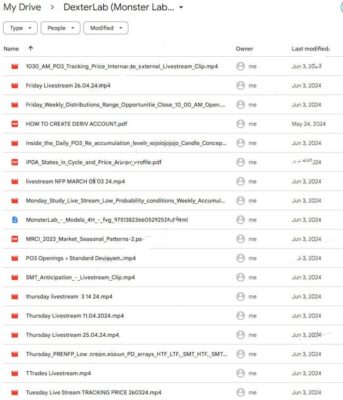

DexterLab (Monster Lab Trading)

Original price was: $497.00.$17.00Current price is: $17.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

DexterLab (Monster Lab Trading)

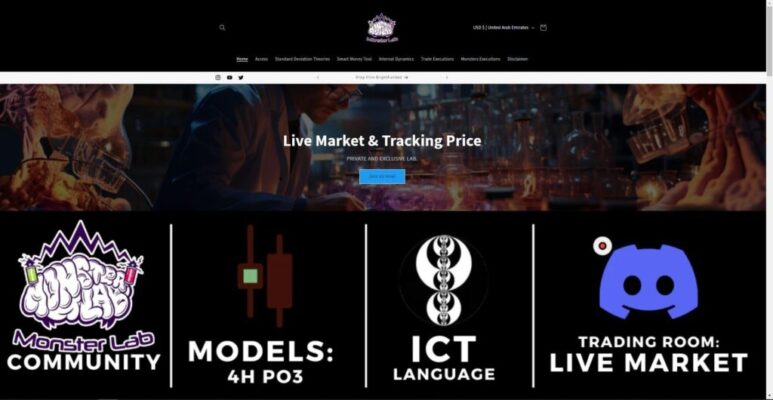

Master Financial Markets with DexterLab (Monster Lab Trading) Course

Welcome to DexterLab (Monster Lab Trading) course, your gateway to mastering trading in financial markets. This advanced course is designed to equip individuals with the knowledge and skills necessary to excel in trading. This course offers a holistic approach to becoming a successful trader, from comprehensive trading strategies and technical analysis to effective risk management and psychological preparedness.

Learn why the DexterLab (Monster Lab Trading) course is worth every investment for beginners and experienced traders.

Why Choose the DexterLab (Monster Lab Trading) Course?

What Makes DexterLab an Exceptional Choice?

DexterLab, also known as Monster Lab Trading, stands out due to its comprehensive curriculum, expert instruction, and interactive learning environment. This course offers detailed insights into various aspects of trading, ensuring that participants gain a robust understanding of the theoretical and practical elements of financial markets.

How Does the Experience of Instructors Enhance Learning?

Expert traders teach the course with years of experience and a proven track record in financial markets. Additionally, guest lecturers who are industry experts and renowned traders occasionally join to provide specialized knowledge. This blend of expertise ensures that you receive top-tier education and insights directly from the best in the field.

What Learning Outcomes Can You Expect?

The DexterLab (Monster Lab Trading) course will help you excel in market analysis, strategy development, risk management, and psychological preparedness. By the end of the course, you will be equipped with the skills to navigate market volatility confidently and make informed trading decisions.

What Core Modules Does the Course Include?

How Does the Course Introduce You to Trading?

What Basics of Trading Are Covered?

The course begins with an introduction to different financial markets, including stocks, forex, commodities, and cryptocurrencies. You will learn about the fundamentals of trading and gain an overview of popular trading platforms, understanding how to use them effectively.

Why Is Understanding Trading Platforms Important?

Knowing how to navigate trading platforms is crucial for executing trades efficiently. The course provides hands-on training on using these platforms, ensuring you can easily place trades, analyze data, and manage your portfolio.

How Does the Course Approach Technical Analysis?

What Charting Techniques Will You Learn?

Technical analysis is a cornerstone of trading. The course delves into various charting techniques, including candlestick, line, and bar charts. Understanding these charts is essential for analyzing market trends and making data-driven decisions.

How Do Indicators and Oscillators Enhance Trading?

You will explore key indicators and oscillators such as moving averages, RSI, MACD, and Bollinger Bands. These tools help identify market conditions and potential trading opportunities, providing a quantitative basis for your trading strategies.

What Is the Role of Fundamental Analysis?

How Do Economic Indicators Affect Markets?

Fundamental analysis evaluates economic indicators such as GDP, inflation, and employment data. Understanding these factors helps in predicting market movements and making long-term investment decisions.

Why Is Company Analysis Important?

Analyzing financial statements, earnings reports, and company news is crucial for stock trading. The course teaches you how to assess a company’s financial health and potential impact on stock prices, enabling you to make informed investment choices.

What Trading Strategies Will You Master?

What Techniques Are Used in Day Trading?

Day trading requires quick decision-making and a thorough understanding of market movements. The course covers scalping and momentum trading techniques, providing strategies to capitalize on short-term market fluctuations.

How Does Swing Trading Differ?

Swing trading focuses on capturing short- to medium-term market movements. You will learn strategies to identify trends and make trades based on market cycles, aiming for profits over days or weeks rather than minutes or hours.

What Is Position Trading?

Position trading involves holding positions for an extended period, focusing on market fundamentals. This strategy is ideal for those who prefer a long-term approach, and the course provides insights on how to identify and capitalize on long-term trends.

How Does the Course Address Risk Management?

Why Is Risk Assessment Crucial?

Effective risk management is vital for trading success. The course teaches you how to identify and assess potential risks, ensuring that you can protect your investments and minimize losses.

What Techniques Are Used for Position Sizing?

Determining the appropriate amount of capital to allocate to each trade is key to managing risk. The course covers methods for calculating position sizes based on your risk tolerance and market conditions, helping you make balanced and strategic investments.

How to Set Stop Loss and Take Profit Levels?

Setting stop-loss and take-profit levels is essential for managing trades. You will learn how to set these levels effectively to protect your capital and lock in profits, ensuring that a solid risk management strategy backs your trading decisions.

What Is the Importance of Trading Psychology?

How to Develop a Disciplined Mindset?

A disciplined and objective mindset is crucial for successful trading. The course emphasizes the importance of maintaining discipline and provides techniques for developing a strong mental framework for trading.

How to Manage Emotions?

Trading can be emotionally challenging. The course offers strategies for managing emotions and avoiding impulsive decisions, helping you stay calm and focused even in volatile market conditions.

How to Build Mental Resilience?

Building mental resilience is essential to handle losses and setbacks. You will learn techniques to stay resilient and maintain a positive outlook, ensuring that you can recover quickly and continue making informed trading decisions.

What Additional Features Enhance the Learning Experience?

How Do Interactive Components Benefit You?

Interactive components such as live trading sessions with expert traders and regular Q&A sessions provide personalized guidance and practical experience. These sessions allow you to apply what you’ve learned in real-time and receive feedback from seasoned professionals.

Why Is Community Access Important?

Access to a community of traders for networking and knowledge sharing enhances your learning experience. Engaging with peers allows you to exchange ideas, share experiences, and gain new perspectives on trading.

What Resources and Tools Are Provided?

How Do Study Materials Aid Learning?

Comprehensive study materials, including eBooks, research papers, and case studies, provide additional learning resources. These materials complement the course content and offer deeper insights into various aspects of trading.

What Role Do Trading Simulators Play?

Trading simulators allow you to practice trading without financial risk. Using these simulators, you can hone your skills and test strategies in a risk-free environment, building confidence before trading with real money.

How Do Market Updates Keep You Informed?

Regular updates and insights on current market trends and events ensure you stay informed about the latest developments. These updates help you adjust your strategies based on current market conditions and make timely trading decisions.

What Are the Credentials of the Instructors?

Who Are the Expert Traders?

Experienced traders teach the course with a proven track record. Their expertise and real-world experience provide valuable insights and practical knowledge, ensuring that you receive high-quality instruction.

How Do Guest Lecturers Enhance Learning?

Occasional guest lectures from industry experts and renowned traders provide specialized knowledge and unique perspectives. These sessions offer additional learning opportunities and expose you to a broader range of trading strategies and techniques.

What Certification Opportunities Are Available?

What Is the Certificate of Completion?

Participants receive a certificate upon successful completion of the course. This certificate acknowledges your achievement and can enhance your professional credentials.

What Advanced Certifications Are Offered?

For those who wish to further their expertise, advanced certifications in specialized trading areas are available. These certifications recognize advanced skills and knowledge, enhancing career prospects in the financial industry.

How to Enroll and What Are the Fees?

What Is the Enrollment Process?

The enrollment process is simple and can be completed online. Detailed instructions guide you through each step, ensuring a smooth registration process.

What Are the Fee Structures?

Various pricing plans are available, including one-time payment and installment options. These flexible payment options make the course accessible to a wider audience.

Are Scholarships Available?

Scholarships are available for deserving candidates. These scholarships provide financial assistance to those who demonstrate potential and a commitment to learning, making the course more affordable and accessible.

What Do Testimonials and Success Stories Say?

How Have Participants Benefited?

Numerous testimonials from past participants highlight their success and improved trading skills. These success stories demonstrate the real-world impact of the course and the effectiveness of its teaching methods.

What Are the Real-Life Case Studies?

Real-life case studies illustrate the application of course concepts. They provide practical examples of how the strategies taught in the course can be applied to achieve success in trading.

Conclusion: Why Enroll in DexterLab (Monster Lab Trading)?

DexterLab (Monster Lab Trading) offers a comprehensive and structured approach to learning trading, making it suitable for beginners and experienced traders. The course equips participants with the skills and knowledge needed to succeed in the financial markets by covering a wide range of topics from technical analysis to trading psychology.

Ready to Transform Your Trading Skills?

Enroll in the DexterLab (Monster Lab Trading) course today and take the first step towards mastering financial markets. With expert instruction, interactive components, and a supportive community, this course provides everything you need to become a successful trader. Start your journey to trading excellence now!