TL;DR: The Cash Flow Investing Course provides comprehensive training in financial statement analysis, stock valuation, and portfolio management. Learn to read 10K reports, build DCF models, and forecast stock prices like professional investors with this complete value investing course.

Cash Flow Investing Course Review: Best Value Investing Training

Looking for a value investing course that teaches real analytical skills? The Cash Flow Investing Course goes beyond surface-level stock picking to teach you the fundamental analysis methods used by Warren Buffett, Charlie Munger, and institutional fund managers.

Unlike courses focusing solely on technical analysis or trading signals, this program teaches you to evaluate companies based on their intrinsic value. For broader portfolio strategies, also explore Trading Dominion – Portfolio Investing.

Master Financial Statement Analysis Course Content

The Cash Flow Investing Course teaches you to dissect 10K and 10Q reports like a professional analyst. You’ll understand income statements, balance sheets, and cash flow statements.

Learn to identify red flags, recognize sustainable competitive advantages, and spot companies with strong cash generation. This financial statement analysis course provides the foundation for all intelligent investing decisions.

What You’ll Learn in Cash Flow Investing Course

- Analyze 10K and 10Q reports to understand company fundamentals

- Build DCF valuation models to calculate intrinsic stock value

- Identify undervalued stocks using professional screening methods

- Calculate free cash flow and understand its importance

- Evaluate competitive moats that protect company profits

- Construct diversified portfolios based on value principles

Stock Valuation Methods That Work

The Cash Flow Investing Course teaches DCF analysis, comparable company analysis, and asset-based valuation. You’ll learn when to apply each method. For additional frameworks, consider Macrohedged – Options Education FULL Course.

Who Is Cash Flow Investing Course Best For?

This program is ideal for investors who want to move beyond speculation to fundamental analysis. For swing trading strategies, see Oliver Kell – Swing Trading Masterclass.

Build Investment Models Like Professionals

The Cash Flow Investing Course includes hands-on model building exercises. Related portfolio strategies are covered in Trading Dominion – Portfolio Margin Trading Tactics.

Cash Flow Investing Course: Frequently Asked Questions

Is Cash Flow Investing Course worth it for beginners?

Yes, the Cash Flow Investing Course starts with basic concepts and builds to advanced techniques. No prior finance education required.

What’s included in Cash Flow Investing Course?

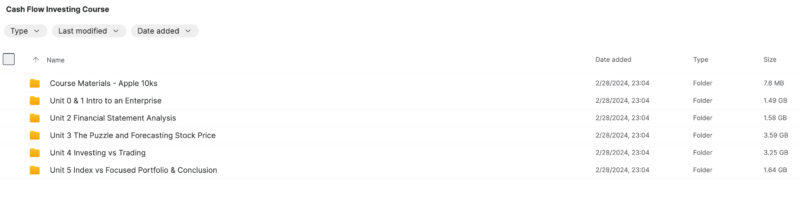

Video training on financial statement analysis, DCF valuation, 10K/10Q reading, stock screening, portfolio construction, and real company examples with templates.

How does Cash Flow Investing compare to other courses?

Cash Flow Investing Course focuses on practical application. See also T3 LIVE – Strategic Swing Trader.

Can I use these methods for any stock?

The methods work best for established companies with predictable cash flows. Adjustments needed for growth companies, banks, and REITs.

Is Cash Flow Investing Course good for long-term investors?

Absolutely. Designed for long-term wealth building through intelligent stock selection.

Can I access Cash Flow Investing Course immediately?

Yes, instant access upon purchase. Explore AXIA Futures – Elite Trader Blueprint for additional perspectives.