Trader Divergent – Rule Based Price Action

Original price was: $378.00.$13.00Current price is: $13.00.

- 24/7 Contact Support & Fast Chat

- Original Courses HD Quality

- Courses Are Updated

- Checked Download Links

- Guaraneed Safe Checkout

Description

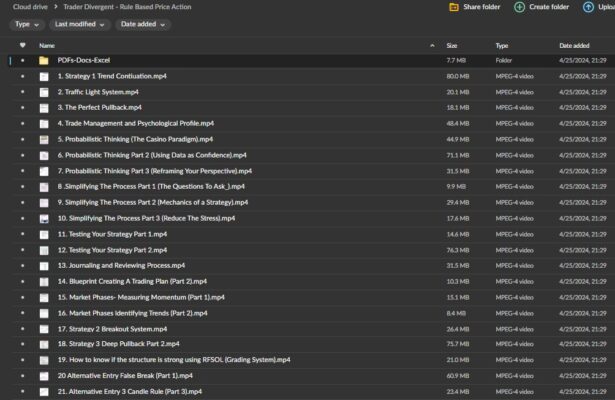

Trader Divergent – Rule Based Price Action

Unlock Consistent Trading Success: The Trader Divergent – Rule-Based Price Action Course

Transform your trading approach with the Trader Divergent – Rule-Based Price Action course—a revolutionary program designed to instil precision, discipline, and consistency in your trading practices. If you’ve ever struggled with subjective decision-making, emotions, or the unpredictability of discretionary trading, this course offers a systematic solution that guides you toward long-term success.

Why Choose a Rule-Based Price Action Course?

The Rule-Based Price Action course offered by Trader Divergent is based on the principle that trading should be systematic and free from emotional influence. By adhering to clearly defined rules, traders can eliminate the guesswork and decision fatigue often accompanying traditional trading methods. This structured approach allows you to focus on executing your strategy confidently, paving the way for consistent results and sustained profitability.

What Are the Pitfalls of Discretionary Trading?

Many traders fall into the trap of discretionary trading, which often relies on “gut feelings” or emotional reactions to market movements. This approach can lead to erratic decisions, self-doubt, and trading failures.

Why Is Discretionary Trading Often Ineffective?

- Emotional Decision-Making: Discretionary trading can cause traders to make impulsive decisions based on fear or greed rather than data-driven analysis. This emotional involvement often leads to mistakes and inconsistent results.

- Lack of Structure: Without a structured framework, discretionary trading can feel overwhelming, with no clear guidelines. This can result in decision fatigue, as traders are constantly forced to make choices without a solid foundation.

How Does the Rule-Based Price Action Method Improve Trading?

The Rule-Based Price Action course offers a comprehensive framework that removes subjectivity and emotions from trading. Instead of relying on intuition, this approach is built around rules that dictate when to enter and exit trades, how to manage risk, and how to handle different market conditions.

What Are the Benefits of a Rule-Based Approach?

- Elimination of Guesswork: By following a rule-based system, traders can eliminate the uncertainty and ambiguity of discretionary methods. Every decision is backed by a predefined rule, reducing the likelihood of error.

- Consistent Performance: A rule-based strategy promotes consistency by ensuring that every trade is executed according to the same set of criteria. This consistency is key to building a track record of successful trades.

What Makes the Rule-Based Price Action Course Unique?

The Trader Divergent – Rule Based Price Action course is not just another trading program but a culmination of years of market experience, trading knowledge, and tested strategies condensed into a single, actionable framework. The course is the missing piece for intermediate traders who understand the market but need help putting all the elements together.

How Does This Course Provide a Blueprint for Success?

- Step-by-Step Structure: The course offers a structured, step-by-step guide that simplifies the complexities of trading. It is designed to be easily digestible, ensuring traders of all levels can understand and apply the concepts.

- Real-World Application: With practical examples, live scenarios, and hands-on exercises, the course bridges the gap between theory and practice. Traders learn the “what” and the “how” of successful trading, applying techniques directly to the market.

What Key Topics Are Covered in This Course?

The Rule-Based Price Action course explores several critical aspects of trading, each with detailed explanations and actionable insights.

What Are the Mechanics of a Rule-Based Trading Strategy?

- Strategy Development and Simplification: Learn how to develop a robust trading strategy that is both simple and effective. The course guides you in creating a trading plan outlining your entry, exit, and risk management rules.

- Psychology and Emotional Control: Understanding the mental aspects of trading is crucial. The course explores traders’ psychological challenges, offering tools to manage emotions and maintain a disciplined mindset.

How Do You Identify Market Conditions Effectively?

- Market Condition Identification: Learn to recognize different market conditions—trending, ranging, and volatile markets—and adapt your strategy accordingly. This skill helps you stay prepared for any scenario, enhancing your ability to capitalize on market movements.

- Best Tools and Indicators: Discover the most effective tools and indicators to use in your trading strategy. From moving averages to support and resistance levels, learn how to use these indicators to make data-driven decisions.

How Can You Achieve Consistency with Rule-Based Trading?

The course provides a detailed blueprint for achieving consistency in trading. This involves understanding the mechanics of the strategy, managing risk, and developing the right habits and routines.

What Are the High-Probability Techniques You Will Learn?

- Exiting for a Small Loss: The course emphasizes minimizing losses. Learn how to exit trades quickly and efficiently when conditions are unfavourable, preserving your capital for more promising opportunities.

- Grading Systems and Mechanical Techniques: Develop a grading system for evaluating trade setups and learn mechanical techniques for executing trades. This structured approach helps you maintain objectivity and reduces emotional interference.

Why Is Risk Management Critical in Rule-Based Trading?

Effective risk management is the cornerstone of any successful trading strategy. The Rule Based Price Action course teaches you how to manage your risk by setting stop losses, calculating position sizes, and developing strategies for handling drawdowns.

How Can You Protect Your Capital While Maximizing Gains?

- Risk Management Fundamentals: Learn how to protect your trading capital by understanding risk management principles. The course covers essential topics like stop-loss placement, position sizing, and portfolio diversification.

- Handling Drawdowns: Understand how to handle drawdowns—a natural part of trading—without allowing them to impact your mental state or trading decisions. Learn how to recover from losses and continue trading with confidence.

How Do You Journal and Review Your Trades?

Journaling and reviewing trades are crucial for continuous improvement. The course provides a framework for maintaining a trading journal, helping you track your performance, identify strengths and weaknesses, and refine your strategy.

What Are the Best Practices for Effective Journaling?

- Recording Key Metrics: Learn what data to record in your trading journal, such as entry and exit points, trade duration, market conditions, and emotional state. This detailed record allows for a comprehensive review of your performance.

- Reviewing and Analyzing Trades: Develop a habit of regularly reviewing your trades to identify patterns, mistakes, and opportunities for improvement. Use these insights to fine-tune your strategy and enhance your trading outcomes.

Who Should Take This Course?

The Trader Divergent—Rule Based Price Action course is designed specifically for intermediate traders who have foundational knowledge of market dynamics but struggle to develop a cohesive strategy.

How Will This Course Benefit Intermediate Traders?

- Structured Learning Path: The course provides a learning path that helps intermediate traders consolidate their knowledge and build a solid trading strategy. This structure ensures that every trader has a clear roadmap to follow.

- Practical Skills and Insights: Focusing on practical skills, the course teaches traders how to implement their strategy in real-time, adapt to market changes, and continuously improve their performance.

Enroll in the Trader Divergent – Rule-Based Price Action Course Today!

If you are ready to move beyond the pitfalls of discretionary trading and embrace a rule-based, methodical approach, the Trader Divergent – Rule Based Price Action course is your gateway to trading success. With a structured blueprint for achieving consistency, this course will help you eliminate emotions, reduce guesswork, and achieve a disciplined trading practice.

Don’t Miss Out on This Opportunity to Transform Your Trading!

Join the Trader Divergent – Rule Based Price Action course today and start your journey toward disciplined, rule-based trading. This course is the ultimate solution for traders looking to enhance their skills, optimize their strategy, and achieve long-term success in the financial markets.