What is it? The Better Butterfly Tradingology Options Trading Course teaches the butterfly spread strategy for generating income from options. The Better Butterfly Tradingology Options Trading Course covers setup selection, trade management, and adjustments specific to Better Butterfly Tradingology strategies—defined-risk trades that profit when stocks stay within a specific price range across different market conditions.

Verified Deliverables:

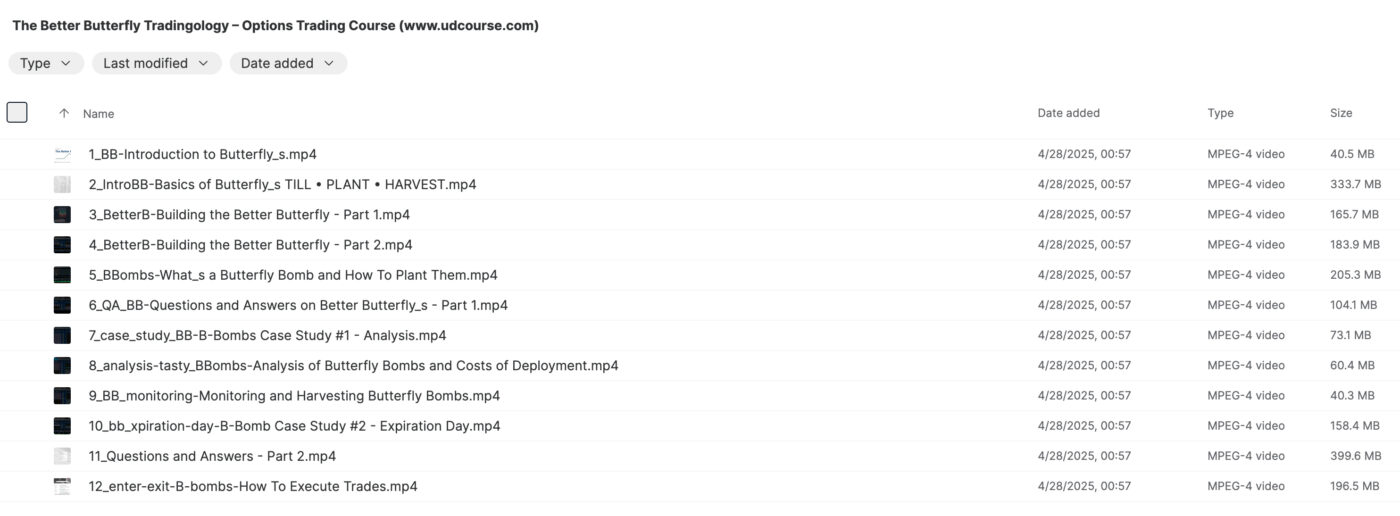

- Complete butterfly options trading curriculum

- Video training modules

- Trade setup examples and case studies

- PDF guides and checklists

- Delivery: Mega & Google Drive

- Access: PC, Tablet, Mobile

- Lifetime access included

Why Butterfly Spreads for Income Trading in 2025

Butterfly spreads offer defined risk income trading. Unlike naked options selling where losses can exceed premiums collected many times over, butterfly losses are capped at the initial debit paid. The Better Butterfly Tradingology method profits when the underlying stays within a range, making it suitable for stocks and indices that aren’t trending strongly. Butterflies work particularly well in elevated volatility environments where premium is rich but directional bets are risky. The strategy requires less capital than iron condors while offering similar profit characteristics in certain setups. Traders seeking additional butterfly techniques may find SJG Trades Deep Dive Butterfly Trading Strategy Class provides complementary advanced techniques.

Technical Setup and Platform Configuration

Proper platform setup maximizes butterfly trade execution. The course covers configuring your options chain display for multi-leg strategies: show bid/ask, mark price, delta, theta, and open interest columns. Probability analysis tools like those in thinkorswim or tastytrade display profit zones visually. Set up custom layouts showing the option chain, position Greeks, and profit/loss diagram simultaneously. For analysis, configure implied volatility charts to assess whether current IV is elevated (good for selling) or depressed (bad for butterflies). Use IV percentile readings—butterflies work best when IV is above 30% of its 52-week range. Commission optimization requires platforms with competitive multi-leg pricing since butterflies involve 4 contracts per position. Mobile alerts should track underlying price approaching profit/loss targets.

What the Course Covers

The Better Butterfly Tradingology curriculum starts with butterfly mechanics—how the strategy works, why it profits, and what causes losses. Setup selection modules teach which underlyings work best for butterflies and what market conditions favor the strategy. Entry timing covers when to establish positions relative to expiration and volatility levels. Trade management shows how to handle positions as price moves and time passes. Adjustment techniques demonstrate how to roll, widen, or close positions when trades move against you. For traders wanting complete options education that includes multiple strategies, Simpler Trading Bulletproof Butterflies 2.0 Elite covers additional defensive butterfly techniques alongside aggressive setups.

Rule-Based Entry Logic: Butterfly Trade Checklist

The Better Butterfly Tradingology course teaches a systematic entry framework with specific parameters:

- Underlying Selection: High-liquidity ETFs (SPY, QQQ, IWM) or stocks with tight bid/ask spreads

- IV Environment: Enter when IV percentile is above 30% (ideally 40-60%)

- Days to Expiration: 30-45 DTE for standard butterflies, 14-21 DTE for more aggressive setups

- Strike Selection: Center strike at expected price target, wings 10-20 points wide depending on premium

- Risk/Reward Target: Risk $1 to make $3-5 (pay $1 debit for $3-5 max profit)

- Position Size: Maximum 2-3% of account per butterfly position

- Delta Target: Center strike delta near 0.50 for at-the-money placement

- Exit Rules: Close at 50% of max profit OR 21 DTE, whichever comes first

Butterfly Strategy Mechanics

A butterfly spread involves buying one option, selling two at a middle strike, and buying one at another outside strike. The position profits most when the underlying closes exactly at the middle strike at expiration. Profit potential is highest at the center with risk limited to the initial debit. Understanding Better Butterfly Tradingology mechanics helps traders select appropriate strike widths and expiration dates. The course explains how changing these variables affects risk, reward, and probability of profit. Position sizing based on maximum loss keeps accounts protected during losing streaks.

Butterfly vs Other Income Strategies

| Aspect | Naked Options | Butterfly Spreads |

|---|---|---|

| Risk | Potentially unlimited | Capped at debit paid |

| Capital required | High margin | Lower debit |

| Profit zone | Wide range | Specific range |

| Adjustment options | Roll or close | Multiple techniques |

Note: These parameters are optimized for high-liquidity ETFs like SPY and QQQ. Individual stocks may require wider wings and smaller position sizes due to higher gap risk.

Strike Selection and Timing

Not all butterflies are created equal. Strike width affects reward-to-risk ratio. Expiration selection balances time decay with adjustment flexibility. The Better Butterfly Tradingology course teaches a systematic approach to selecting these parameters rather than guessing. Understanding implied volatility levels helps identify when butterflies offer favorable pricing. Traders learn to recognize when the strategy fits market conditions versus when other approaches work better. For traders interested in indicator-based timing for butterfly entries, Dan Sheridan All Weather Butterfly Program provides technical analysis methods specifically designed for butterfly timing.

Trade Adjustments

Markets rarely cooperate perfectly with trade plans. The course covers what to do when prices move outside the profitable zone. Rolling butterflies to new strikes can extend trades or reduce losses. Converting to broken wing butterflies changes the risk profile. Knowing when to take a loss versus when to adjust separates struggling traders from profitable ones. These adjustment techniques require practice, and the course includes examples showing when each makes sense.

About Tradingology

Tradingology focuses on options education with emphasis on income-generating strategies.

Tradingology focuses on options education with emphasis on income-generating strategies. The Better Butterfly course concentrates specifically on this single strategy rather than trying to cover all options approaches. The Better Butterfly Tradingology approach allows deeper coverage of butterfly-specific setups and management techniques.

Managing Greeks in Butterflies

Understanding how delta, theta, gamma, and vega affect butterfly positions separates profitable traders from confused ones. The course covers monitoring position Greeks daily and knowing what each tells you about current risk. Theta works in your favor as time passes, but gamma increases as expiration approaches. Vega exposure means IV changes affect position value significantly. Traders wanting additional butterfly and related strategies training may explore Aeromir Butterfly and Condor Workshop for complementary techniques including iron condors and broken wing butterflies.

Who This Course Is For

- Options traders who want a defined-risk income strategy

- Traders with options basics who want specialized knowledge

- Income seekers who understand that naked options risk blowups

- Systematic traders who prefer repeatable setups

- Anyone interested in non-directional options strategies

For more options education, explore Options Trading courses on GeniTrader, and students interested in expanding their butterfly knowledge may also benefit from the All Weather Butterfly Program for advanced seasonal and volatility-based Better Butterfly Tradingology strategies.

Why get it here: Original price $497 — instant download at a fraction of the cost. If the link breaks, we replace it within 24 hours. 30-day money-back guarantee if files are corrupt.

Better Butterfly Options Course FAQ

What is the Better Butterfly course?

Options trading education focused specifically on butterfly spread strategies for income generation with defined risk.

Is this the complete course?

Yes. Full curriculum with all modules and materials.

Do I need options experience first?

Basic options understanding helps. The course focuses on butterfly specifics, not options fundamentals.

What strike widths work best for butterflies?

The course recommends 10-20 point wings on SPY/QQQ. Wider wings offer higher max profit but lower probability; narrower wings offer higher probability but smaller gains.

How much capital do I need to trade butterflies?

$5,000-10,000 minimum for proper diversification. Each SPY butterfly typically costs $200-500 debit depending on width and IV.

How do I access it after purchase?

Instant download link provided immediately after payment.

What if the download link doesn’t work?

Contact us and we’ll replace it within 24 hours.

Is there a refund policy?

Yes. 30-day money-back guarantee if files are corrupt or incomplete.