Trader Daye Quarterly Theory 2024 (21 Videos)

$150.00 Original price was: $150.00.$18.00Current price is: $18.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

Trader Daye Quarterly Theory 2024 (21 Videos)

Master Strategic Market Analysis with the Trader Daye Quarterly Theory 2024 (21 Videos) Course

The Trader Daye Quarterly Theory 2024 (21 Videos) course is an advanced training program that offers traders a strategic approach to navigating the financial markets. Developed by the experienced and highly successful Trader Daye, this comprehensive course delves into the power of quarterly market cycles and long-term trends, providing participants with a unique framework to identify high-probability trading opportunities and manage risks effectively. With a focus on aligning trading strategies to quarterly cycles, this course helps traders move beyond the short-term noise of the markets to capture the true essence of broader trends.

For traders looking to enhance their skills and gain a deeper understanding of market movements, the Trader Daye Quarterly Theory 2024 (21 Videos) course is a must-have. Its unique blend of fundamental analysis, technical analysis, and market sentiment evaluation equips traders to make informed decisions and achieve consistent profitability. Whether you’re a novice trader eager to build a strong foundation or a seasoned investor aiming to refine your strategy, this course is designed to guide you in navigating the complexities of the market with confidence.

What Sets the Trader Daye Quarterly Theory 2024 (21 Videos) Course Apart?

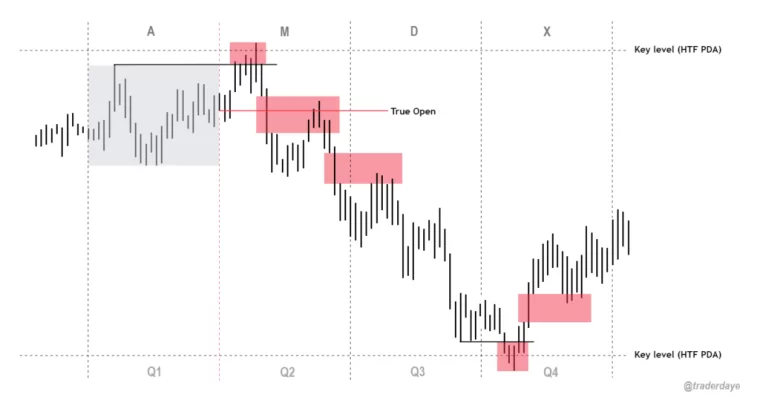

The Trader Daye Quarterly Theory 2024 (21 Videos) course stands out because it offers an in-depth exploration of quarterly cycles—an often overlooked but critical aspect of market analysis. While daily price movements and short-term trends consume many traders, Trader Daye emphasizes the importance of taking a broader view. By focusing on quarterly cycles, traders can capture larger price movements and better understand the underlying forces driving market direction.

This course goes beyond traditional technical analysis by incorporating fundamental analysis and sentiment evaluation elements. Participants learn how to interpret economic data, corporate earnings, and geopolitical events to assess market health and predict potential turning points. Additionally, the course delves into market psychology, teaching traders how to gauge investor sentiment and recognize patterns of collective behavior that often signal major shifts in market trends. This holistic approach ensures participants have a well-rounded skill set that prepares them to trade effectively across various market conditions.

How Does Trader Daye Analyze Market Cycles?

A key component of the Trader Daye Quarterly Theory 2024 (21 Videos) is its focus on understanding and leveraging market cycles. Trader Daye teaches participants how to identify and interpret quarterly cycles, which can provide valuable insights into long-term market trends. By aligning trading strategies with these broader cycles, traders can reduce the impact of short-term volatility and increase their chances of achieving sustained profitability.

Trader Daye’s approach begins with a detailed analysis of historical price data to identify recurring patterns and phases within the quarterly cycle. Participants learn how to distinguish between expansionary and contractionary phases, as well as how to recognize key turning points such as market tops and bottoms. This knowledge allows traders to position themselves more strategically, entering trades during high-probability periods and exiting before major reversals occur.

Additionally, the course covers sector rotations and how different sectors perform during various stages of the market cycle. By understanding these dynamics, traders can make more informed decisions about which assets to trade at different times, maximizing their opportunities for profit while minimizing exposure to risk.

What Role Does Fundamental Analysis Play in the Course?

While technical analysis is often the cornerstone of many trading strategies, the Trader Daye Quarterly Theory 2024 (21 Videos) places a strong emphasis on integrating fundamental analysis. Trader Daye believes that understanding the economic and financial factors that influence market movements is essential for making sound trading decisions. Throughout the course, participants learn how to evaluate key economic indicators, corporate earnings reports, and geopolitical developments to gain a comprehensive view of the market.

For example, Trader Daye explains how to interpret data such as GDP growth, unemployment figures, and interest rate changes to assess the overall health of the economy. Participants also learn how to analyze earnings reports and corporate guidance to gauge the strength of individual companies and sectors. By combining this information with their technical analysis skills, traders can develop a more nuanced understanding of market conditions and make better-informed trading decisions.

This focus on fundamentals ensures that participants are not merely reacting to price movements but are proactively anticipating how broader economic trends will impact the market. This proactive approach helps traders avoid the common pitfalls of emotional decision-making and allows them to position themselves for long-term success.

How Does Trader Daye Utilize Technical Analysis for Market Timing?

Technical analysis is a core component of the Trader Daye Quarterly Theory 2024 (21 Videos), providing participants with the tools to identify precise entry and exit points. Trader Daye’s technical analysis techniques include chart pattern recognition, trendline analysis, and the use of oscillators and indicators to confirm trading signals. Participants learn how to apply these techniques to various time frames, allowing them to adapt their strategies to different market conditions.

For example, the course covers the use of moving averages to determine trend direction and strength, as well as how to spot potential trend reversals using oscillators like the RSI and MACD. Trader Daye also teaches participants how to identify key support and resistance levels, which are critical for setting stop-loss orders and managing risk effectively. By mastering these techniques, traders gain the ability to enter trades with confidence and exit at the optimal time, maximizing their profit potential.

Moreover, the course explores advanced concepts such as Fibonacci retracements, Bollinger Bands, and volume analysis. These tools help traders refine their strategies and add an extra layer of precision to their market timing. By combining these technical indicators with the insights gained from quarterly cycle analysis, participants can develop a powerful, multifaceted approach to trading that adapts to changing market dynamics.

How Does the Course Address Market Sentiment?

Market sentiment plays a crucial role in shaping price movements, and the Trader Daye Quarterly Theory 2024 (21 Videos) delves deeply into this aspect of trading. Trader Daye teaches participants how to assess investor sentiment using a variety of tools, including sentiment surveys, the put/call ratio, and the Volatility Index (VIX). Understanding sentiment allows traders to identify periods of extreme optimism or pessimism, which often precede major market reversals.

The course also covers the psychology of trading and how emotions like fear and greed influence market behavior. By recognizing these patterns, participants can adopt a contrarian approach when appropriate, taking advantage of market inefficiencies created by emotional trading. This ability to anticipate shifts in sentiment and adapt accordingly is a key differentiator for traders using the Trader Daye Quarterly Theory.

Additionally, Trader Daye discusses behavioral biases that can cloud judgment, such as confirmation bias and overconfidence. By being aware of these biases, traders can maintain discipline and avoid common psychological traps that lead to poor decision-making. This focus on market psychology helps participants cultivate a mindset of patience and objectivity, which is essential for long-term trading success.

What Risk Management Techniques Does Trader Daye Emphasize?

Risk management is a cornerstone of the Trader Daye Quarterly Theory 2024 (21 Videos). Trader Daye believes that effective risk management is the key to preserving capital and achieving consistent profitability. Participants learn how to implement a range of risk management techniques, including position sizing, stop-loss orders, and diversification strategies.

The course teaches traders how to calculate the optimal position size based on their risk tolerance and account size, ensuring that no single trade has the potential to cause catastrophic losses. Trader Daye also provides guidelines for setting stop-loss levels to protect against adverse market movements. By adhering to these risk management principles, participants can trade with confidence, knowing that their downside is limited and their capital is protected.

Additionally, the course covers portfolio diversification and how to spread risk across different asset classes and sectors. This approach helps traders mitigate the impact of unexpected market events and maintain a balanced portfolio, even in volatile conditions. By mastering these risk management techniques, participants can build a solid foundation for sustainable trading success.

Why Choose the Trader Daye Quarterly Theory 2024 (21 Videos) Course?

The Trader Daye Quarterly Theory 2024 (21 Videos) is more than just a trading course—it’s a comprehensive framework that empowers traders to take control of their financial future. By focusing on quarterly cycles, long-term trends, and a disciplined approach to trading, this course provides participants with a powerful set of tools to navigate the complexities of the market. Trader Daye’s emphasis on patience, precision, and risk management ensures that traders can achieve consistent profitability while minimizing risk.

Whether you’re new to trading or an experienced professional, the Trader Daye Quarterly Theory 2024 (21 Videos) course offers a unique perspective that will transform the way you approach the markets. With its focus on strategic trading, market psychology, and effective risk management, this course equips traders with the skills and confidence needed to thrive in today’s dynamic financial landscape.

Start your journey to mastering market timing and long-term success with Trader Daye’s proven methodology today!

Product For Sale

Product For Sale Related Products

$149.00 Original price was: $149.00.$20.00Current price is: $20.00.

$298.00 Original price was: $298.00.$15.00Current price is: $15.00.

$400.00 Original price was: $400.00.$30.00Current price is: $30.00.

$4,997.00 Original price was: $4,997.00.$19.00Current price is: $19.00.