Palden Bhutia – Funded Trading Institution – Course

Original price was: $470.00.$12.00Current price is: $12.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

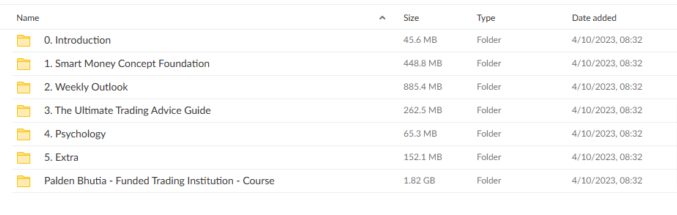

Palden Bhutia – Funded Trading Institution – Course

Palden Bhutia – Funded Trading Institution – Course: Mastering the Path to Funded Trading

Palden Bhutia’s Funded Trading Institution Course is a comprehensive program designed to provide aspiring traders with the knowledge and tools to navigate the financial markets successfully. Leveraging Bhutia’s expertise in funded trading, this course goes beyond basic trading principles, offering practical insights into securing funding for trading activities. In this exploration, we’ll delve into crucial components that make Palden Bhutia’s Funded Trading Institution Course a valuable resource for those looking to turn their trading skills into a funded venture.

Foundations of Trading: Building a Strong Base

What are the essential trading principles?

At the core of the course lies a solid foundation in trading principles. Bhutia ensures participants grasp essential concepts such as technical analysis, risk management, and market dynamics. Understanding the fundamentals is crucial for building a solid trading strategy that forms the basis for securing funding.

- Technical Analysis: Learn to read and interpret charts, identify patterns, and use technical indicators to predict market movements.

- Risk Management: Master the art of protecting your capital by setting stop-loss orders, managing leverage, and understanding position sizing.

- Market Dynamics: Gain insights into how different markets operate, the role of liquidity, and how various economic factors influence market behaviour.

How does understanding these principles aid in trading?

By understanding these foundational principles, traders can develop robust strategies for consistent performance. This knowledge also builds the confidence to approach funding institutions, showcasing a trader’s preparedness and competence.

Risk Management Strategies: Protecting Your Capital

Why is risk management pivotal in trading?

Bhutia significantly emphasises risk management, recognizing its pivotal role in successful trading. The course delves into advanced risk management strategies, teaching participants how to protect capital, minimize losses, and optimize risk-reward ratios. Mastering risk management is a critical factor in gaining the confidence of funding institutions.

- Advanced Techniques: Explore methods like the Kelly Criterion, position sizing algorithms, and volatility-based risk assessments.

- Protective Measures: Learn to implement trailing stops, hedging strategies, and diversification to safeguard your investments.

How does effective risk management attract funding?

Effective risk management demonstrates a trader’s ability to handle market volatility and protect investment capital, making them more attractive to funding institutions. It shows a disciplined approach to trading, which is essential for long-term success.

Funded Trading Model Explanation: Understanding the Path

What is the funded trading model?

The unique aspect of Bhutia’s course is its focus on the funded trading model. Participants receive a detailed explanation of how funded trading works, including the criteria and expectations set by financing institutions. Understanding the intricacies of the funded trading model is essential for traders aiming to access capital for their trading activities.

- Funding Criteria: Learn about the performance metrics, risk parameters, and trading consistency required by funding firms.

- Application Process: Understand the steps involved in applying for funding, from initial assessment to final approval.

Why is it important to understand this model?

By comprehending the funded trading model, traders can align their strategies and performance metrics to meet the expectations of funding institutions, thereby increasing their chances of securing the necessary capital.

Trading Psychology and Discipline: Mastering the Mind

How vital is trading psychology?

The course addresses the psychological aspects of trading, emphasizing the importance of discipline and emotional control. Bhutia provides insights into developing a resilient mindset, overcoming psychological hurdles, and maintaining discipline during various market conditions. Trading psychology is a critical component for traders seeking funding.

- Emotional Control: Techniques to manage stress, fear, and greed, ensuring that decisions are made logically rather than emotionally.

- Building Discipline: Establish routines and habits that promote consistent performance and adherence to your trading plan.

What role does psychology play in securing funding?

A strong psychological foundation demonstrates to funding institutions that a trader is equipped to handle the pressures of the market, reducing the risk of emotional decision-making that can lead to significant losses.

Practical Application and Trading Challenges: Real-World Experience

How does the course integrate practical application?

Bhutia’s program goes beyond theory by incorporating practical application and addressing real-world trading challenges. Participants engage in hands-on exercises, simulations, and case studies to apply their knowledge in practical trading scenarios. This experiential learning approach prepares traders for the dynamic nature of financial markets.

- Simulations: Participate in simulated trading environments to practice and refine strategies without financial risk.

- Case Studies: Analyze real-world trading scenarios to understand how strategies perform under different market conditions.

Why is practical experience crucial?

Practical experience bridges the gap between theoretical knowledge and real-world application, equipping traders with the confidence and skills needed to navigate the complexities of live trading.

Application Process and Funding Strategies: Securing Capital

What are the steps to secure trading funding?

A distinctive feature of the Funded Trading Institution Course is guidance on the application process for securing funding. Bhutia provides insights into crafting compelling trading proposals, meeting performance metrics, and effectively communicating one’s trading strategy to funding institutions. Participants learn strategies to increase their chances of securing funding successfully.

- Crafting Proposals: Learn to create detailed trading proposals that highlight your strategy, risk management, and expected performance.

- Performance Metrics: Understand the key performance indicators that funding institutions look for, such as profit consistency, drawdown control, and risk management.

How can traders increase their chances of getting funded?

By presenting a well-rounded proposal demonstrating a clear strategy, effective risk management, and consistent performance, traders can significantly enhance their attractiveness to funding institutions.

Ongoing Support and Community: Building a Network

How does the course support ongoing learning?

Recognizing the importance of ongoing support, the course includes access to a community of traders. Bhutia fosters an environment where participants can engage with peers, share experiences, and seek guidance. This sense of community provides valuable ongoing support as traders navigate their funded trading journeys.

- Community Engagement: Join a network of like-minded traders for collaboration, support, and shared learning experiences.

- Continual Learning: Access to updates, webinars, and Q&A sessions with Bhutia to keep skills sharp and knowledge current.

Why is community support vital?

Community support offers a platform for continuous learning, feedback, and encouragement, which is crucial for maintaining motivation and adapting to market changes.

Conclusion: A Comprehensive Path to Funded Trading Success

Palden Bhutia’s Funded Trading Institution Course stands as a strategic and empowering guide for individuals seeking to turn their trading skills into a funded venture. With its focus on foundational trading principles, risk management, the funded trading model, psychology, practical application, funding strategies, and ongoing support, the course equips participants with the knowledge and tools needed to succeed in the competitive world of funded trading. Traders embracing Bhutia’s approach gain access to a transformative experience that positions them for success in securing funding and building a sustainable career in the financial markets.

By integrating these comprehensive elements, the Funded Trading Institution Course provides a holistic approach to trading, ensuring that participants are well-prepared to meet the market’s challenges and secure the funding necessary to scale their trading activities. Enroll today and embark on a journey towards becoming a successful funded trader with Palden Bhutia’s expert guidance.