SMC Gelo – Low Timeframe Supply and Demand Course

Original price was: $369.00.$13.00Current price is: $13.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

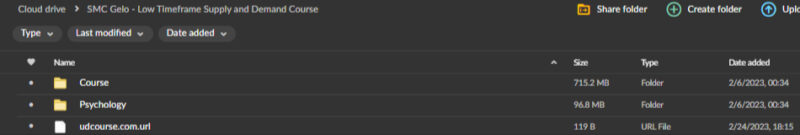

SMC Gelo – Low Timeframe Supply and Demand Course

Master Market Movements with the Low Timeframe Supply and Demand Course

Unlock the secrets to successful trading in fast-paced financial markets with the Low Timeframe Supply and Demand Course by SMC Gelo. This comprehensive program equips traders with the knowledge, strategies, and tools necessary to excel in shorter timeframes. By focusing on the intricacies of supply and demand within these intervals, this course provides a nuanced understanding of market dynamics, helping you make informed and profitable trading decisions.

Designed for both new and experienced traders, this course delves into the core principles of supply and demand with a special emphasis on practical application. You will gain insights into interpreting market trends, mastering entry and exit points, and developing a mindset toward consistent success. Here’s why the Low Timeframe Supply and Demand Course is a game-changer for your trading journey.

What Makes Low Timeframe Dynamics So Unique?

Understanding the unique dynamics of low timeframe trading is essential for those looking to succeed in rapidly moving markets. The course begins by diving into the fundamentals of low timeframe trading, highlighting the challenges and opportunities these shorter intervals present. In low timeframe trading, price movements can be rapid and unpredictable, requiring traders to make swift, well-informed decisions. SMC Gelo breaks down the essential aspects of supply and demand principles as they apply to these dynamic environments, clearly understanding how these forces influence price action.

This course focuses on shorter timeframes, equipping you with the skills to interpret the rapid shifts in supply and demand that characterize such markets. You’ll learn to recognize the patterns that precede these shifts and anticipate potential changes, giving you a distinct edge in identifying profitable opportunities.

Why Are Supply and Demand Concepts Critical for Traders?

Understanding supply and demand is crucial because it forms the foundation of all market movements. The course explores how these principles shape market trends, from small fluctuations to significant price changes. You will learn to identify areas of supply, where sellers are likely to enter, and areas of demand, where buyers are likely to step in, allowing you to pinpoint potential reversals and continuations in the market.

The focus is not just on theory but also on practical application. This course teaches you how to read the market’s signals, recognize patterns that indicate supply and demand imbalances, and use this knowledge to make strategic trading decisions. By mastering these concepts, you’ll be able to anticipate market moves more accurately and position yourself for success.

How Does Practical Application Enhance Learning?

Practical application is essential in learning low timeframe trading strategies; this course excels in delivering that. A standout feature of the Low Timeframe Supply and Demand Course is its hands-on approach to teaching. SMC Gelo uses real-world case studies to bring theoretical concepts to life, demonstrating how supply and demand zones manifest in different market conditions. You will see firsthand how these principles apply in live trading environments, reinforcing your understanding and building your confidence.

The course walks you through specific trading scenarios, showing you how to apply supply and demand analysis to various assets and market situations. This hands-on learning approach ensures you are well-prepared to implement these strategies in your trading activities, enhancing comprehension and execution.

How Do Risk Management Strategies Factor In?

Risk management plays a crucial role in low timeframe trading, and this course prepares you to manage it effectively. Risk management is critical in any trading style, but it’s especially important in low timeframe trading, where market conditions can change rapidly. SMC Gelo dedicates much of the course to teaching effective risk management techniques. You’ll learn to set appropriate stop-loss orders, determine optimal position sizes, and evaluate risk-to-reward ratios to protect your capital.

Mastering these strategies equips you to navigate the inherent risks of low timeframe trading while maximizing your profit potential. This focus on risk management helps you develop a disciplined approach that minimizes losses and builds long-term success.

Why Are Effective Entry and Exit Points Vital in Low Timeframe Trading?

Navigating the intricacies of low-timeframe supply and demand requires a keen understanding of entry and exit points. SMC Gelo guides participants in identifying optimal moments to enter trades based on supply and demand imbalances. The course provides a detailed exploration of various market entry and exit strategies, tailored to the fast-paced nature of low-timeframe trading.

Understanding where to enter and exit trades is essential for maximizing gains and minimizing losses. The course equips you with the tools to identify high-probability entry points and secure profitable exits, even in the most volatile market conditions. This focus ensures you are well-positioned to capitalize on short-term trading opportunities while maintaining a solid risk management stance.

How Does the Course Address the Psychology of Low Timeframe Trading?

Recognizing the psychological challenges inherent in low timeframe trading is vital for success. The course addresses the importance of mindset and discipline, exploring common psychological pitfalls such as fear, greed, and impulsiveness. SMC Gelo provides strategies for maintaining emotional balance and cultivating a resilient mindset, helping you stay focused and make rational decisions even during rapid market fluctuations.

A disciplined approach to trading psychology enables you to stick to your plan, avoid emotional decision-making, and maintain confidence in your strategy. This mental resilience is critical in the fast-paced world of low-streaming trading, where quick decisions and strong convictions are often necessary.

How Does the Course Foster Customized Trading Plans?

A notable feature of the SMC Gelo – Low Timeframe Supply and Demand Course is its emphasis on individualized trading plans. Recognizing that every trader has unique goals, risk tolerance, and preferences, the course guides participants in developing personalized strategies that align with their strengths and objectives. This tailored approach fosters a greater sense of confidence and adaptability in dynamic market conditions.

Building a customized trading plan helps ensure that you can navigate the markets with clarity and precision. You will learn to create a trading plan that suits your individual needs and refine it based on ongoing market feedback, enhancing your ability to achieve consistent results.

What Continuous Support and Community Engagement Can You Expect?

Understanding the importance of ongoing support in the learning journey, SMC Gelo provides access to a vibrant community of traders. This community allows participants to exchange insights, seek clarification, and share experiences, fostering a collaborative learning environment. Regular updates and supplementary materials enrich the learning experience, ensuring traders remain well-informed and connected.

Continuous support and community engagement are vital for sustained growth in trading. Interacting with fellow traders and experts on an ongoing basis ensures you stay updated on market trends and strategies, helping you maintain your competitive edge.

Why Should You Choose the Low Timeframe Supply and Demand Course?

The Low Timeframe Supply and Demand Course is a valuable resource for traders seeking to enhance their skills in fast-paced markets. Through a combination of theoretical insights, practical case studies, risk management strategies, and psychological resilience training, participants gain a comprehensive understanding of low timeframe dynamics. This course not only equips traders with the tools to navigate short-term fluctuations but also fosters a mindset conducive to long-term success in the dynamic world of financial trading.

Enroll today and take the first step towards mastering the art of low timeframe trading, leveraging the power of supply and demand to achieve consistent profitability in any market condition.