass.

Optimizing Trades with Swing Projections

This module equips traders with the skills to project market swings and set realistic profit targets. Mastering swing projections can enhance your risk-reward ratios and optimize overall trade management. This strategic approach encourages disciplined decision-making, helping you avoid impulsive trades and focus on high-probability setups.

Participants learn to use swing projections to identify key market turning points, allowing them to enter and exit trades with greater precision. By setting clear objectives based on projected swings, traders can minimize risk and maximize their potential for profit.

How Do You Differentiate Between High Probability and Low Probability Trading?

Understanding the difference between high-probability and low-probability trading is crucial for maintaining discipline and achieving consistent results.

Focusing on High Probability Trading Setups

The final module of the Braveheart Trading Market Structure Masterclass emphasizes the importance of distinguishing between high-probability trading (HPT) and low-probability trading (LPT). Participants learn to identify setups that are more likely to succeed, ensuring that their trading decisions are grounded in solid strategies and favorable market conditions. This module instills the principles of discipline and patience, guiding traders away from the risks associated with low-probability trades.

Focusing on high-probability setups can increase your chances of success and build a more consistent trading record. This module teaches you to recognize the factors that differentiate high-probability trades from low-probability ones, helping you make smarter decisions and achieve better results.

Why Is the Braveheart Trading Market Structure Masterclass a Smart Investment?

The Braveheart Trading Market Structure Masterclass course offers a comprehensive education in market dynamics that benefits traders at all levels. But what makes this course a smart investment?

Gain a Deep Understanding of Market Dynamics

This course provides participants with a thorough understanding of market structure, enabling them to navigate the financial markets with confidence and precision. By covering everything from the basics to advanced concepts, the Braveheart Trading Market Structure Masterclass ensures that you have a well-rounded skill set to approach the markets strategically, minimize risks, and maximize profits.

Develop a Strategic Approach to Trading

The Braveheart Trading Market Structure Masterclass course is designed to help you develop a disciplined, strategic approach to trading. By focusing on high-probability setups, understanding market dynamics, and leveraging advanced techniques, you’ll be better equipped to achieve sustainable trading success.

Conclusion: Elevate Your Trading Skills with the Braveheart Trading Market Structure Masterclass

The Braveheart Trading Market Structure Masterclass course is an invaluable resource for any trader looking to enhance their understanding of market dynamics and develop a strategic approach to trading. With expert instruction, practical modules, and a focus on high-probability trading, this course provides everything you need to navigate the financial markets confidently.

Don’t miss the opportunity to elevate your trading skills and unlock your full potential – enroll in the Braveheart Trading Market Structure Masterclass today!