The Orderflows – Delta Trading Course

Original price was: $990.00.$12.00Current price is: $12.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

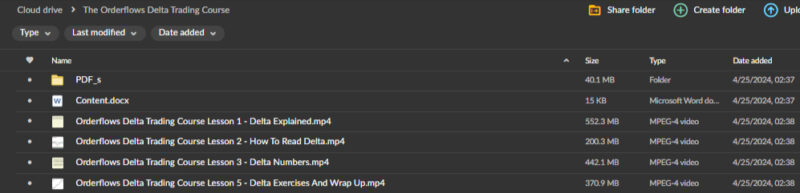

The Orderflows – Delta Trading Course

Master Market Dynamics with The Orderflows – Delta Trading Course

The Orderflows: Delta Trading Course is a cutting-edge educational program designed for traders aiming to enhance their ability to read and interpret order flow and delta analysis. Developed by seasoned traders, this comprehensive course provides participants with deep insights into market dynamics, empowering them to make informed trading decisions based on sophisticated order flow data.

Why Choose The Orderflows – Delta Trading Course?

In the fast-paced world of trading, having a thorough understanding of order flow and delta analysis can give traders a significant edge. The Orderflows – Delta Trading Course is an essential resource for those serious about mastering these advanced trading techniques. Here’s why this course is indispensable:

Understanding Order Flow

At the heart of the Delta Trading Course is a deep dive into the intricacies of order flow dynamics. Participants learn how buy and sell orders impact price movements and market sentiment. The course covers critical concepts such as bid-ask spreads, order book imbalances, and the significance of order flow data in determining market trends. This foundational knowledge is crucial for traders looking to precisely navigate the markets.

Delta Analysis Fundamentals

Delta analysis is a core component of this course. It focuses on the relationship between price changes and changes in the open interest of contracts. Participants learn to interpret delta values to gauge the strength of buying or selling pressure in the market. This fundamental knowledge forms the basis for developing more nuanced and effective trading strategies.

Advanced Technical Analysis Tools

The Delta Trading Course incorporates advanced technical analysis tools that enhance participants’ trading capabilities. These tools include cumulative delta charts, footprint charts, and other specialized indicators that provide a granular view of order flow dynamics. Understanding and utilizing these tools can give traders a significant edge in their decision-making process.

Trading Strategies Based on Delta

One of the central focuses of the course is developing trading strategies based on delta analysis. Participants explore identifying key entry and exit points by leveraging order flow information. The course covers various trading strategies, including scalping, swing trading, and position trading, all tailored to capitalize on delta imbalances and market inefficiencies. These strategies are designed to be adaptable to different market conditions, providing traders with versatile tools for success.

Risk Management in Delta Trading

Effective risk management is crucial for sustainable trading success, and the Delta Trading Course strongly emphasizes this aspect. Participants learn to assess and manage risk within delta trading strategies. This includes setting appropriate stop-loss levels, determining position sizes based on market conditions, and adapting risk management techniques to the nuances of order flow trading. These skills are essential for protecting capital and optimizing long-term profitability.

Real-Time Application through Simulations

Practical application is a critical component of the learning process in the Delta Trading Course. The course offers participants opportunities for real-time application through trading simulations. These simulated trading scenarios allow participants to practice applying delta analysis in a controlled environment, honing their skills before executing trades in live markets. This hands-on experience is invaluable for building confidence and proficiency.

Market Profile and Auction Market Theory

The course delves into market profile and auction market theory to complement delta analysis. Participants gain insights into how these concepts intersect with order flow dynamics, providing a more holistic understanding of market structure and behavior. This integration enhances participants’ ability to make informed trading decisions, as they learn to read market profiles and understand auction processes in conjunction with delta analysis.

Continuous Learning and Updates

Given the dynamic nature of financial markets, the Delta Trading Course emphasizes the importance of continuous learning and staying abreast of market developments. Participants receive updates and ongoing support to ensure they have the latest insights and strategies to navigate evolving market conditions. This commitment to continuous improvement reflects the course’s dedication to providing lasting value to its students.

Conclusion: A Comprehensive Path to Trading Mastery

The Orderflows – Delta Trading Course offers a comprehensive and advanced curriculum for traders seeking to master order flow and delta analysis. The course provides a thorough education in delta trading by covering foundational concepts, advanced technical tools, trading strategies, risk management, and real-time application through simulations. With a commitment to continuous learning and updates, the course caters to traders aspiring to stay ahead in the ever-evolving landscape of financial markets.

H2 Subheaders

The Orderflows – Unraveling Market Dynamics

The Orderflows Delta Trading Course begins with a thorough exploration of order flow dynamics. Understanding how buy and sell orders influence price movements is crucial for any trader. This section introduces participants to the fundamental concepts of bid-ask spreads, order book imbalances, and the significance of order flow data. By grasping these concepts, traders can better predict market trends and make informed decisions.

Delta Trading Course – Mastering Delta Analysis

Delta analysis is a cornerstone of the course. This section delves into the relationship between price changes and changes in the open interest of contracts. Participants learn how to interpret delta values to gauge the strength of buying or selling pressure. This knowledge is critical for developing advanced trading strategies that leverage market momentum.

Advanced Technical Tools – Enhancing Trading Capabilities

The course incorporates advanced technical analysis tools to provide a competitive edge. Participants learn to use cumulative delta charts, footprint charts, and other specialized indicators to understand market dynamics. These tools help traders identify patterns and opportunities that are not visible through traditional analysis methods.

Developing Delta-Based Trading Strategies

This section focuses on practical trading strategies based on delta analysis. Participants explore various approaches, including scalping, swing trading, and position trading. Each plan is designed to capitalize on delta imbalances and market inefficiencies, providing traders with versatile tools for different market conditions.

Effective Risk Management – Protecting Your Capital

Risk management is a crucial aspect of successful trading. This section teaches participants how to assess and manage risk within the context of delta trading. By setting appropriate stop-loss levels and determining position sizes based on market conditions, traders can protect their capital and ensure sustainable profitability.

Real-Time Simulations – Building Practical Skills

Practical application is a crucial focus of the course. Through real-time trading simulations, participants can practice applying delta analysis in a controlled environment. This hands-on experience is invaluable for building confidence and proficiency before executing trades in live markets.

Integrating Market Profile and Auction Market Theory

To provide a comprehensive understanding of market behavior, the course includes market profile and auction market theory. Participants learn how these concepts intersect with order flow dynamics, enhancing their ability to make informed trading decisions.

Continuous Learning and Support

The course emphasizes the importance of continuous learning. Participants receive updates and ongoing support to ensure they stay current with market developments and new strategies. This commitment to continuous improvement ensures that traders remain competitive in the evolving financial markets.

Conclusion: A Path to Trading Excellence

The Orderflows – Delta Trading Course is a comprehensive educational program designed to master order flow and delta analysis. With a focus on advanced technical tools, practical trading strategies, effective risk management, and continuous learning, the course equips traders with the skills needed to navigate the complexities of the financial markets successfully. Whether you are a novice trader or an experienced professional, this course offers a valuable path to trading excellence. Enroll today and take the first step towards mastering the art of delta trading.