Classic Trading Tactics Theory and Practice by Linda Raschke is the definitive swing trading course from a Market Wizard.

What is it? Linda Raschke Classic Trading Tactics is a course from one of the most respected traders in the industry covering Classic Trading Tactics Theory and Practice methods, pattern recognition, and market timing techniques. Classic Trading Tactics Theory and Practice teaches her proven approaches to reading markets and executing trades—based on over 40 years of professional trading experience as featured in Jack Schwager’s “New Market Wizards.”

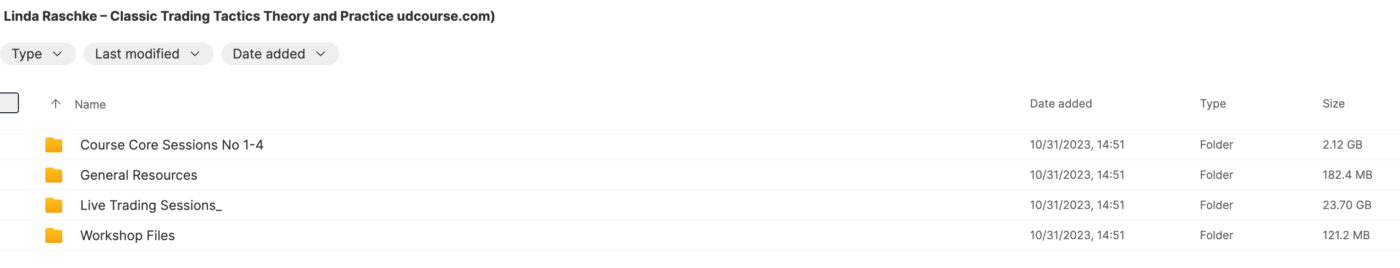

Verified Deliverables:

- Complete Classic Trading Tactics curriculum

- Video training modules

- PDF reference materials

- Delivery: Mega & Google Drive

- Access: PC, Tablet, Mobile

- Lifetime access included

Why Learn from a Market Wizard in 2025

Most trading educators never traded professionally. They teach theory they read in books or patterns they backtested but never traded live with real money. Linda Raschke traded professionally for over four decades, managing money and running a CTA. She was profiled in Jack Schwager’s “New Market Wizards” alongside trading legends. When she teaches pattern recognition or Classic Trading Tactics Theory and Practice management, it comes from actual experience executing thousands of real trades. That practical foundation separates this education from courses created by marketers who discovered trading education is more profitable than trading itself.

Technical Setup and Platform Configuration

Linda’s methods work on any platform that displays clean price action. The course recommends daily and 60-minute charts as primary timeframes, with 15-minute charts for timing entries in active markets. Essential indicators include ADX(14) for trend strength measurement—readings above 25 indicate tradeable trends. Stochastics (14,3,3) provide momentum readings for overbought/oversold conditions. Keltner Channels or Bollinger Bands (20,2) define volatility boundaries for mean reversion setups. Moving averages (10 and 20 EMA) serve as dynamic support/resistance. The approach emphasizes readable charts over indicator overload—if you can’t tell what’s happening at a glance, you have too many indicators. Platform settings should include volume bars and a clean color scheme that doesn’t strain eyes during long sessions.

What the Course Covers

Classic Trading Tactics covers Linda’s approach to reading market structure and identifying swing trading opportunities. Pattern recognition modules teach how to spot setups with high probability outcomes. Market timing techniques show when conditions favor aggressive trading versus defensive positioning. Trade management sections cover entries, exits, position sizing, and handling losing streaks. Classic Trading Tactics Theory and Practice curriculum balances theory with practical application, showing how concepts work in real market conditions. Traders interested in additional momentum-based setups may find Top Swing Trader Pro provides complementary momentum techniques that align with Linda’s swing trading philosophy.

Rule-Based Entry Logic: The Holy Grail Setup

One of Linda’s signature patterns demonstrates her systematic approach to entries:

- ADX Requirement: ADX(14) must be above 30, indicating strong trend

- Pullback Identification: +DI crosses below -DI (bullish) or -DI crosses below +DI (bearish)

- Entry Trigger: Enter when price takes out the high of the crossover bar

- Stop Placement: Below the low of the pullback swing (typically 2-3 bars)

- Target Logic: Target previous swing high or 2:1 reward-to-risk minimum

- Time Filter: Avoid entries in the last hour before market close

- Confirmation: Volume should increase on the entry bar versus pullback bars

This represents just one setup—the course covers multiple patterns with equally specific parameters.

Swing Trading Methodology

Linda’s style focuses on capturing intermediate moves lasting days to weeks. This timeframe avoids the noise of intraday trading while not requiring months of capital commitment. Swing trading allows traders with day jobs to participate since entries and exits don’t require constant screen watching. Classic Trading Tactics Theory and Practice teaches how to identify when markets are setting up for swings versus when they’re likely to chop sideways. Understanding market state prevents overtrading during unfavorable conditions and positions traders for the moves that actually matter.

Educator Traders vs Real Traders

| Aspect | Most Educators | Linda Raschke |

|---|---|---|

| Trading experience | Limited or simulated | 40+ years professional |

| Industry recognition | Self-promoted | Market Wizards featured |

| Method source | Books and backtests | Decades of live trading |

| Risk management | Theoretical | Battle-tested |

Note: These parameters are optimized for swing trading stocks and futures. Forex applications may require timeframe adjustments due to 24-hour market structure.

About Classic Trading Tactics Theory and Practice Creator

Linda Bradford Raschke is a professional trader with over 40 years of market experience. She was featured in “The New Market Wizards” by Jack Schwager. She ran LBR Group, a CTA managing client money. She served as President of the Market Technicians Association. Her trading methods are based on actual professional experience, not theoretical concepts.

Classic Trading Tactics Theory and Practice Patterns

Classic Trading Tactics Theory and Practice teaches specific patterns Linda uses to identify trade opportunities. These aren’t generic textbook patterns but setups she has traded profitably over decades. The training shows how to recognize these patterns in real-time market conditions, not just on historical charts where hindsight makes everything look obvious. Context matters in pattern trading, and the course explains when setups are likely to work versus when similar patterns should be avoided. Traders interested in order flow analysis to validate pattern entries may explore Wyckoff Swing Analysis 2024 for volume-based techniques that complement pattern recognition.

Classic Trading Tactics Theory and Practice Management

Entry signals get all the attention, but Classic Trading Tactics Theory and Practice management determines profitability. Linda teaches how to handle positions once entered, including when to add, when to scale out, and when to exit completely. Stop placement isn’t arbitrary but based on market structure. Profit taking balances capturing moves with avoiding giving back gains. These skills separate recreational traders who occasionally get lucky from professionals who extract consistent returns.

Professional Risk Control

Surviving four decades in markets requires exceptional risk management. The course covers Linda’s approach to position sizing, drawdown limits, and knowing when to step back entirely. Professional traders know that preserving capital during bad periods is more important than maximizing gains during good ones. Traders seeking additional professional trading approaches may find Live Traders Professional Trading Strategies provides complementary risk management techniques from another experienced professional.

Who This Course Is For

- Swing traders who want proven methods from a professional

- Traders tired of learning from people who don’t actually trade

- Stock and futures traders looking for pattern-based approaches

- Anyone who read Market Wizards and wants to learn from one

- Traders who want practical Classic Trading Tactics Theory and Practice management, not just entries

For more professional trading education, explore Day Trading courses on GeniTrader, and students interested in systematic approaches may also benefit from Jared Wesley’s Professional Trading Strategies for additional perspective on professional-level trading.

Why get it here: Original price $1,500 — instant download at a fraction of the cost. If the link breaks, we replace it within 24 hours. 30-day money-back guarantee if files are corrupt.

Linda Raschke Trading Course FAQ

What is Classic Trading Tactics?

Linda Raschke’s course covering Classic Trading Tactics Theory and Practice methods, pattern recognition, and Classic Trading Tactics Theory and Practice management from her 40+ years of professional experience.

Is this the complete course?

Yes. Full curriculum with all video modules and materials.

Who is Linda Raschke?

Professional trader featured in “New Market Wizards,” former CTA manager, past President of Market Technicians Association.

What indicators does Linda use?

ADX(14) for trend strength, Stochastics (14,3,3) for momentum, Keltner Channels for volatility boundaries, and 10/20 EMAs for dynamic support/resistance.

What timeframes work best for these methods?

Daily charts for position identification, 60-minute for timing, 15-minute for active intraday setups. Swing trades typically last 2-10 days.

How do I access it after purchase?

Instant download link provided immediately after payment.

What if the download link doesn’t work?

Contact us and we’ll replace it within 24 hours.

Is there a refund policy?

Yes. 30-day money-back guarantee if files are corrupt or incomplete.