What is it? Options Insight Full Course Bundle is a complete options trading education covering strategy selection, Greeks understanding, trade management, and portfolio construction. The Options Insight Full Course Bundle includes multiple courses packaged together, taking traders from options basics through advanced income and directional strategies—designed for traders who want thorough options education rather than single-strategy courses.

Verified Deliverables:

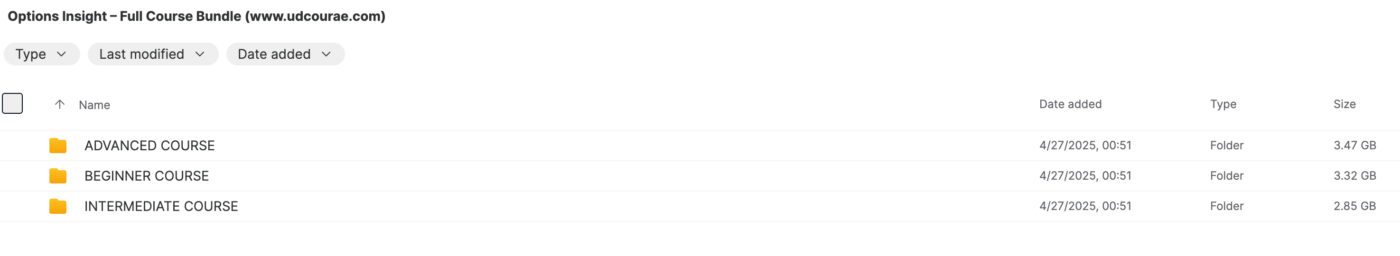

- Full Options Insight course bundle

- Multiple complete courses included

- Video training modules

- PDF guides and strategy references

- Delivery: Mega & Google Drive

- Access: PC, Tablet, Mobile

- Lifetime access included

Why Complete Options Education Matters in 2025

Options trading requires understanding multiple interconnected concepts. Knowing one strategy without understanding Greeks means not knowing why trades profit or lose. Knowing Greeks without understanding strategy selection means applying the wrong trades to market conditions. Many traders piece together random YouTube videos and end up with gaps that cost money. A complete curriculum builds knowledge systematically so each concept supports others. Understanding how volatility, time decay, and price movement interact allows making informed decisions rather than hoping setups work. For traders who already have options basics and want specialized advanced strategies, Piranha Profits Options Ironstriker Level 2 provides advanced directional techniques.

Technical Setup and Platform Configuration

Options trading platforms require proper configuration for informed decision-making. The bundle covers setting up options chain displays with essential columns: bid/ask prices, mark (mid-point), delta, theta, gamma, vega, implied volatility, and open interest. For thinkorswim, configure the Analyze tab for position Greeks and risk profile visualization. Set probability cones for 1-standard-deviation expected moves. Configure watchlists with IV percentile readings to identify elevated/depressed volatility environments. Set up trade tickets for multi-leg orders using Natural pricing (mid-point) as default. Alert configurations should include price alerts, IV rank changes, and earnings calendar notifications. The course covers platform-specific setup for thinkorswim, tastytrade, Interactive Brokers, and Schwab StreetSmart Edge.

What the Bundle Covers

The curriculum progresses from foundational options mechanics through advanced multi-leg strategies. Basics modules explain calls, puts, intrinsic value, and time value for traders new to options. Greeks education shows how delta, gamma, theta, and vega affect positions and how to use this knowledge for trade selection. Strategy modules cover covered calls, spreads, iron condors, butterflies, and directional trades. Trade management sections teach adjustments, rolling, and position exits. Portfolio-level thinking shows how to combine strategies for balanced exposure. Traders specifically interested in butterfly strategies may find Aeromir Butterfly and Condor Workshop provides deep-dive butterfly education that complements the bundle’s broader coverage.

Rule-Based Strategy Selection Checklist

The bundle teaches systematic strategy selection based on market analysis:

- Volatility Assessment: Check IV percentile—above 50% favors premium selling, below 30% favors buying

- Directional Bias: Bullish → calls, call spreads, put credit spreads; Bearish → puts, put spreads, call credit spreads

- Neutral View: Iron condors (high IV) or butterflies (target price) for range-bound expectations

- Time Horizon: 30-45 DTE for standard income strategies, 60-90 DTE for long premium plays

- Risk Tolerance: Defined risk spreads for protection, undefined risk for higher premium but margin requirements

- Capital Allocation: Maximum 5% of account per position, maximum 25% in correlated positions

- Earnings Filter: Avoid undefined risk through earnings, consider strangles if playing volatility crush

Understanding the Greeks

Options pricing isn’t intuitive without understanding Greeks. Delta measures directional exposure—a 0.30 delta call gains $30 for every $1 underlying increase. Gamma shows how delta changes as price moves, accelerating near expiration. Theta represents time decay working for or against positions—short options benefit, long options suffer. Vega indicates sensitivity to volatility changes—high vega positions gain when IV increases. The course explains each Greek practically—not just formulas but what they mean for real trades. Knowing your theta tells you how much you make or lose daily from time passing. Knowing your vega tells you whether volatility expansion helps or hurts. This knowledge transforms options from confusing to logical.

Piecemeal Learning vs Structured Education

| Aspect | Random Videos | Complete Bundle |

|---|---|---|

| Knowledge gaps | Inevitable | Systematically covered |

| Concept building | Out of order | Progressive |

| Strategy selection | Limited options | Full toolkit |

| Time to competence | Longer with mistakes | Efficient path |

Note: These parameters are optimized for traders with $25,000+ accounts allowing full strategy flexibility. Smaller accounts may need to focus on defined-risk strategies that work within limited capital.

Strategy Selection Framework

Different market conditions favor different options strategies. High volatility environments suit premium selling while low volatility favors premium buying. Trending markets suit directional trades while ranges favor neutral strategies. The course teaches a framework for selecting strategies based on market assessment rather than trading the same setup regardless of conditions. This adaptability means having the right tool for current markets instead of forcing one approach everywhere.

Risk Management for Options

Options can lose 100% of premium paid or result in assignment obligations. Understanding these risks before entering trades prevents surprises. Position sizing based on maximum loss keeps accounts protected during inevitable losing streaks. The course covers how to evaluate risk before trades and manage it during positions. Traders wanting to combine options knowledge with broader investment approaches may find SJG Trades Deep Dive Butterfly Trading provides complementary income strategies.

About Options Insight

Options Insight provides options trading education through structured curriculum covering the full options market. The bundle format packages multiple courses together for comprehensive learning.

Trade Adjustment Techniques

Positions rarely work exactly as planned. Knowing how to adjust gives options for managing trades gone wrong. Rolling extends time, changes strikes, or converts strategies. Understanding when to adjust versus when to close prevents throwing good money after bad. The course teaches specific adjustment techniques for different situations and strategies.

Portfolio-Level Options Management

Beyond individual trades, the bundle covers managing options as a portfolio. Balancing long and short delta prevents overexposure to market direction. Monitoring portfolio theta shows daily income/decay across positions. Vega management controls volatility exposure. Correlation analysis prevents multiple positions that will all fail simultaneously. This portfolio approach separates professional options traders from gamblers running individual trades. Traders seeking broader market education may also explore the Tradeversity All Time High Trading Course for stock selection techniques that complement options strategies.

Who This Course Is For

- Traders new to options who want complete foundational education

- Stock traders looking to add options strategies to their toolkit

- Options traders with knowledge gaps wanting systematic coverage

- Income seekers interested in premium-selling strategies

- Anyone overwhelmed by options complexity wanting structure

For more options education, explore Options Trading courses on GeniTrader.

Why get it here: Original price $699 — instant download at a fraction of the cost. If the link breaks, we replace it within 24 hours. 30-day money-back guarantee if files are corrupt.

Options Insight Bundle FAQ

What is the Options Insight Full Course Bundle?

Complete options education including basics, Greeks, strategies, trade management, and portfolio construction across multiple courses.

Is this the complete bundle?

Yes. All courses in the bundle with full materials.

Do I need options experience?

No. The curriculum starts with basics for complete beginners.

Which platform is best for the strategies taught?

The course covers thinkorswim, tastytrade, and Interactive Brokers setups. All three offer the tools needed for multi-leg strategies and portfolio Greeks analysis.

How long to complete the full bundle?

Expect 4-8 weeks for thorough coverage including practice trades. Rushing leads to knowledge gaps that cost money in live trading.

How do I access it after purchase?

Instant download link provided immediately after payment.

What if the download link doesn’t work?

Contact us and we’ll replace it within 24 hours.

Is there a refund policy?

Yes. 30-day money-back guarantee if files are corrupt or incomplete.